Introduction

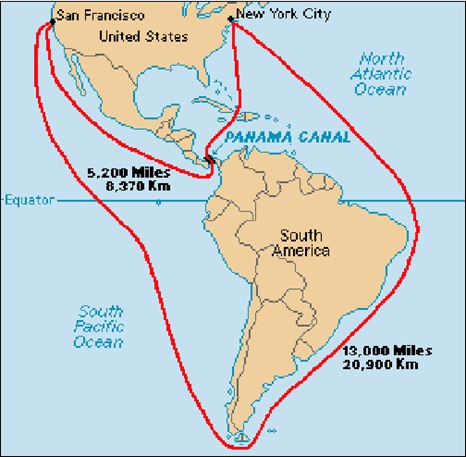

Spanning 51 miles (82 kilometers) across the Isthmus of Panama, the Panama Canal stands as a cornerstone of global maritime trade. Completed in 1914 and managed by Panama, this engineering marvel revolutionized shipping by offering a direct passage between the Atlantic and Pacific Oceans.

Previously, vessels endured the treacherous route around Cape Horn, significantly extending travel times and costs. The canal dramatically shortened distances, for instance, reducing journeys between the US eastern and western coasts by a staggering 8,000 nautical miles (15,000 kilometers). Similar benefits apply to trade routes connecting North and South America, Europe and Asia, and even Europe and Australia. These time and cost savings demonstrably invigorated global trade.

The canal employs a sophisticated lock system, elevating ships from sea level to Gatun Lake and then lowering them on the Pacific side. This feat facilitates the seamless movement of cargo across continents. However, the canal’s influence extends beyond economics, impacting national security, diplomatic relations, and logistical resilience, particularly for the United States, with a significant portion (approximately 72%) of canal traffic originating from or destined for US ports.

The canal’s influence extends to generating significant cost and time efficiencies. Ships utilizing the canal experience a dramatic reduction in fuel consumption and travel times when compared to alternative routes. This translates to faster delivery of goods, a factor of particular importance for perishable items and industries that rely on just-in-time supply chains.

Furthermore, the Panama Canal serves as a vital artery within the intricate network of the global supply chain. It facilitates the movement of a diverse range of commodities, including dry bulk goods, containerized cargo, chemical tankers, liquefied petroleum gas (LPG) carriers, liquefied natural gas (LNG) carriers, vehicle carriers, refrigerated cargo, general cargo, and even passengers. This vast array of goods underscores the canal’s critical role in fostering and sustaining global trade.

The looming threat: Drought and declining water level

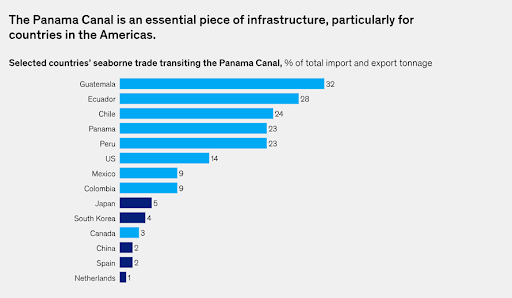

The Panama Canal serves as a critical artery for global trade, particularly for goods traveling between North Asia and the East and Gulf Coasts of the United States. An estimated 14% of all U.S. seaborne trade transits the canal, highlighting its importance.

However, the canal’s significance extends far beyond the United States. For several Latin American nations, the canal is an indispensable link for their imports and exports. As this research demonstrates, some countries rely on the canal for a staggering quarter or more of their total seaborne trade volume.

For Panama itself, the canal is an economic powerhouse. Direct contributions to the national treasury in fiscal year 2022 amounted to roughly $2.5 billion. When factoring in indirect contributions, the canal generates a staggering figure exceeding 6% of Panama’s GDP.

Water levels in the canal are steadily declining, threatening the very system that keeps global commerce flowing. The canal’s functionality hinges on a network of locks, colossal chambers that elevate and lower ships between varying elevations. To ensure smooth operation, these locks necessitate a specific water depth. If water levels plummet below this critical point, the safe passage of ships becomes impossible.

Beyond the lock system, a minimum water depth is equally paramount for navigating the canal itself. Ships require sufficient water beneath their hulls for safe maneuvering. A decrease in water level can significantly restrict the size and type of vessels able to transit the canal, hindering its overall capacity.

This looming threat of drought underscores the urgency of implementing water conservation measures and exploring alternative water sources. The Panama Canal’s smooth operation is not just vital for the Panamanian economy but for the efficient flow of goods worldwide.

A necessary response: Implementing transit restrictions

Initially, the declining water levels in the Panama Canal primarily impacted bulk carriers (ships transporting loose cargo like grain or coal) and tankers (carrying liquids). Container ships, known for their adherence to strict schedules, faced minimal restrictions, offering a temporary advantage to container shipping companies.

