As the global economy continues to endure unforeseen economic bottlenecks, it becomes crucial for central banks and governments to resort to important policy containments (monetary, fiscal, and income) to moderate inflationary pressures. Meanwhile, to achieve substantial growth rates, it is equally important to concentrate on Consumer Confidence levels and Manufacturing Indexes, to ease the demand and supply side crunches across the fulcrum. The RBI Monetary Policy Statement, 2022-23 by the Monetary Policy Committee (MPC), released on August 19, 2022, highlights two major decisions. Firstly, It has increased the repo rate to 5.40% with immediate effect to adjust effective liquidity in the economy. Secondly, it also aims to ensure the withdrawal of accommodation as a measure to control inflation and support growth.

Since the June 2022 MPC’s meeting, the global economy has continued to contend with grappling inflation (significant crude oil and food inflation), slowing growth, and persisting geopolitical conflicts in the European region. The supply chain bottlenecks post-COVID-19, stagflation concerns, tightening global financial conditions, and risks to financial stability, push the central bank to adopt even stricter reforms.

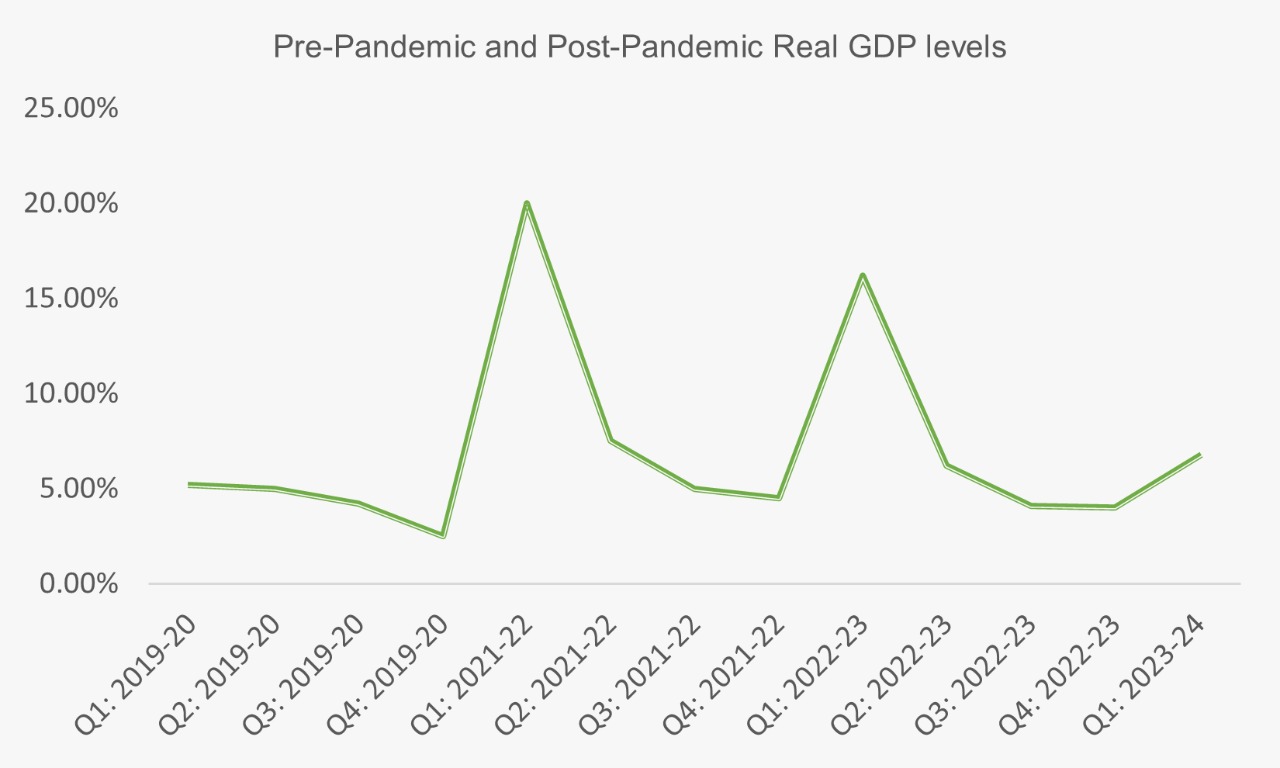

GROWTH ASSESSMENT OF THE INDIAN ECONOMY

The MPC has observed that the global economy continues to grapple with multi-decadal high inflation and slowing growth, worsening geopolitical tensions and downturns, increasing global financial volatility, and elevated prices of crude oil.

