What Are Tariffs?

Economics defines tariff as a tax imposed by a government on imported commodities. Either a fixed amount per item (specific tariff) or an ad valorem percentage of the value of the product may be levied. Apart from promoting domestic producers and deterring imports, tariffs can enhance the “terms of trade” for large economies that can shift the burden to their exports by increasing the price at home of imported products.

Most economists are in accordance with the belief that tariffs induce distortions that damage efficiency, generate deadweight losses, and elicit retaliation even when governments justify them as a means of making a profit, defending protection, or negotiating. Consequently, tariffs should be understood as both an economic and a political instrument that reconciles global obligations with local limitations.

A U.S. History of Tariffs

Tariffs are indispensable to American Economic History. From the republic’s early years to the present day, they have served as tools for revenue generation, protectionism, liberalization, and as geopolitical leverage.

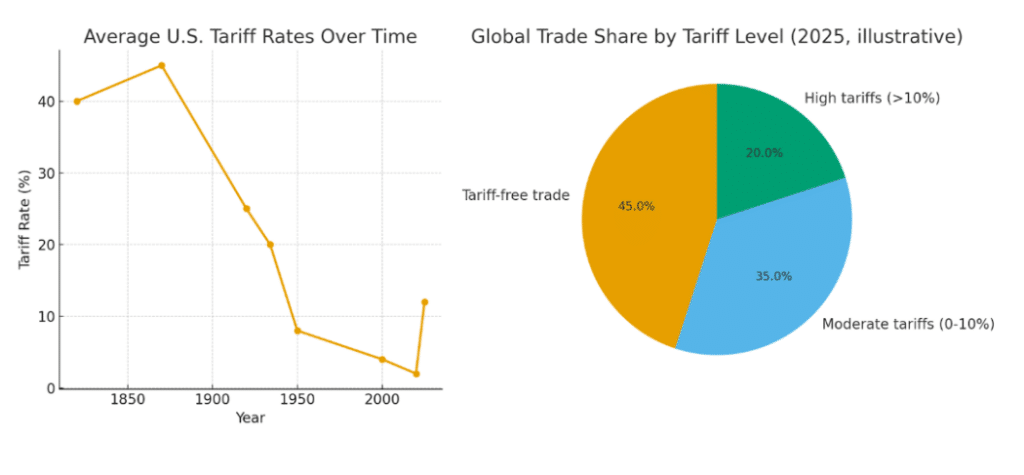

1790–1860: In this period tariffs were but a fiscal measure to raise federal revenue, given no federal income tax at the time. Customs duties funded up to 90% of federal revenue. Rates averaged around 20–40% depending on the period. At the same time, they provided modest protection to emerging American industries such as textiles, iron, and shipbuilding against British imports.

Political divide: North American industrialists favoured higher tariffs, while Southern planters, dependent on imported manufactured goods and export markets for cotton, opposed them.

1861–1933: The American Civil War (12 Apr 1861 – 9 Apr 1865) initiated a transition toward high protective tariffs. The Morrill Tariff of 1861 and subsequent laws substantially raised duties. After the war, the Republican Party demonstrated protectionism as its core economic policy.

By the 1880s–1890s, tariffs averaged 40–50%, among the highest in the world.

The McKinley Tariff of 1890 briefly pushed rates even higher but also introduced reciprocity provisions; an early recognition that bilateral concessions could benefit U.S. exporters. While protectionism was considered essential for nurturing industry, it evoked consumer resentment, especially among farmers paying higher prices for manufactured goods.

1930- 1947: The Great Depression brought forth the risk of tariff wars. Retaliation from Canada, Europe, and others was ignited by the Smoot–Hawley Tariff Act of 1930 which raised average duties to about 45%. This caused U.S. exports to collapse by over 60% between 1929 and 1934, worsening the Depression. Economists today cite it as a textbook case of beggar-thy-neighbor policy (protectionist economic strategy where a country takes actions, such as imposing tariffs or devaluing its currency, to improve its own economy at the expense of other nations) backfiring. In response, Congress passed the Reciprocal Trade Agreements Act (RTAA) of 1934, granting tariff-cutting authority to the president. This innovation allowed the U.S. to negotiate bilateral tariff reductions with the promise of reciprocity, removing tariff policy from the grip of Congress. This set the stage for U.S. leadership in creating the General Agreement on Tariffs and Trade (GATT) in 1947, embedding reciprocity as a multilateral rule.

