Introduction

Netflix, the streaming giant that undoubtedly revolutionized home entertainment, is facing a dilemma. Subscriber growth has stagnated, competition is fierce, and the danger of password sharing looms large. In response, Netflix has announced plans and put out beta tests to crack down this widespread practice, a move with potentially significant financial ramifications. This article aims to explore the intricate web of profit, loss, and “Tudum” surrounding this decision, exploring its impact on Netflix and the future of streaming.

The Password Sharing Dilemma

Netflix estimates that over 100 million households globally access its platform through shared passwords. While convenient for friends and families, this practice undermines the company’s revenue model. Each shared account represents a lost subscriber, translating to decreased subscription fees and ultimately, lower profits. Analysts estimate that password sharing costs Netflix billions of dollars annually, which is a substantial dent in its financial revenue.

Crackdown Policy

To combat loss in revenue, Netflix is deploying a multi-faceted approach. It’s currently testing various methods, including:

- Household WiFi logins and IP address tracking: Identifying and potentially restricting simultaneous logins from different locations. Users must login to their accounts at least once every 31 days from their household WiFi IP Address.

- Verification codes: Sending temporary codes to account holders before granting access from new devices.

- Family plan restrictions: Limiting the number of simultaneous streams allowed on family plans. Members with different IP Addresses can be added to the plan for an additional fee ($8 per new member)

These measures, while aimed at boosting revenue, come with potential pitfalls. Tightening access could alienate subscribers accustomed to sharing, leading to cancellations and eventually causing damage to the brand’s reputation. Moreover, implementing these measures effectively requires significant technological investment and could be met with user frustration.

Ethical Considerations of Password Sharing

The legality and ethical considerations of password sharing amongst friends and family members is questioned because of the large number of users who do so.

Sharing Netflix login credentials is technically restricted by the service’s terms and conditions. The terms state that customers may only share their username and password with “members of their household.” However, there is no consensus as to what constitutes a “household,” and many users continue to share passwords with friends and family who do not reside with them. Therefore, password sharing, while not against the law, is still in breach of the streamer’s policy.

Password sharing essentially constitutes a moral grey area. It has benefits for users but at the cost of breaching confidence between users and the platform (which may be interpreted as theft), while also harbouring security concerns.

Financial Impact

Lost Revenue

It’s beyond the imagination to figure out exactly how much revenue Netflix’s long time nemesis, password-sharing, has actually cost them. To statistically analyse how much revenue has been lost, let’s look at some of the estimated figures:

- It is estimated that Netflix loses anywhere between $9-15 billion annually, solely due to password sharing.

- This is almost 10% of their potential revenue, a significant amount of their earnings.

- As stated previously, approximately 100 million households access the streaming service through shared passwords

- This translates to almost 30% of their global users.

Cost of Crackdown

Netflix’s password-sharing crackdown policy has many factors at play that affect the actual cost of this policy, including but not limited to –

- Development and Execution: Building and updating systems to enforce password sharing measures requires technological investment. This includes hiring engineers, developing software, and integrating it with existing infrastructure.

- Customer Support: Dealing with user inquiries and complaints resulting from the crackdown will necessitate additional customer service resources.

- Public relations: Managing negative publicity and backlash from users and many other stakeholders, who may perceive the crackdown as unfair or restrictive, requires strategic communication efforts.

- Subscription losses: Some users may cancel their subscriptions in response to the crackdown, leading to lost revenue and a decrease in the user base. This impact is difficult to quantify as the impact of user motivations for cancellation can be quite complex.

