What Are Neobanks?

Neobanks are digital-first banks which operate completely online and have zero brick-and-mortar presence. All the services they provide like withdrawals, accepting deposits, lending and investing, are done via online means as opposed to traditional banks.

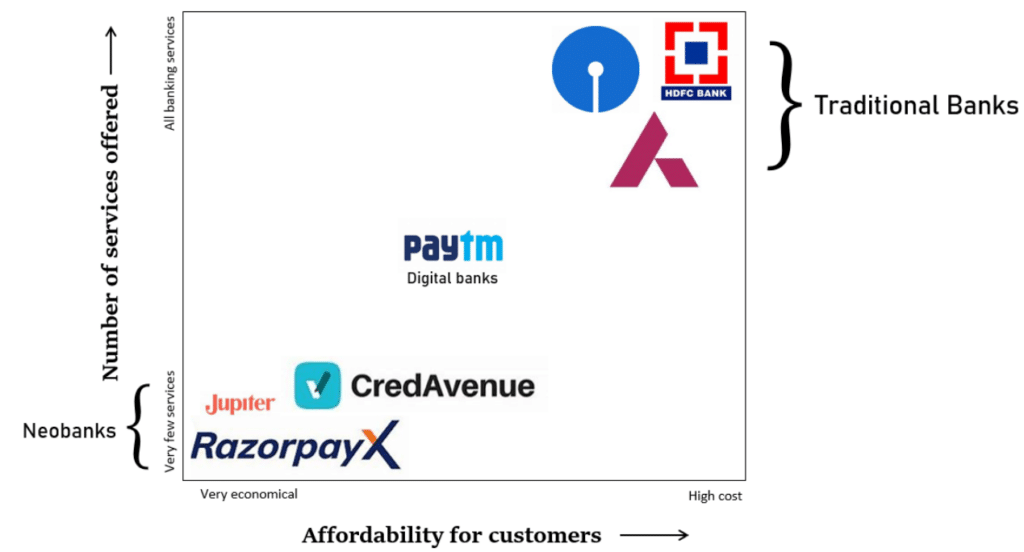

For example: RazorpayX, CredAvenue, Jupiter and Fi are thriving in the neobanking space.

The Legacy-Innovation League: Traditional SuperGiants Vs. Neo Titans

-

- Offline Presence: While traditional banks maintain several branches at salient locations across the country, neobanks operate solely online and have zero physical footprint.

- Regulation: Since neobanks have not been recognized as legal entities yet, they are not obliged to comply with the regulations that traditional banks are supposed to follow.

- Services: Traditional banks strive to be a one-stop shop for their customers by offering a wide range of banking services as well as financial products. However, neobanks focus on “verticalization” by providing only a few services but customising them greatly to the needs of the customers.

- Flexibility: Neobanks have fewer rigid rules than traditional banks in terms of lending loans, issuing credit cards and opening bank accounts. In traditional banks, one has to undergo several checks, fill endless forms and wait a lot of time for even the simplest requests to get processed (e.g.: change of address).

- Demographic popularity: Neobanks, because of their heavy reliance on innovative technology, are obviously not the first choice for not-so tech-savvy senior citizens. Moreover, even the population in their 40s and 50s lack trust and credibility in the concept of neobanks and prefer face-to-face interaction/clarification especially in matters relating to their hard-earned money. Thus, millennials have emerged to be the predominant clientele of neobanks.