1947–2000s: Through successive GATT rounds; the Kennedy, Tokyo, and Uruguay Rounds, U.S. tariffs dropped to below 5% by 2000. Trade brought about postwar prosperity and globalization.

Return of Tariffs in the 21st Century: The Trump administration (2018–2020) reintroduced tariffs on steel, aluminum, and $370 billion of Chinese imports, justifying them as tools of fairness and security. Though average tariffs remained modest, the precedent was set: tariffs were once again a central instrument of U.S. foreign economic policy.

The U.S.–India Tariff Crisis of 2025: History, Economics, and Strategic Implications

An Overview of the U.S.–India Economic Relations

The economic relationship shared by the US and India has evolved drastically in the previous century, shaped by their changing political and economic agendas, this in turn has shaped the individual foreign policies of the two nations. Following India’s independence in 1947, the country adopted a protectionist economic policy incorporating heavy import substitution while for America, it was a period of growth and greater economic interaction with European and East Asian countries. With the US primarily exporting machines and chemicals and India dealing in textiles and agri products, trade interaction between the two countries remained insignificant.

Trade relations started to cultivate between the two countries, following India’s liberalisation measures in 1991 which led to reduction in trade barriers and opening of the economy to foreign capital. This attracted American investment in India’s technology and pharmaceuticals sector. The boom in India’s IT industry and outsourcing services deepened global economic integration, while U.S. investment helped modernize Indian industry. By the 2000s India and the US were crucial trading partners in both trade and geopolitics.

Indian exports including gems, textiles, chemicals and pharmaceuticals found a profitable market in the US in the 21st century, US on the other hand, exported aircraft, defense equipment, technology, and agricultural products to India.

This interdependence positioned the U.S. as India’s single largest trading partner and India as one of America’s fastest-growing trade relationships. By 2024, bilateral trade had grown to over $212 billion annually, with India enjoying a surplus of around $45 billion.

The 2025 Reciprocal Tariffs and Escalation

The American government has always argued that India’s significantly higher tariff rate is a source of disadvantage to the American farmer(12% compared to the U.S.’s 2.2%). In 2019, USA revoked India’s preferential trade status under the generalised system of preferences (GSP) which had previously allowed duty-free access for many Indian goods, due to its discontent with India’s tariff policy. Both governments kept the disputes under control given the broader strategic value of their partnership.

However, In April 2025, President Trump announced soaring reciprocal tariffs on Indian goods, stating the imbalance in tariff regimes. A 25% base tariff was imposed on $48 billion worth of Indian exports, effective from August. What began as a commercial dispute quickly escalated when Washington linked additional penalties to India’s continued purchase of discounted Russian oil. By late August, an additional 25% penalty tariff was imposed, doubling duties to 50% on key Indian exports which is the highest level ever applied to a strategic partner.This abrupt escalation shocked businesses and policymakers. For India, whose labor-intensive industries such as textiles, gems, footwear, and seafood are heavily export-dependent, the implications were more than detrimental.

In response to Industry associations conjecture of job losses in hubs like Tiruppur and Surat and the government’s Chief Economic Adviser estimate of a 0.5–0.6% hit to GDP for the fiscal year, the central government has introduced relief measures, including cutting the Goods and Services Tax (GST) on hundreds of consumer items to stimulate domestic demand and support exporters. Meanwhile, India has also intensified trade negotiations with the European Union in an effort to diversify markets and reduce reliance on the U.S.