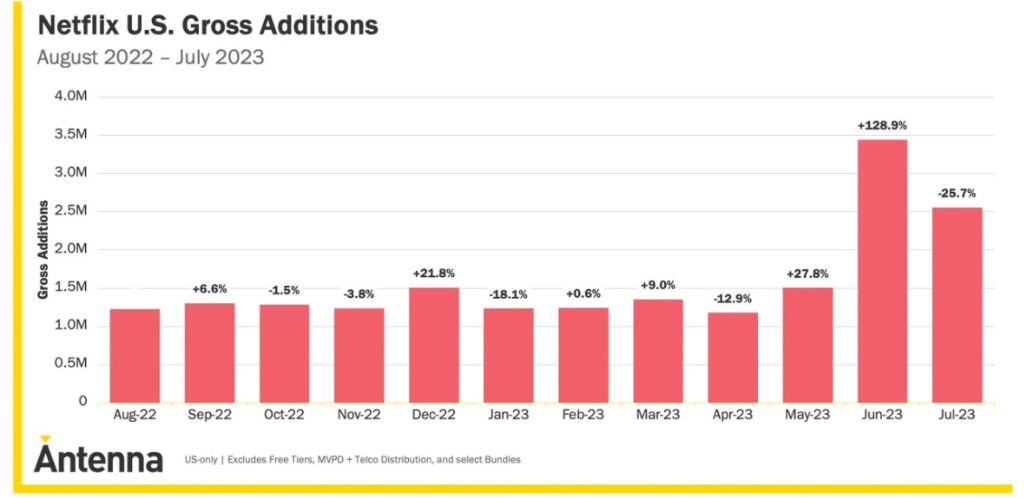

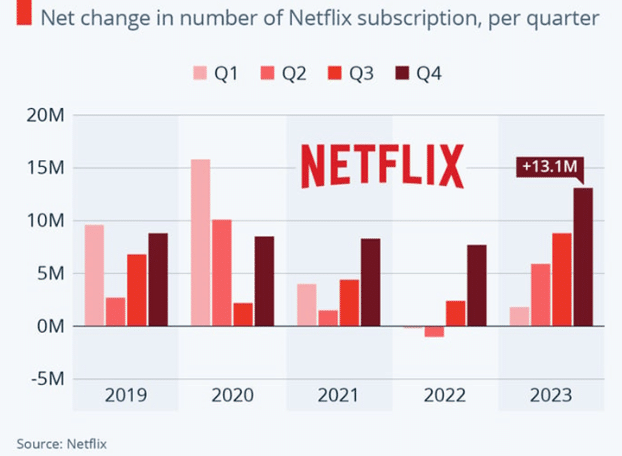

Despite all these costs of implementation to Netflix, it has launched this policy and the initial reports released by the streamer, regarding its impact have been called “a smashing success”, with the subscriber growth rate increasing substantially in 2023 Q1, a trend that has not been seen since the Covid-19 pandemic.

User growth graph | Source: https://www.zdnet.com

Strategies and Solutions

Netflix is a trailblazer in the digital entertainment space, revolutionising the way we watch and consume media . However, the phenomenon of password sharing has emerged as a challenge, prompting Netflix to consider measures to uphold fairness and sustainability.The initial goal of Netflix is to help users cut back on sharing themselves, without the company forcing the issue. In this exploration, we dissect the strategies and solutions in use as well as proposed to tackle Netflix’s crackdown on password sharing. By examining technological innovations, authentication methods, and industry dynamics, we aim to shed light on the evolving landscape of digital content distribution and consumption.

Targeted Pricing Model

Netflix previously had three price tier segments based on the number of devices allowed and the quality of streaming (HD, full HD or ultra HD). For years, Netflix has consistently offered ad-free streaming to continue luring customers with uninterrupted service delivery. Netflix’s pricing strategy is centred on value. Value-based pricing is unique in that it offers three different subscription options, each with a different value associated with the various costs. The brand has an advantage over competitors who charge per episode or movie with this subscription-based approach.Netflix is available in India with three different plans: the Basic plan, which costs Rs 500 per month, the Standard plan, which costs Rs 650 per month, and the Premium plan, which costs Rs 800 per month. It makes its customers use its streaming services with its feasible and simple plans. This applies the best to all its audience.

Adopting a significant change in its pricing strategy , Netflix now allows users to enjoy watching various originals and movies with frequent ads at a lower price ..In the US, Basic with Ads is $7 a month, a savings of $3 monthly compared with the cheapest ad-free membership. That’s the cheapest Netflix has ever offered a stand-alone streaming subscription in the US.

