Introduction

In today’s modern world, the internet has become more and more accessible to all, integrating itself into our daily lives. The entertainment industry too has been a part of this virtual movement making the streaming platform industry a very attractive and profitable venture, providing a new and better way to consume media anytime and anywhere. The online streaming platform industry market size stood at USD 342.44 billion in 2019 and is estimated to reach USD 842.93 billion by 2027. Our analysis focuses on various aspects of this industry to develop a more holistic and critical view of its growth potential.

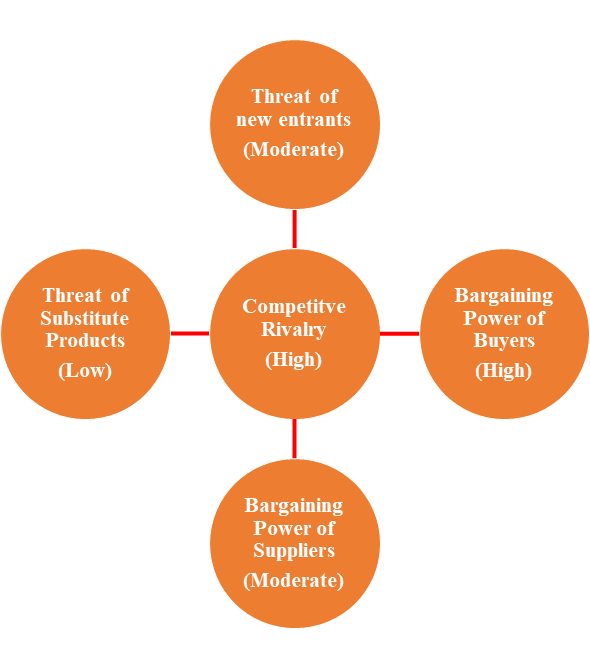

Porter’s Five Forces Analysis of Online Streaming Platforms

1. The Threat of New Entrants-

The barriers to entry in the OTT platform industry are high due to the high initial cost of investment as well as the presence of high difficulty in acquiring licenses for streaming media. On the other hand, for the established organizations in the entertainment industry, the barriers to entry are fairly low. These organizations will be able to immediately launch the service with their own content already having a fan base for the organization as a whole or a specific series (example: HBO Max). The Global Video Streaming Software Market is estimated to hit $19,537.1 million and grow with a significant CAGR of 20.4% from 2020 to 2027 (Paliwal, 2021). Thus, this makes it very attractive for established big players to enter this market increasing the threat of new entrants.

2. Bargaining Power of Buyers-

The bargaining power of buyers in the streaming market is high due to low switching costs and the presence of a monthly subscription-based business model. There are a large number of streaming platforms offering similar services making the industry very price sensitive. The most important aspect of product differentiation in this industry is the number as well as the quality of original series and movies which are not available on other platforms.

3. Bargaining Power of Suppliers-

Suppliers enjoy a high bargaining power in the streaming market power as they are the only suppliers of a specific media entity and they have an edge over the price negotiations, especially in the case of popular media entities. However, the Netflix original content accounted for just 17% of Netflix’s US streams in January 2017, as compared to 37% in October 2018 according to video-measurement firm 7Park Data. This shows that the online streaming platforms are more than ever focusing on creating original content to establish more market power reducing the power of suppliers.

4. The Threat of Substitute Products-

The streaming platform industry primarily faces competition from various physical branches of the entertainment industry like tv shows and cinema along with other types of online platforms like YouTube, Instagram, etc. The daily average time people are watching broadcast TV in the UK is 242 mins in 2010 as compared to 192 mins in 2019. On the other hand, the average viewing time of subscription videos on demand such as Netflix rose by 7 mins in 2019 compared to 2017. The physical entertainment industry is continuously declining which has been further accelerated by the covid-19 pandemic all around the world. The online streaming platform is definitely the future of the entertainment industry due to higher flexibility, convenience, and customer satisfaction.

4. Competitive Rivalry-

The scale of competition is very high in this industry. The major players in this industry are Netflix, Amazon Prime, Hulu, Disney Plus, HBO Max, Crunchyroll. All of these have a range of original as well as popular content to set them apart and need to constantly add new quality content to remain in the market. For instance, many relatively new online streaming platforms are removing the most popular video content from Netflix (like Disney Plus) to show on their own platforms, continuously stealing market share from Netflix and increasing competition in the industry.