However, the situation has become increasingly dire. As the canal experiences continued water loss, the Panama Canal Authority (PCA) has been forced to implement substantial reductions in daily transits, and these limitations now encompass container ships.

The PCA’s current strategy involves a one-third reduction in overall ship traffic. However, a more significant impact is expected for container ships specifically. Starting in February 2024, daily transits for container vessels will be nearly halved. This translates to a daily allowance of 24 ships of any size, a considerable decrease from the pre-drought capacity of 35-40 ships.

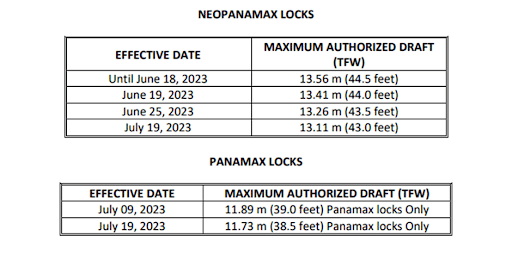

Furthermore, to optimise water usage, the PCA has imposed limitations on the maximum draft (depth a vessel can safely submerge) allowed for traversing the canal. Neo-Panamax vessels, the largest class able to navigate the canal, are now restricted to a draft of 43 feet, down from the previous 50 feet. Similarly, smaller Panamax vessels (e.g., those in the OC1 service connecting Oceania and the Americas) face a reduced draft limit of 38.5 feet, compared to the standard 45 feet.

The financial toll: Mounting losses on the Panama Canal

The Panama Canal, a cornerstone of global trade, faces a significant financial strain due to the ongoing drought. The Panama Canal Authority (ACP) anticipates a revenue decline of $600 million to $800 million as a result of the continued water shortage, restrictions on ship size, and a decrease in daily transits.

This financial predicament is starkly evident in the early months of fiscal 2024. Administrator Ricaurte Vásquez of the ACP reports, “Toll revenues have been $100 million below each of the first three months of operation: October, November, and December.” Projecting this trend forward, Vásquez estimates a potential loss of approximately $800 million by June 2024, assuming a return to normal operations by that time.

The roots of the canal’s financial woes can be traced back to 2023, with the El Niño phenomenon causing historically low water levels in the canal basin. Despite a $500 million investment to secure water supplies, the long-term capacity of the canal remains uncertain. These financial losses raise concerns about the canal’s ability to maintain its role as a vital artery of global trade.

Moreover, In a bid to bypass the congestion caused by reduced capacity and delays, data indicates that shippers have collectively spent a staggering $235 million on alternative routes.

The shipping industry feels the pinch

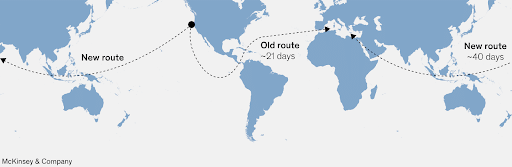

The Panama Canal slowdown has affected various trade segments and stakeholders. Prominent shipping and alliances are working to alter their networks. For instance, ships traveling from Asia to the East Canal are now using the Suez Canal instead of the Panama Canal. However, the Red Sea is prone to attacks by the Houthi Rebels which is decreasing the traffic of services through this route as well. There are certain routes that have been explored, only to the dismay of increasing the duration for the companies. Instead of traveling east through the Panama Canal, a ship sailing from the west coast of North America to the Mediterranean Sea may head west through the Suez Canal. However, this route would increase the cost by around 2x, which is a change from 21 days to 40 days, causing proportional hikes in the costs of the transits as well.

All of this means that the shippers will have to pay higher for freight in order to make up for the longer transits. Currently, there are more departures scheduled to pass through the Cape of Good Hope in South Africa on the way back from the East Coast of the United States to Asia. The probable imposition of fees on Asia-US East Coast shipping routes could result in an increase of several hundred dollars per Forty-Foot-Equivalent-Unit (FEU) container due to restrictions imposed by the drought. Moreover, a number of carriers have implemented fees related to the Panama Canal, which could add an extra $400 to $500 per FEU on top of the regular spot costs. In fact, a $297 Panama Canal levy has already been implemented by the Mediterranean Shipping Company.