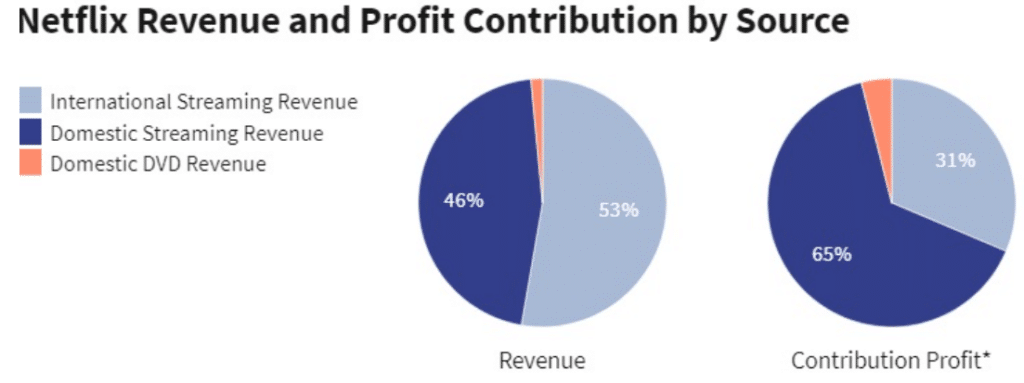

Potential Alternative Revenue Streams Other Than Subscription

Interestingly the only promising monetization comes from subscriptions for DVD rentals and video streaming .In a saturating market, where competition is fierce and growth opportunities may be limited, Netflix could explore alternative ways to generate revenue. Here are some potential strategies for Netflix to consider:

- Diversification of Content: Netflix could expand its content library beyond movies and TV shows to include original podcasts, documentaries, live events, or interactive experiences. By diversifying its content offerings, Netflix can attract new audiences and create additional revenue streams through sponsorships, advertising, or premium content subscriptions.

- Partnerships and Licensing: Netflix can explore partnerships and licensing deals with other companies or content creators. This could involve licensing popular content to other streaming services, partnering with production studios for exclusive collaborations, or co-producing content with other platforms. These partnerships can bring in additional revenue through licensing fees, distribution agreements, or shared production costs.

- Merchandising and Brand Extensions: Netflix can leverage its popular content to create merchandise, such as clothing, collectibles, or branded products. Additionally, they could consider licensing their intellectual property for video games, board games, or theme park attractions. These brand extensions can generate revenue from merchandise sales and licensing fees.

- Data Monetization: Netflix possesses valuable user data and viewing patterns. They could explore partnerships or collaborations with market research firms, advertisers, or content creators to provide anonymized data insights for targeted advertising or content development. Monetizing data can create an additional revenue stream without compromising user privacy.

Source: https://www.zippia.com

Content and Marketing Strategy

Password sharing paradox is a double-edged sword that fuels viewership but cripples revenue. To navigate this dilemma, Netflix needs a marketing strategy as captivating as its content, one that reels in individual subscribers without sacrificing the magic of shared experiences.

Ad Business of Netflix

While much attention has been paid to Netflix’s ad-supported tier, which launched in November 2022, the advertising revenue is not significantly affecting its bottom line. There’s a need for potential ad-tech infrastructure, both internally and alongside global ad-tech and sales partner Microsoft. Eventually, the company could end its partnership with Microsoft once its build-out is complete.The company remains confident that its ad business will eventually generate 10% of its revenue.

However , it is crucial to navigate the approach of targeted advertising with a financial lens acknowledging its potential.

- Focus on Value Proposition: Targeted ads should highlight the benefits of individual subscriptions, emphasising exclusive content, personalised recommendations, and seamless viewing experiences.

- Creative Formats: Experiment with engaging ad formats like interactive ads or personalised video messages to capture user attention and drive action.

- Balancing Privacy and Profit: Netflix needs to strike a balance between maximising ad revenue and respecting user privacy. Transparency and control over data usage are crucial.

Content Marketing – Beyond Trailers and Teasers

Netflix is an excellent example of how personalised content can improve user satisfaction. Netflix knows what TV shows and movies its users like to watch. It uses this information to create customised recommendations for them. To continuously ace this game ,Netflix should broadcast some behind the scenes , offer exclusive interviews , deleted scenes only to individual subscriber, organise a live watch party , digital comics and interactive quizzes based on some popular shows. These will help Netflix ace its content game.

Guerrilla Marketing

Guerrilla marketing is a technique for increasing brand exposure by attracting attention through unusual means. This marketing tactic has already worked well for them with the popular South Korean show, Squid Game. One of the most memorable aspects of Squid Game is the doll in the “Red Light, Green Light” game. Netflix installed this doll in a variety of cities, including Los Angeles, Sydney, Seoul, and England. The subsequent equipment of this marketing method will most likely have an important job in captivating its viewers as it rolls out password sharing.

