Introduction

Pop culture, like blockbuster movies and our obsession with celebrities, can impact everything from the clothes we wear to the food we eat. And, as new data shows, it can also influence the stocks we buy.

Investing platform Public’s recent retail investor report found that while retail investors continue to become more nuanced in their investing strategies, cultural trends play a large part in shaping some investors’ decisions.

Compiling user data from the Public’s investing platform and responses to three surveys with roughly 1,000 respondents each, the company found that big cultural moments like the Barbie film release and a recent Bud Light advertising controversy have grown the number of new investors in those brands’ respective parent companies.

The number of investors on the Public platform in Mattel stock grew more than six times larger after the success of Barbie. Similarly, the number of Public investors in AB InBev — Bud Light’s parent company — grew by 1.5 times amid backlash and a boycott from conservatives after transgender influencer Dylan Mulvaney promoted the beer on Instagram.

Exploring the Intersection of pop culture and investing trends

Over the last year, and really since the start of the pandemic lockdowns, we saw a pattern emerge. Cultural Trends were spreading like wildfire through society. With the help of Facebook/Meta, Instagram and Twitter hierarchical diffusion seemed to be on steroids. Hierarchical Diffusion is the spread of an idea from persons or nodes of “authority” or “power” to other persons and places. We entered the era of “influencers”, and they were talking about everything under the sun but especially investments. Cryptocurrency which had once been an obscure topic that many could generalize about was the hot trend as hundreds of thousands of new ‘coins’ emerged. Further, the novice investors collectively became market movers bringing stocks/companies that were on the brink of collapse to resurrection – just look at GameStop and AMC. This trend has taken on a life of its own and everyone is weighing in. This has never been clearer now that Elon Musk’s offer to purchase Twitter was accepted and the whole world has an opinion. Here is a deeper dive into some of the more pop culture investing trends:

Cryptocurrency & Blockchain in the Financial Ecosystem

Quickly crypto and blockchain are becoming more mainstream. While I suspect that we will continue to see the emergence of new ‘coins’, the more often that business is conducted utilizing crypto and blockchains the less it will be considered an ambiguous, foreign concept. The more established ‘coins’ such as Ethereum and Bitcoin are finding their places among Governments and Countries are continuing to adopt their usage. As such understanding of their operations and regulations is going to make them more investor friendly and less risky.

Exploring the phenomenon of Meme Stocks

The meme stocks have a cult-like following online and novice investors have swarmed to them causing the stock price to become overvalued, allowing investors to see drastic price increases in very short amounts of time. The stocks have increased because of the sheer volume of trading not because of how well the company performs or how healthy their financial balance sheet is. This hype has caused a euphoric, idealistic viewpoint of investing and ‘stock picking’ and many fear this trend will cause investors who bought at the ‘exact right moment’ to become overconfident. Investing in meme stocks is generally very risky.

For us, investing is about risk management; investing for the long-term and taking calculated risks to ensure present and future financial security. Whereas Pop culture investing is more akin to gambling in a casino and betting $500 on black – sometimes you will win, sometimes you won’t. A general rule of thumb is not to use funds that you can’t afford to lose on investing in pop culture investments or taking chances on stocks that the latest TikTok investment expert turned you onto. While some of these stocks have a place in a healthy diversified portfolio, not all do and we urge you to speak to a financial professional to help you navigate the ins and outs of these stocks.

Exploring the relationship between Social media platforms and the stock market dynamics

Platforms like Twitter, Facebook, Instagram and Reddit have made it easier for celebrities and influencers to share their opinions, easily swaying the stock market and wiping off millions of dollars or conversely inflating a company’s value with just a single message.

Social media has created an environment in which information travels at lightning speed.

How one single tweet can affect the share price?

When it comes to tweets, no one can beat the market Mover: Elon Musk, who is known for his prolific tweeting and the impact that his tweets can have on the stock market. Here are some examples of his market-moving tweets:

Tesla

In May 2020, Musk wiped nearly $14 billion off the value of his own company after tweeting that its share price was “too high”, and the company’s stock price closed 10% lower that day. This caused Musk’s stake in Tesla to fall in value by $3 billion.

Bitcoin

In February 2021, Musk announced that Tesla had bought $1.5 billion in Bitcoin to enable the company to facilitate payments in the cryptocurrency. However, in May, Musk announced that Tesla would no longer accept Bitcoin payments due to the environmental costs. This caused Bitcoin’s value to fall by more than 10%.

Musk later confirmed on June 21st that Tesla would resume allowing transactions made in the digital currency once crypto mining becomes greener. This announcement caused Bitcoin to hit a three-week high, climbing above $40,000.

Signal Advance Inc

One of Musk’s most impactful tweets was when he tweeted, “Use Signal.”

The tweet likely referred to the messaging app in light of privacy concerns over WhatsApp. However, it ended up boosting the wrong company’s stock as the Signal app isn’t publicly listed. Medical device company Signal Advance’s stock surged more than six-fold after the tweet, and many investors jumped on board without realising their mistake.

Dogecoin

How can we forget the famous MEME coin, which recently even became the logo of the bird app for a week or so? Musk’s support of Dogecoin has caused its price to skyrocket. The coin’s price has risen from just fractions of a cent to around $0.30. Thanks to Musk, the coin hit a total market capitalisation of over $70 billion in May 2021.