RBI is concerned about the domestic inflation outlook based on the continued global geopolitical situation and the consequently elevated commodity prices. Edible oil prices continue to grapple under adverse global supply conditions. Elevated international crude prices have risks of pass-through to domestic fuel pumps. The Ukraine War has significantly impacted crude oil prices, pushing them to $105 per barrel in August 2022. The inflation rates are retained at 6.7% in 2022-23, with Q1 at 16.2 %; Q2 at 6.2 %; Q3 at 4.1 %; and Q4 at 4.0 %.

Source: RBI Monetary Policy Statement 19 August 2022

In FY 2022-23, real GDP growth is retained at 6.7%, owing to tightening global financial conditions. Under CPI, inflation during May-June 2022 has eased to 7.0 % from 7.8 % in April, although it persists above the 6% band. Food inflation has eased, especially with the prices of edible oil prices decreasing, and substantial deflation in pulses and eggs. Fuel inflation continued to register double digits in June primarily due to the rise in LPG and kerosene prices. India’s foreign exchange (forex) reserves have hit a two-year low of $564.053 billion as of August 19, mainly tied to a sharp downturn in foreign reserve assets. The revised projections by the International Monetary Fund for 2022, released in July, place world GDP growth at 3.2 %, a sharp drop from 4.4 % projected in January 2022 and 3.6 % in April 2022. The world trade volume of goods and services is now projected to grow by 4.1 % in 2022 over the previous year, a decline from 6 % projected in January 2022.

RBI RATE HIKE ASSESSMENT

Personal Finance

The impact is likely to be more effective on longer loans than on short-term borrowings. Considering the case of a 20-year loan, advanced at 7%, every 0.25% hike in interest will increase the repayment tenure by 10 months. For example, say, if your home loan has 19 more years to due and the rates are hiked by 0.75%, the raise accounts for more than 30 more EMIs. Primarily, because of the proportional relation between interest rates and EMIs.

The rate hike has shouldered up the government bond yields. So, small savings rates may also get revised upwards, given that small savings rates are linked to government bond yields of the same maturity and are reset every quarter. As the bond yields go up the value of existing bonds falls, as a result, bond funds and NPS funds have been the worst to hit long-term securities.

Transmission of rate hikes to loans and deposits

Since most of the loans given to the retail segment, micro, small and medium enterprises are influenced by external benchmarks, a hike in policy repo rate rates leads to a faster transmission to lending rates. Lending rates are flagged to rise further after the recent 50-basis-point hike in the policy repo rate. The hike in repo rates is gradually transmitted to the bank deposit rates since banks eventually need to hike interest rates provided on deposits to maintain sources for loans Though borrowers will feel the pinch due to higher interest rates, fixed-income investors can gain higher returns.

Government borrowing and bond markets

Bond yields have been rising faster than anticipated this year, driven by the anticipation of higher-than-budgeted borrowing due to recently announced duty cuts and subsidies. Thus, eroding the government treasury. It has helped emphasize the withdrawal of surplus liquidity; hence, any move to cool yields through, say, open market operations (OMOs), would have complicated the stance of the RBI.

Impact on output production

Any hike in short-term borrowing and lending rates by the RBI discourages small and medium enterprises, as it leads to a subsequent increase in production costs and hampers competitive advantage. The high cost at which credit is made available to SMEs is the biggest roadblock to enhancing their growth and competitiveness in domestic and global markets. With 11 of 30 BSE SENSEX Stocks being Interest Rate Sensitive, the RBI’s action may hurt their businesses.

FEDERAL INTEREST HIKE ASSESSMENT

The federal policy rate is, currently, maintained in the range of 3%-3.35%, after a 0.75% hike, to tame decadal-high inflation. The Fed had previously raised the rates by 0.25% in March, 0.5% in May, and 0.75% in June.

Impact on US Economy

- The continuous tightening by the Fed is expected to push the Dollar index to levels of 112.60-113.30.

- With the prices down to 3.2% for the week so far, U.S. gold futures fell 0.4% to $1,670.50. Gold prices have gradually declined to hit a two-year low as US Fed-rate-hike fears mount.

- The imminent 0.75% hike in Fed rates is also suspected to crash the US Stock Markets by 20%.

- Oil prices have fallen after the Federal Reserve delivered the biggest rate increase in almost three decades and the US economy showed signs of demand slipping.

- The rate hike is also suspected to cause a potential dig into the US government finances. The federal government borrowing costs on its $30.89 trillion debt are expected to triple to a whopping $1.2 trillion in 2032.

The inflation rates amount to 8.3% for a year-over-year estimate, explicitly inflation increased by 0.1%compared to the last month, down from its June peak of 9.1%. But, there is not much room for respite, since prices for shelter, food and medical care have been on an uptick. The food rates registered an increase of 8% in August, while a 0.7% increase was recorded for both medical and shelter costs.