Industry Implications

Imagine a pebble dropped into a still pond, sending ripples outwards, disrupting the water’s serenity. That’s the potential impact of Netflix’s password sharing crackdown, not just on its own bottom line, but on the entire streaming industry. As the industry leader makes waves, its ripples could reshape the landscape for competitors, content creators, and ultimately, viewers themselves. We’ve to deep dive into the understanding of Netflix’s crackdown on password and its far reaching implications on the streaming industry.

Rise of free streaming platforms

The advent of free streaming apps with ad-supported models is an intriguing trend in the streaming business. Apps such as Freevee, Tubi, and Pluto TV are vying for a part of the market. With the market’s focus on the top streaming applications, the key to success for new free streaming services is to lure customers from these leading players rather than directly compete with other ad-supported streaming platforms. Free streaming applications stand a better chance of carving out a niche in the competitive streaming industry if they provide appealing content and use targeted advertising.

Increasing competition

This policy shift might also encourage competition. Other platforms could capitalise on Netflix’s crackdown by emphasising their more relaxed account-sharing policies to attract users, leading to a more diversified and competitive market.Attracting new subscribers and retaining old ones has become a tough task in the last few years as customers now have a surfeit of options – Walt Disney’s streaming service, Amazon.com’s Amazon Prime Video and Warner Bros Discovery’s Max, among others.Wall Street had raised concerns that password-sharing could mute subscriber growth. However, Netflix’s crackdown managed to reinvigorate its user additions.

Following the suit

Paid sharing may or may not negatively impact Netflix’s financial results, but it may also have significant effects on the streaming market as a whole. Disney, Warner Bros. Discovery, and Paramount, among other businesses, are probably watching to see how customers react to Netflix’s crackdown on password sharing. Since all streamers have the same problem with password sharing, if everything goes according to plan, other services may wish to take a cue from this. There’s always a chance that paid sharing will become standard practice in the industry when a major streamer like Netflix enters the market. The successful crackdown on password sharing by Netflix has been reported, coinciding with Disney’s crackdown on account sharing. Disney claims to be following Netflix’s lead and will reveal its new password sharing policies by the end of 2024.

Global Perspectives: Investors, Subscribers and Competitors

Given the multifaceted and intricate nature of Netflix’s new password sharing strategy, this strategy has elicited a diverse response from people across the world including some from its investors, subscribers, content creators, competitors, national governments etc. To anticipate how the profitability of Netflix might shape up in the future owing to the crackdown, it is important to examine stakeholder’s behaviour towards this strategic step taken by the entertainment giant.

As investors weighed the potential benefits of this crackdown against its possible risks, their initial response to the new pricing strategy has been cautiously optimistic. Immediately after Netflix made this announcement in April last year, its share price surged by more than 20% rising from an initial level of $222 to $270 per share. Investors perceive it favourable from a profitability standpoint, which is one of the reasons they have an optimistic outlook. They believe the company would now earn the revenue that was lost due to 100 million free riding users. This is expected to grow its consumer base by almost 40% across the world.

Subscribers are the most important stakeholders of any entertainment company because they are the ones without whom the company won’t operate and generate revenue. This is believed to be true because having no subscribers would mean nobody to create the content for. Netflix’s decision to abandon its long-established practice of allowing subscribers to share their account passwords with friends and family outside their households has forced the lurkers and freeloaders to get converted into paid subscribers. This would mean that any device logged in from an IP address different from that of the household would be automatically logged out.

Now the question here is that will people give up on their binge-watching because of the additional costs they’ll have to incur out of their pockets? The much-observed fact that binge watching has somewhat inelastic demand, answers this question. Meaning that even when less consumers get to experience the pleasure of watching their favourite shows and movies on Netflix for the same price, they continue to subscribe to the app. To speak the language of numbers, before the cracking down on password sharing, Netflix reported 221.6 million subscribers at the end of Q1 2023, and this number gradually increased to 238.4 million at the end of Q3 2023, with Q2 contributing 5.4 million new subscribers and Q3 contributing 9 million new subscribers.