Musk’s tweets have gained so much attention that some have called for them to be regulated. His influence on the financial markets is undeniable, and his followers take his tweets as the “golden rule.”

A study which analysed 17 tweets by Musk found that, on average, he caused an 84% average change to the share prices of the companies he mentioned.

That’s a massive impact! Investors are always on the lookout for any mention of a company by Musk, as it can cause the stock prices to soar or plummet in seconds.

Next in line, we have the Kylie Jenner Effect.

Kylie effect

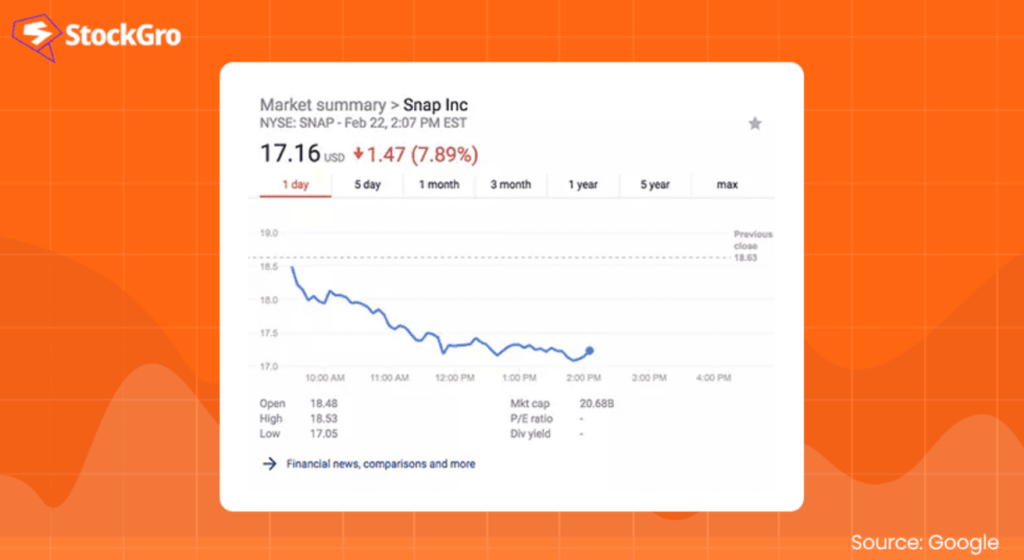

Kylie Jenner is one of the celebrities who has significantly impacted the stock market with her tweets. In February 2018, Jenner tweeted that she no longer used the Snapchat app, causing the company’s market capitalisation to drop by $1.3 billion.

Even though Jenner quickly followed up with another tweet saying how much she loved the app, it took until June 2020 for the share price to reach the same level it had pre-Jenner’s tweet.

Bieber’s Boost for Crocs

Justin Bieber caused a stir on social media when he posted a photo of Crocs in a pool with the caption “soon” on his personal Instagram account. The post resulted in a 6% boost in the shoe company’s shares.

Investigating the impact of influencers and celebrities on stock prices

In recent years, new funds and individual celebrities have been stepping up to change the way startup capital is raised. Celebrities have been the face of companies for generations, with some stars even venturing out and starting their brands. What we are now seeing is celebrities taking on the role of venture capital firms and investing in startups themselves using private funds.

Companies have long known that celebrities can make or break their businesses. That’s why they pay big bucks to use their fame in advertisements. But now, the actions of influencers and celebrities can also affect the stock market.

When a celebrity or influencer invests in a company, it can cause speculators to go into overdrive. This is what we call “Celebrity stocks”. On the other hand, when a celebrity shows negative feelings towards a company, it can make the market reeling.

The Kohli Effect on Vedant Fashions

Indian cricketer Virat Kohli is known for his impressive performances on the field, but he’s also made a name for himself off the field as well. In addition to his various endorsements, Kohli is the brand ambassador for Vedant Fashions, a popular clothing retailer in India.

Summary

- Popular culture trends have an impact on investment decisions, as evidenced by an increase in retail sales of companies associated with cultural trends such as the Barbie movie and the Bud Light advertising controversy.

- Social media platforms are the fastest growing part of the investment industry; with influencers discussing topics ranging from cryptocurrency to meme stocks, causing rapid fluctuations in stock prices.

- Elon Musk’s tweets had a huge impact on stock prices such as Tesla, Bitcoin, Signal Advance Inc and Dogecoin.

- Celebrities like Kylie Jenner and Justin Bieber have also made a huge impact on the stock market through their ads and endorsements, as seen in Jenner’s tweet affecting Snapchat’s market capitalization and Bieber’s post boosting Crocs’ shares.

- As Virat Kohli’s collaboration with Vedant Fashions in India shows, the influence of influencers and celebrities continues to influence new investments, and their endorsements or criticisms can influence the investor’s opinion and business practices.

References

- From ‘Barbie’ to Bud Light, here’s how pop culture changes the way people invest, Money. https://money.com/how-pop-culture-changes-how-we-invest/?amp=true

- Pop culture investing trends (no date) Attentive Investments. Available https://www.attentiveinv.com/education/pop-culture-trends?format=amp

- Athena Stone, M. (2022) Pop culture investing trends, Financial Matters. https://www.attentiveinv.com/education/pop-culture-trends?format=amp

- Meghani, H. (2023) Lights, camera, invest: Pop culture’s impact on investment trends, StockGro Blogs. https://www.stockgro.club/blogs/trending/role-of-pop-culture-in-stock-market/