Besides disrupting trade flows, Washington’s measures have injured the long developed strategic partnership. While the U.S. defended the tariffs as a measure taken in “reciprocity”, the masses of India largely view tariffs as punitive and politically motivated. The U.S. India Business Council urged quiet diplomacy cautioning that decades of cooperation in technology, defense, and energy were at stake. International reactions reflected the geopolitical undertones. Ukraine’s Presi no dent Zelenskyy openly endorsed the U.S. stance, defending the tariffs as justified pressure on India for its ties with Russia. Analysts note that the tariffs are no longer simply an economic tool but a strategic lever, blurring the line between trade policy and foreign policy.

Russia Factor

US Criticism of India’s Oil Imports from Russia

US President Donald Trump linked India’s continued imports of Russian oil to the new sanctions and imposed an additional 25% tariff on Indian goods, raising it to 50%. This is considered an action towards ending the Russia-Ukraine war. According to US Treasury Secretary Scott Bessent, India is ‘profiteering’ from the war and highlighted that Indian imports of Russian oil have increased from 1% to 42%. This was linked to India taking arbitrage advantage of the situation, buying cheap Russian oil and reselling it as a product, making a profit of 16 billion dollars, which was pocketed by the wealthiest families in India. Other than accusations related to war profiteering, India was also accused of financing Russia’s war in Ukraine.

Sanctions Spillover and Secondary Pressure

New sanctions are used as a threat on Russia, and secondary sanctions are imposed on countries that continue to buy Moscow’s crude oil. The US law landscape is pushing for the ‘Sanctioning Russia Act of 2025’. The bill targets any country that imports Russian oil and natural gas, and imposes 500% tariffs by the US.

Although the entire world faces this threat, China, on the other hand, is not facing any punitive actions by claiming that it is more ‘complicated’. The US Treasury Secretary defended this decision by stating that China has diversified its oil imports, and during the Russia-Ukraine war their oil imports had only increased from 13% to 16%. Since US-China trade tensions are high, analysts believe Chinese firms may still buy Russian oil despite the risk of facing US penalties.

India’s Strategic Autonomy and Energy Security Concerns

In 2024, India imported 88 million tonnes of Russian oil. From 2022 to 2025, India became the second-largest importer after China. India also bought around 18% of Russian coal exports during this period.

The Chinese embassy stated that China’s trade with Russia complies with international law, while India has not explicitly stated this. Considering the significant energy needs of the country, it falls into a similar situation.

The trade war is an advantageous situation for India; in case all targeted countries retaliate against US tariffs, India may gain a stronger position in the international market. US tariffs on major economies will allow Indian products to be cheaper in the global market. Negotiations have been initiated by India with the US administration, and high tariffs have been reduced on products like motorcycles. India has also agreed to diversify its oil imports and buy more oil from the US and slashed import taxes on many commodities in the current budget to facilitate a trade deal and address trade concerns.

Historically, in similar situations, we can learn that simply a trade deal with the US out of compulsion cannot be a solution to this tariff war, as seen with Canada, Mexico, and China. India should focus on ‘home market reforms’ which include labour, financial, and trade reforms.

India has pursued market diversification, coming up with new trade agreements with the UAE, Australia, and the EU, with an ongoing FTA with the UK. Due to trade imbalances with China, India has opted out of the Regional Comprehensive Economic Partnership.

In order to pursue a self-reliance strategy that focuses on reducing import dependency, especially on countries like China, India continues to raise its tariff and non-tariff barriers to protect the interests of domestic suppliers and promote domestic production through initiatives like ‘Make in India’ and ‘Atmanirbhar Bharat’. These strategies foster India’s manufacturing sector and mitigate vulnerabilities from the volatile international market and risks from participants like China.

India is using its imports of US aircraft, LNG, defence technology, and its role in the global supply chain for major companies like Apple and Tesla as a bargaining chip in negotiation talks.

India’s strategy also includes taking legal action through the World Trade Organization (WTO) and collaborating with other impacted countries to form a united front against the aggressive tariff measures taken by the US.

Broader Economics and Diplomatic Impact

Trade Diversion and Global Supply Chain Effects

Although the US tariff war was largely initiated to impact the world economy, India is one of the few countries reaping the benefits. This is because US tariffs on major competitors like Canada, Mexico, China, and the EU make Indian commodities cheaper in the global market, shifting demand towards Indian products.