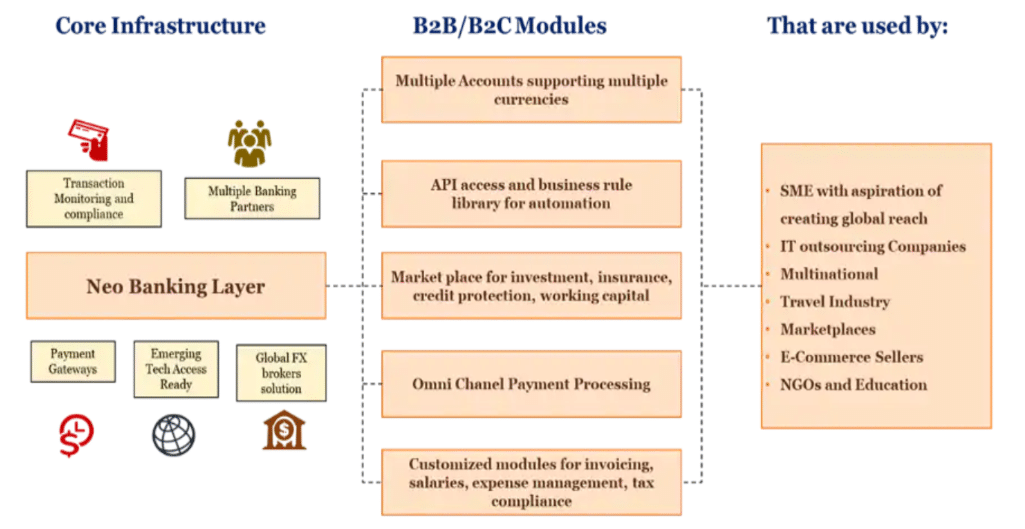

This figure illustrates the structure of Neo banks: (i) Core Infrastructure consisting of the functions of Neo banks; (ii) B2B/B2C Modules consisting of the services they offer; (iii) Beneficiaries of the services

Neobanks and the next banking revolution, PwC. https://www.pwc.in/industries/financial-services/fintech/fintech-insights/neobanks-and-the-next-banking-revolution.html

Decoding Neobanks: Features and Functions

- Affordability: Since Neobanks have no physical branches, they incur zero overhead expenses in the form of rent, electricity, maintenance etc. This lower cost ultimately gets transferred to customers, manifesting itself in the form of lower transaction fees and higher interest rates.

- Convenience: Neobanks allow you to carry out all your bank-related transactions in the safety and comfort of your home. As a sedentary lifestyle is taking over, people find it easier to just open their laptop or mobile and run errands rather than stand in line for hours at a conventional bank for a petty signature.

In case of complaints and/or queries, customer care centres or chatbots can be reached out to; they are very prompt in their responses. Additionally, these customer care centres might offer round-the-clock support, resulting in quicker redressal of grievances.

- Smooth UI: Because neobanks provide a limited number of services, their apps are immaculately designed, allowing for maximum clarity and ease of use. With the interface being highly streamlined (with self-explanatory icons), navigating through such apps becomes hassle-free.

- Personalization: Neobanks offer a high degree of personalization. Although they provide only a few services, they ensure they are the best at it. First Boulevard is a neobank that customises its services to suit the needs of Black Americans particluarly. Aspiration is another neobank that aims at fostering environmental sustainability by issuing plant-based (in place of plastic) credit and debit cards. Thus, neobanks often figure out their niche and tailor their services accordingly in order to win the trust and confidence of potential users.

In this graph, Affordability for Customers is measured on the X-axis whereas the number of services offered is represented on the Y-axis. We see here that on this scale, digital banks serve as a crossover between Traditional Banks and Neobanks.

Current Neo Banks in India:

Consumer-centric Neobanks

- FamPay

- Atlantis

- Akudo

- Jupiter

- SaveIn

- Walrus

- Fi Money

- OcareNeo

- Piggy

- Niyo

Business-centric Neobanks

- ZikZuk

- North Loop

- RazorpayX

Neobanks by Traditional Banking Institutions

- Kotak 811

- Digibank by DBS

- Yono by SBI

The Rapidly Rising Appeal of Neobanks: The Growth and Future of Neo Banks in India

The success of neobanks is driven by its low cost-model for end customers in the form of zero or close to zero fees on maintenance of minimum balance and withdrawals, higher interest rates on deposits as well as greater flexibility in terms of evaluation of creditworthiness. Additionally, opening and operating bank accounts is made simpler by eliminating unnecessary formalities, documentation and verification.

The Indian banking landscape is witnessing a seismic shift, driven by a surge in smartphone penetration and a generation yearning for convenience and efficiency. The growth trajectory of Neo Banks in India is nothing short of remarkable. Transaction value in the market is projected to touch a staggering US$113.6 billion by 2024, with a CAGR of 14.61% by 2028. This translates to a potential market size of US$196 billion, a testament to the immense potential this sector holds.

Factors propelling this growth are:

- Smartphone Boom: With smartphone penetration expected to reach 96% by 2040, India is witnessing a digital revolution. This tech-savvy population is the perfect audience for Neo Banks, who offer seamless financial services through mobile apps.

- Awareness and Education: New-age startups are actively dispelling myths and educating the public about the ease and convenience of Neo Banking. This awareness campaign is paving the way for widespread adoption.

- Strategic Partnerships: Traditional banks and card providers like VISA and Mastercard are recognizing the potential of Neo Banks. They are forging partnerships to expand their reach and tap into this flourishing market.

- Digital India Push: The government’s “Digital India” initiative is providing a fertile ground for Neo Banks to thrive. The focus on digitalization within the banking sector is creating a supportive environment for their growth.