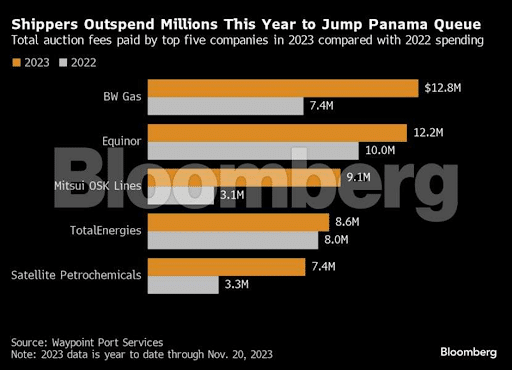

However this doesn’t mean that the slowdown has affected, or will continue to do so in the future, all the supply chains equally. For instance, most container ships are already subjected to an extra fee to use the reservation system that enables them to use priority canal transit slots. For them, paying an extra margin may not cost so much. The same could be said about LNG carriers, which are usually associated with higher operating and inventory holding costs. This can be especially said as the delayed transit of LNG carriers in 2024 contributed to a temporary impact on the commodity prices in Asia. Therefore, it might be beneficial for them to participate in auctions that would book them on a priority basis. However, the same can’t be said for other carriers with lower daily operating costs and less valuable cargo. For every extra day at sea as a container ship, dry-bulk carriers and general cargo ships pay half of the operational costs. This makes it more convincing for them to take a longer route to avoid booking costs. However, this had a detrimental effect on the agricultural commodity market with the prices of products like soybeans and corn experiencing high volatility due to shipment delays.

The LNG carriers have especially been a spotlight category when it comes to the slowdown. According to the International Energy Agency, the number of US LNG cargoes via the Panama Canal fell precipitously in 2023, especially in the second quarter (down 16% year over year). Under normal circumstances, the LNG tankers would expect a 2-3 day waiting period, which has been increased to that of an average 15 days due to unreserved slots. For tankers who booked in advance through the Panama Canal’s Transmit Reservation Booking System, around $6,00,000-7,00,000 was charged for a capacity of 1,70,000 cubic meters. For those, who participated in slot auctions, run the danger of rising expenses and uncertainty. While the routes through the Suez Canal are exposed to maritime war dangers and are longer, they do promise certainty in scheduling and help in avoiding congestion. The Suez Canal Authority (SZA) introduced a staggered discount system for LNG tankers sailing from the US Gulf of Mexico to ports east of Egypt in October 2023 in an effort to entice shippers to use its route. However, the increasing attacks in the Red Sea have heightened the risk of transit through Suez becoming redundant, putting the LNG in further issues and confusion.

The situation is even more dire for perishable cargos, involving shorter haul excursions with time kept in refrigerated containers due to dearth of options. The only way out is to shift the perishable cargo into refrigerated containers, carried aboard container ships. However, this may lead to an overhaul of certain supply chains over time.

One of the hardest hid are ships moving crops, which faced waiting times of up to three weeks. This happened as grain ships typically book months in advance, putting them at the rear of the queue since they typically look for transit slots just a few days before landing. For the few available slots, which are usually auctioned off, the charges are as high as $1 million or more, which can usually not be met by the meager margins that grain trading businesses make. Given that the restrictions stay, the bulk carrier segment is going to be the last one to pass through the Canal. Taking up other routes will involve longer transit time, higher inventory levels, and increased costs which all leads to a lot of uncertainty. However, all of these could benefit the commodity traders, given they are able to take advantage of the longer sailing times and demand for higher storage capacity on land.

Regardless of how the different segments react to the slowdown, the costs and longer durations will likely be passed down to the final customers, increasing their costs as well.

Seeking solutions: A look at mitigation strategies

To lessen the impact that upcoming drought will have on the area, several possible remedies have developed since the low water levels restrict travel across the Panama Canal, leading to severe economic and financial impacts across various supply chains. In 2020, the ACP initiated the Water Program to address the drought situation over the long term. The aim of the program was to ensure freshwater supply for the upcoming 50 years. Some of the measures under the program were as follows:

- Cross-Filing Technique In Panama Canal Locks: This entails recycling the water from one lock chamber into another, eventually lowering the volume of water required by each transit. It was reported that this would lead to saving of energy equivalent to five daily transits.

- Simultaneous Lockages: The ACP would execute simultaneous lockages to further preserve water, whenever the size of the vessel would permit it. This method maximizes water utilization by enabling two ships to pass through the same chamber simultaneously.

- Optimised Transit Schedules: To maximize water savings in every transit, the ACP has carefully planned transit schedules to accommodate as many vessels as possible by minimizing water usage.

- Transparency and Communication with Customers: This entails maintaining transparency with the customers and regularly informing them about any necessary adjustments.