In India, chemicals, metals, machinery, electrical, transportation equipment, and other manufacturing products are forecasted to see a rise in exports. Utility services like gas distribution, electricity, water, and construction would also increase. Intermediate goods like rubber and plastic, despite declining exports, could see an increase in output due to intermediate demand.

However, the trade war will impact a few sectors, among which extraction and pharmaceuticals could see an export drop of 21% and 11% respectively, with pharmaceuticals facing the biggest output loss of up to 3.9%. Moreover, sectors including grains, processed food, textiles, leather, and rubber and plastic products are also on the losing end of the spectrum.

Due to the impact of US tariffs on Chinese imports in the US, many companies have been encouraged to seek commodities from countries like India, Vietnam, and Mexico, especially for electronic and agricultural commodities. The tariff war has flooded the Indian market with Chinese products, increasing India’s trade deficit with China to USD 85 billion.

The US trade war has shaken the global economy, with most countries except India, Japan, and South Korea expected to face GDP and welfare losses. Non-retaliating participants are also impacted due to disruptions in the global supply chain and reduction in demand for intermediate goods, affecting industries globally.

Chinese goods have not just penetrated Indian markets, but the diverted Chinese exports are also flooding the European market, leading to ‘a second China shock’. This has increased competition for domestic EU producers, especially in the steel, electronics, and machinery sectors. The surge in Chinese imports into the European market has increased the EU’s trade deficit with China by 22% in one month.

The EU is expected to face a GDP reduction of 0.2% to 0.8%, depending on the measures taken as retaliation. Germany, Ireland, Italy, France, the Netherlands, and Belgium’s export volumes face substantial risk.

WTO Disputes and Legality Questions

The US President accused trading partners like India of using high tariffs and sustaining a trading surplus with US products. Ironically, the US itself uses excessive non-tariff measures to protect its domestic markets. China’s trade with Russia is susceptible to international laws, however Trump’s tariffs are stated as a violation of international law by the EU, which issued a World Trade Organization (WTO) dispute against this. The tariff policy is stated to contravene WTO principles, including the most-favoured-nation rule and imposing tariffs in excess of bound tariffs.

The US administration faces legal challenges on its justification of using tariffs as a measure of national security. Following a Court of International Trade ruling on 28th May 2025, tariffs under the International Emergency Economic Powers Act (IEEPA) were declared unconstitutional. However, this ruling is currently under appeal, temporarily pausing the enforcement of the lower court’s decision.

What this Means for Future India-US, China-US, and India-Russia Relations

India-US Relations: India and the US have agreed to reach a USD 500 billion trade goal by 2030. Considering this, India has also taken measures and addressed US concerns by lowering import duties on some US products including specific motorcycles, synthetic flavouring essence, fish hydrolysate, and waste/scrap items. Despite such trade agreements, China, Mexico, and Canada have still faced US tariff threats, suggesting a trade deal does not guarantee protection. Hence, emphasis should be placed on home market reforms.

China-US Relations: The China-US trade war has been ongoing since 2016 and escalated when the US imposed 10% tariffs on Chinese imports and 25% tariffs on steel and aluminium earlier this year, which were met with reciprocal tariffs from China. It is suspected that Trump is using tariffs to buy time in his non-action against China to negotiate a trade deal that includes rare earth minerals, whose processing and extraction has long been dominated by China. These are highly demanded by industries dependent on them. Some export restrictions have been eased on advanced semiconductors to China. It is predicted that a ceasefire declared in Ukraine could bring greater stability to the international system, benefiting China’s economy. However, currently trade flow reallocation is expected and a collapse in bilateral trade between the US and China.

India-Russia Relations: Although US trade wars have impacted the global economic landscape and plummeted the demand for Russian oil and gas, hurting Russian exports, India’s relationship with Russia during the US tariff war is marked by significantly increased energy imports. India became the second-largest buyer of Russian crude. This prompted US tariffs on Indian goods, partly due to these oil purchases. Despite this pressure, Indian Prime Minister Modi and Russian President Putin affirmed a “special and privileged” partnership, with bilateral trade reaching a record $68.7 billion in FY 2024-25. India continues to assert its strategic autonomy in maintaining these ties.