- Covid-19 Pandemic: Lockdown created a favourable environment for digital and neobanks, as the situation allowed them to manage onboarding and key servicing processes remotely.

Future possibilities of expanding Neo Banking:

- Diversification Beyond Banking: Neo Banks will move beyond basic banking services, offering wealth management, micro-investments, and other value-added solutions, catering to a wider range of financial needs.

- Hyper-personalization: Data-driven insights will personalize the banking experience, with AI and ML tailoring products and services to individual preferences and financial goals.

- Rural Outreach: Financial inclusion is a national priority, and Neo Banks are poised to bridge the digital divide. By offering affordable and accessible financial services, they can empower rural communities and contribute to inclusive economic growth.

All these reasons have made (and are making) neobanks a popular choice among unbanked and underbanked customers like freelancers, gig economy employees and immigrants. Micro enterprises which are still in their nascent stages and not established enough to approach banks also seek assistance from neobanks for a hassle-free loaning facility. People who have sporadic incomes and are unable to adhere to the stringent bank guidelines are also increasingly resorting to neobanks.

Regulatory Roadblocks for Neobanks in India

The regulatory landscape surrounding neobanking in India remains somewhat murky, presenting challenges and opportunities for these innovative players. Currently, neobanks in India operate under a patchwork of regulations, often indirectly applied through their partnerships with existing banks, NBFCs, and payment system operators. This lack of a dedicated regulatory framework creates ambiguity and uncertainty for neobanks, hindering their growth potential.

- No direct licensing framework: Unlike some developed economies, India lacks a specific licensing regime for neobanks. This means they cannot directly offer certain financial products like deposits and loans, relying instead on partnerships with licensed entities.

- Indirect regulations: Neo-banks are subject to regulations applicable to their partner entities, such as business correspondent (BC) guidelines and outsourcing regulations. However, these guidelines may not fully capture the nuances of their unique business models.

- Data privacy and security: Neo-banks handle sensitive customer data, making data security and privacy a paramount concern. While India is on the cusp of implementing a comprehensive data protection law, the existing framework may not be fully equipped to address the specific challenges of neo-banking.

Way Ahead: How can Neobanks Unlock their Latent Potential and Disrupt the Banking Industry?

While traditional banks are product-centric, neobanks are platform-based or data-driven. Although traditional banks are often oriented towards broadening the pool of products offered, neobanks emphasise strategic utilisation of customer data to upgrade and enrich user experience, developing specific expertise. Traditional banks, on the other hand, are more inclined towards realising economies of scale, i.e., expanding customer base so massively that their expensive infrastructure and complex working mechanism is cost-justified.

To unlock neobanking potential and foster a vibrant ecosystem, the regulatory landscape needs to evolve, some potential pathways that can be taken are:

- Phase 1: Updating Existing Regulations: Revisiting existing regulations for BCs, Branch Authorisation, and Mobile Banking to accommodate neobanks’ digital models is essential.

- Phase 2: Niche Banking Licence: Exploring a dedicated “digital bank” licence, similar to small finance banks, could provide greater clarity and foster sustainable growth.

- Regulatory Sandbox: Encouraging sandbox initiatives allows neobanks to test innovative products and services in a controlled environment, facilitating regulatory agility.

- Collaboration: Continuous dialogue and collaboration between neobanks, regulators, and industry stakeholders is vital for shaping a robust and future-proof regulatory framework.

References

- Difference between Neobanks vs traditional banks (2023) DIRO Original Document Verification Technology. https://diro.io/neo-banks-vs-traditional-banks/.

- Reserve Bank of India – Reports. https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=892#4.

- The evolution of neobanks in India – pwc.in. https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/publications/the-evolution-of-neobanks-in-india.pdf?trk=public_post_main-feed-card_reshare-text.

- Global Research and analytics firm, Aranca. https://www.aranca.com/knowledge-library/special-reports/investment-research/neobanks-the-future-of-banking.

- Neobanking – India: Statista market forecast, Statista. https://www.statista.com/outlook/dmo/fintech/neobanking/india#:~:text=Transaction%20value%20in%20the%20Neobanking,US%24196.00bn%20by%202028.

- Srivastava, Aparajita, Srivastava, Astha and Maheshwari, R. (2023) Fintech laws and regulations: India: GLI, GLI – Global Legal Insights – International legal business solutions. https://www.globallegalinsights.com/practice-areas/fintech-laws-and-regulations/india (Accessed: 02 February 2024).