To address the issue with a long-term lens and develop a necessary solution, the ACP is working closely with experts like the US Army Corps of Engineers on a variety of solutions. These solutions are aimed at development of new reservoirs and advanced water management systems. Instead of concentrating on particular projects, a spokesperson at the Panama Canal Authority talked of a long-term proposal. This would entail defining the Canal’s watershed, changing or extending the boundaries set forth in the 2006 law, and removing certain restrictions on the construction of new reservoirs. The Panamanian authorities are also looking towards the construction of a multipurpose reservoir on the Indio River, as stated by the canal’s administrator Ricaurte Vásquez. This also aligns with the authorities’ plan to increase the supply of fresh water in the canal, which would eventually decrease the restrictions on its capacity during the dry seasons. However, given that the Indio River lies outside the Canal’s watershed, the construction would require a lot of government and bureaucratic intervention. This has also led to a lot of controversy given that the Indio region is known for its biodiversity and construction would entail a lot of environmental concerns and an awful impact on the local communities as well.

While this is a long-term solution and would require substantial implementation and execution time, the authorities have drawn out some short-term solutions as well. One of these entails the construction of an abduction line to link Gamboa and Paraíso, two towns near the Panama Canal, and a new raw water intake in Gamboa. According to the Canal’s procurement page, the proposal was due in January 2024. This will also enhance the use and dependability of water from Gatún Lake, the body of water that the Canal passes through.

Conclusion

The Panama Canal, a vital conduit for international trade, faces a major challenge due to declining water levels. This has resulted in severe financial loss for the Panama Canal Authority as a result and forced them to impose ship traffic limitations. Different segments of the maritime industry have been affected by the downturn, with the final effects being rolled down to the final customers in terms of lower stock and higher prices, especially in the case of perishable cargo and dry-bulkers.

The Panamanian authorities are exploring both short-term and long-term solutions to address the water shortages. While the long-term measures involve solving the issue permanently, they are also prone to environmental and bureaucratic hurdles. As the situation progresses, the global supply chain will need to adapt to this new reality, potentially leading to restricted routes and a revaluation of reliance on the Panama Canal.

References:

- Shippers spend $235 million in bid to bypass Panama Canal Congestion The Economic Times. Available at: https://economictimes.indiatimes.com/small-biz/trade/exports/insights/shippers-spend-235-million-in-bid-to-bypass-panama-canal-congestion/articleshow/105431789.cms?from=mdr (Accessed: 02 April 2024).

- Wirtz, N. (2024) Panama: Crisis in the canal, Global Finance Magazine. Available at: https://gfmag.com/economics-policy-regulation/panama-canal-crisis/ (Accessed: 02 April 2024).

- Panama Canal Drought & Its Impact On Global Shipping | GEP Blogs. Available at: https://www.gep.com/blog/mind/panama-canal-drought-impact-on-global-shipping#:~:text=The%20canal%20authority%20has%20cut,40%20 ships%20before%20the%20 drought (Accessed: 02 April 2024).

- Dierker, D. et al. (2024b) How could Panama canal restrictions affect supply chains?, McKinsey & Company. Available at: https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/how-could-panama-canal-restrictions-affect-supply-chains (Accessed: 02 April 2024).

- Panama canal (2024) Wikipedia. Available at: https://en.wikipedia.org/wiki/Panama_Canal (Accessed: 02 April 2024).

- Panama Canal Drought & its impact on Global Shipping: GEP Blogs (2016a) Contact Us. Available at: https://www.gep.com/blog/mind/panama-canal-drought-impact-on-global-shipping (Accessed: 07 April 2024).

- Satyala, R.K. (2024) The Panama Canal: A cornerstone of global trade and its impact on disruptions, LinkedIn. Available at: https://www.linkedin.com/pulse/panama-canal-cornerstone-global-trade-its-impact-ravi-kanth-satyala-arcrc/ (Accessed: 07 April 2024).

- IEA: Panama canal congestion to slow US–asia LNG trade, Oil & Gas Journal. Available at: https://www.ogj.com/home/article/14304178/iea-panama-canal-congestion-to-slow-usasia-lng-trade (Accessed: 07 April 2024).

- Alcoba, N. (2023) From bananas to LNG, Panama Canal Backlog has wide-reaching implications, Al Jazeera. Available at: https://www.aljazeera.com/economy/2023/9/1/from-bananas-to-lng-panama-canal-backlog-has-wide-reaching-implications (Accessed: 07 April 2024).

- Rodriguez, A. and Rogers, M. (2023) Panama Canal proposes long-term solutions to improve drought issues as low water levels remain, S&P Global Commodity Insights. Available at: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/lng/112223-panama-canal-proposes-long-term-solutions-to-improve-drought-issues-as-low-water-levels-remain# (Accessed: 07 April 2024).

- Anderson, B. (2023) How climate change is impacting the Panama Canal, Greenly. Available at: https://greenly.earth/en-us/blog/ecology-news/how-climate-change-is-impacting-the-panama-canal (Accessed: 07 April 2024).