However, the crackdown on password sharing has not only generated a significant buzz among subscribers and investors but has also prompted reactions from Netflix’s competitors. However, their reaction has not all been unwavering. Some smaller competitors view crackdowns as an opportunity to expand their customer base by attracting users frustrated with Netflix’s new policy. Some competitors however are waiting for the right time to take a decision on whether or not to implement a similar pricing strategy in their models as well. They believe that if Netflix’s crackdown proves successful then it would pave a way for stricter industry wide norms with more companies adopting this measure.

Now, in a bid to bolster monetization and stay ahead in a fiercely competitive industry, Disney+ Hotstar too followed in Netflix’s footsteps to crackdown on its password sharing to enhance its revenue activities. However, the policies of both these entertainment giants, though strategized on similar lines, differ predominantly. While on one, Netflix focuses itself more on households requiring users to be connected to their home wifi at least once a month, Hotstar has put its focus mainly on streaming through mobile phones and desktops. It allows two mobile devices per subscription while four desktop devices per subscription. Second important aspect in which they vary is the alternative approach that the two companies provide to the users against password sharing. Netflix has added an add on option that allows the users to share passwords with people outside their house for an additional fee but Hotstar has not yet come up with any such alternative that it can offer to its subscribers.

Conclusion

The company has demonstrated proficiency in making astute and well-planned decisions across all aspects of its operations, including branding, content, business model, and product. Due to its substantial market share and emphasis on metrics, the brand has succeeded in cultivating a profound comprehension of its target audience. Reactions to Netflix’s crackdown on password sharing have been conflicting among investors, customers, rival companies, and governmental bodies. Investors anticipate higher profitability and a wider customer base, and they are cautiously optimistic. Netflix has disclosed specific statistics that demonstrate the tremendous success of its crackdown policy, as evidenced by the significant increase in subscriber numbers. It is now necessary for subscribers to upgrade to paid service, and while there might be additional costs, binge-watching is still largely desired.

References

- Comprehensive Marketing Mix Of Netflix – 2024. https://iide.co/case-studies/marketing-mix-of-netflix/

- Taking A Page From Netflix: Using Price Segmentation To Boost Revenue. https://www.forbes.com/sites/forbesbusinesscouncil/2022/12/07/taking-a-page-from-netflix-using-price-segmentation-to-boost-revenue/?sh=178535d97003%3E

- Netflix Ads Tier: Pricing Explained. https://www.cnet.com/news/netflix-ads-tier-pricing-explained-and-all-your-questions-answered/

- Netflix signups remain high, fueled by password-sharing crackdown: Report. https://economictimes.indiatimes.com/tech/technology/netflix-signups-remain-high-fueled-by-password-sharing-crackdown-report/articleshow/102990201.cms

- The Netflix Password Sharing Crackdown Is Officially Working. https://www.forbes.com/sites/kateoflahertyuk/2023/08/24/the-netflix-password-sharing-crackdown-is-officially-working/?sh=1c58e50d409e%3E

- Netflix might ruin password sharing for everyone. https://www.theverge.com/2023/5/26/23737858/netflix-password-sharing-crackdown-streaming-industry

- How Does Netflix Make Money. https://www.zippia.com/advice/how-does-netflix-make-money/

- Netflix’s Password sharing comes to India. https://www.forbes.com/advisor/in/business/software/netflix-password-sharing-crackdown/

- Netflix Password sharing reels to subscribers. https://apnews.com/article/netflix-price-increase-password-sharing-results-d2c942bce7ec2c574ca148c8661ccaf0

- Netflix’s Crackdown on Password Sharing in the UK. A Shift in Digital Streaming Policy. <https://medium.com/@m.oldham/unpacking-netflixs-crackdown-on-password-sharing-in-the-uk-a-shift-in-digital-streaming-policy-edb33b02ab8a>

- Kelly, H. (2023, June 1). Netflix restricts password sharing, leaving some angry and confused. Washington Post. https://www.washingtonpost.com/technology/2023/05/27/netflix-password-sharing-why-users-mad/

- Admin, & Admin. (2023, May 2). Netflix Password Sharing: Is it Legal, Ethical, or a Security Concern? Its Released. https://itsreleased.com/netflix-password-sharing-is-it-legal-ethical-or-a-security-concern/