US Fed Rate Impact on Indian Market

1. Tighter financial conditions

Higher interest rates are expected to reduce the incentive for risk capital to flow into emerging markets like India. Similarly, if the Fed can over-watch demand sufficiently in the world’s largest consumer market, there will be less price pressure on imports traded into India.

2. The trade deficit, weaker rupee

Indian markets are becoming less attractive to pool FII. A rising trade deficit, owing to growth in imports outpacing exports, has already caused the Indian rupee to weaken. The Federal Reserve interest rate hike improves the yield on U.S. Treasury, thereby weakening the Rupee against the Dollar. (Rupee is pegged at 81.25 against the US dollar in early trade, as of 25th September 2022)

3. Consumer suffering

As both Fed and Reserve Bank of India withdraw monetary accommodation from their respective economies, higher debt servicing costs will lower the real disposable incomes at hand.

4. Current account deficit

In the framework of a managed floating exchange rate system, RBI has been trying to influence the balance of payments (BoP) indirectly through interest rates, economists said.

(Trade deficit was recorded at $27.98 bn, as of August 2022, double the deficit in August 2021. The CAD levels mainly hover around 3.3% of GDP in August 2022.)

5. Worsening Inflation

Depreciation of the rupee will increase the rupee cost of imported goods such as crude oil, chemicals and fertilisers, active pharmaceutical ingredients, and electronics, pushing inflation.

OTHER CRUCIAL DEVELOPMENTS

- Accommodative stance of RBI: In the August announcement, the MPC statement dropped its commitment to remain accommodative’. The focus is now on ‘withdrawal of accommodation’ to ensure that inflation remains within the target, indicating that the RBI might raise the rates further to tame inflation.

- Standing Deposit Facility Rate has been adjusted to 5.15% and Bank Rate to 5.65%

- RBI has again traced its consumer-first stringent regulations, to the increasing digital lending market (particularly, the MSMEs). Both the loan-service facilitators and digital-lending apps have to comply with protocols, to ensure financial safety.

- The European Central Bank Under its stint to regulate inflation has increased the interest rates substantially taking the Euro-Dollar to its original levels of 0.75-0.80. ECB has hiked key rates by 75 bps, in an unmatched move since 1991, after Eurozone hit high 9.1% levels of inflation, this August.

CONCLUSION

Optimistically, while inflation has risen faster than anticipated, growth has remained resilient. Export performance in both goods and services in 2021-22 was well above the 2019 levels. In Q1: FY 2022-23, exports exceeded the value, on a YOY basis as well. Although IIP for April-May 2022 was only 4.0% above the same period in 2019, it was 12.9 % YOY basis. The PMI for manufacturing has remained expansionary for April- July period. In the case of services also, PMI has registered an upward trend during the period April to June. Capacity utilisation in the manufacturing sector exhibited growth above the long-term average in Q4: 2021-22, with the RBI Industrial Outlook Survey substantiating it.

Source: RBI Monetary Policy Statement 19 August 2022

The rise in capacity utilization coupled with the government’s CAPEX push and the deleverage balance sheets of companies should improve the investment climate, going forward. Overall system liquidity is maintained in surplus, with the average daily absorption at ₹3.8 lakh crore during the June-July period. Money supply (M3) and bank credit from commercial banks rose (y-o-y) by 7.9 % and 14.0 %, respectively, as on July 15, 2022. Similarly, the economic indicators for June-July indicate a broadening of the recovery in economic activity in India. Urban demand is recovering and rural demand is gradually catching up. RBI remains optimistic about the recovery stint and has retained GDP growth projection for 2022-23 at 7.2%. (Fitch Ratings also revised its growth in 2022-23, forecast for India to 7.8% from the early projected rate of 7.8%).

The Indian economy is apprehensive of stringent regulation of demand and supply side leakages, at a time when the nation slowly recovers from the reeling covid-19 downsides, a reprehensible Coronavirus contamination spike, and a fresh set of restrictions on easy trade and transactions.

Our Reference :

- MPC, R. (2022, June 8). Press Release. Reserve Bank of India. Retrieved June 20, 2022, from https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=53832

- Bureau, P. I. (2022, June 8). RBI interest rate hike. RBI hikes Repo Rate by 50 basis points. Retrieved June 20, 2022, from https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1832000

- Bank, F. R. (2022, June 17). The Fed – Monetary Policy Report. Federal Reserve Board. Retrieved June 20, 2022, from https://www.federalreserve.gov/monetarypolicy/mpr_default.htm