References

- Bouët, A., Sall, L. M., & Yu Zheng. (2025). Towards a trade war in 2025: real threats for the world economy, false promises for the US. In CEPII, CEPII Working Paper. https://www.cepii.fr/PDF_PUB/wp/2025/wp2025-03.pdf

- CANARA BANK, ECONOMIC RESEARCH VERTICAL, HEAD OFFICE. (2025). Tariff or tactics or trade war ? https://canarabank.com/UploadedFiles/Pdf/USA-%20India%20Trade%20Deal.pdf

- DE LEMOS PEIXOTO, S., SPITZER, K. G., SABOL, M., LOI, G., Economic Governance and EMU Scrutiny Unit (EGOV), & Directorate-General for Economy, Transformation and Industry. (2025). US tariffs: economic, financial and monetary repercussions. In Economic Governance and EMU Scrutiny Unit (EGOV) (Report PE 764.382). https://www.europarl.europa.eu/RegData/etudes/IDAN/2025/764382/ECTI_IDA(2025)764382_EN.pdf

- Jaiswal, H., Ganesh-Kumar, A., & Indira Gandhi Institute of Development Research, Mumbai. (2025). Trade war and some policy alternatives for India. In Indira Gandhi Institute of Development Research, Mumbai. http://www.igidr.ac.in/pdf/publication/WP-2025-004.pdf

- Kozul-Wright, A. (2025, August 20). Why is the US sparing China, but not India, for importing Russian oil? Al Jazeera. https://www.aljazeera.com/news/2025/8/20/why-is-the-us-sparing-china-but-not-india-for-importing-russian-oil

- Modi and Putin affirm special relationship as India faces steep US tariffs over Russian oil imports. (2025, September 1). PBS News. https://www.pbs.org/newshour/world/modi-and-putin-affirm-special-relationship-as-india-faces-steep-us-tariffs-over-russian-oil-imports

- Nadjibulla, V., & Nadjibulla, V. (2025, September 4). At the Crossroads: India’s Relations with the U.S., China, and Russia. Asia Pacific Foundation of Canada. https://www.asiapacific.ca/publication/crossroads-indias-relations-us-china-and-russia

- Shrivastava, K., & Sharma, S. (2025). LEGAL IMPLICATIONS OF THE USA’S TARIFF WAR – FROM CHINA TO INDIA. In Mondaq, Mondaq (p. 1). https://kochhar.com/wp-content/uploads/2025/05/Legal-Implications-Of-The-USAs-Tariff-War.pdf

- Will Russia come out a winner in Trumps trade wars. (2025, April 3). The Moscow Times. http://themoscowtimes.com/2025/04/03/will-russia-come-out-a-winner-in-trumps-trade-wars-a88238/pdf

- India plans relief package for exporters hit by U.S. Tariffs (September 5, 2025)- Reuters Reuters – India plans relief package for exporters hit by US tariffs Reuters – India’s chief economic adviser says Trump’s tariffs could shave 0.5% off GDP

- Blenkinsop and Manoj Kumar (September 9, 2025)- India, EU push to close gaps in trade talks as year-end deadline looms by Philip– Reuters https://www.reuters.com/world/india/india-eu-push-close-gaps-trade-talks-year-end-deadline-looms-2025-09-09/

- Trump’s India tariffs take effect: Which sector will be hit, what’s exempt? (2025, August 27)- Al Jazeera https://www.aljazeera.com/economy/2025/8/27/trumps-india-tariffs-take-effect-which-sector-will-be-hit-whats-exempt

- Archana Rao (2025, August 19) US Tariff Tracker: Strategic Implications for India’s US$48.2 Billion Exports. India Briefing https://www.india-briefing.com/news/india-us-tariff-conflict-business-guide-39089.html/

- Archana Rao (2025, May 30th). US Appeals Court Reinstates Trump Tariffs: Key Updates for India. India Briefing

https://www.india-briefing.com/news/us-imposes-26-tariff-on-india-36763.html/

Recent Comments