(Shaw, 2021)

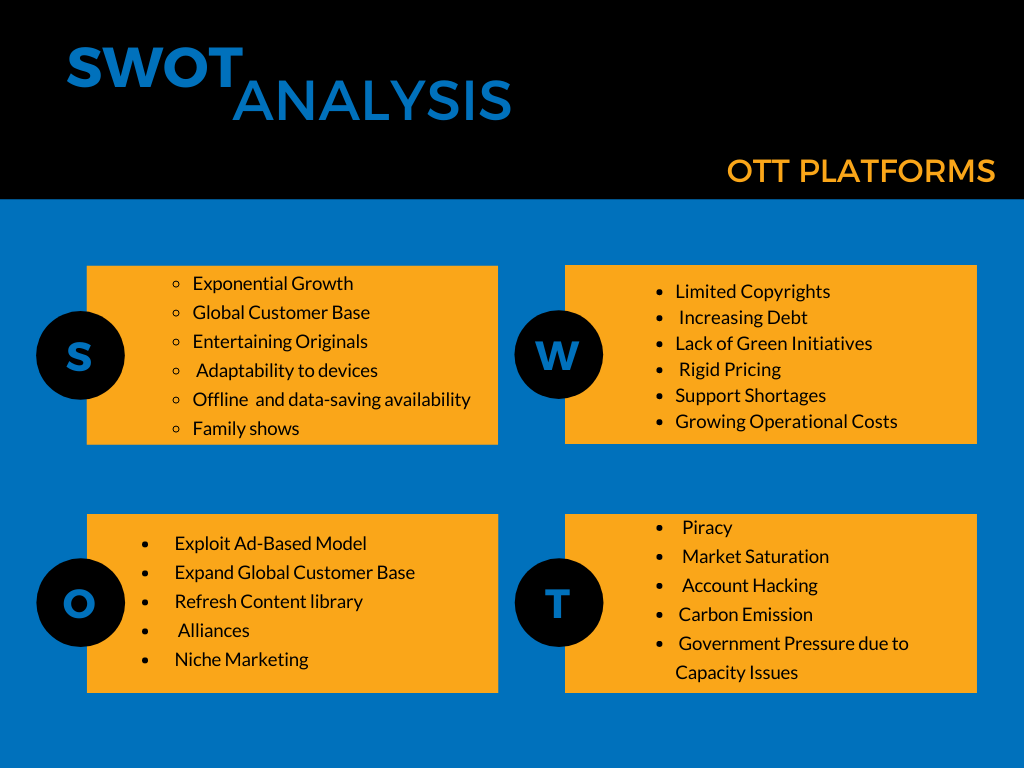

SWOT Analysis of streaming platforms

Strengths:

-

Exponential Growth:

With the advent of Covid-restricted lockdowns in 2020, the whole world was caged in homes and run-of-the-mill life was halted. The unpleasant time resulted in losses for many businesses, but one industry that flourished was the streaming platform industry. Social distancing norms and isolation of people increased at-home digital consumption, thus creating a surge in the demand for subscription-based streaming services. Exponential growth has been discerned since 2020.

-

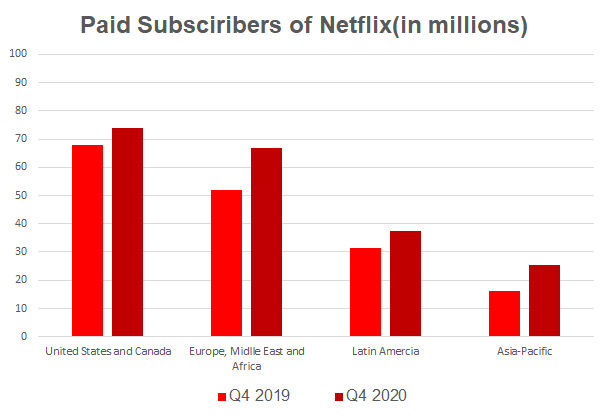

Global Customer Base:

Most streaming platforms are available in more than 10 countries with a massive subscriber base in each country. For instance, Netflix operates in around 190 countries, having a strong customer base. The following data shows the international reach of Netflix and how it fueled up in 2020.

(Parker, 2020)

-

Entertaining Originals:

The high-quality originals produced by these streaming platforms have been remarked as successful over the years and discerned as an important factor in increasing the customer base. Originals add up to the conventional theatre-movie trope and entertain the audience to the brim.

-

Adaptability to devices:

You can watch the same show or movie, on your mobile phone, laptop, or television. It makes streaming flexible and consumer-friendly. So, adaptability to devices serves as a great strength of OTT platforms.

-

Offline and data-saving facility:

The content on these platforms is downloadable and can be watched anytime. Some of them also bestow data-saving systems which control user’s internet data usage.

-

Family shows:

Family shows are available on such platforms along with the kids’ page. The kids’ page has a parental controlling system that furnishes ad-free entertainment to kids.

Weaknesses:

-

Limited Copyrights:

Most of the content on such platforms isn’t owned by the company and rights expire after a few years, which leads to streaming of its content on other websites for free. This affects the business negatively and reduces the subscriber base.

-

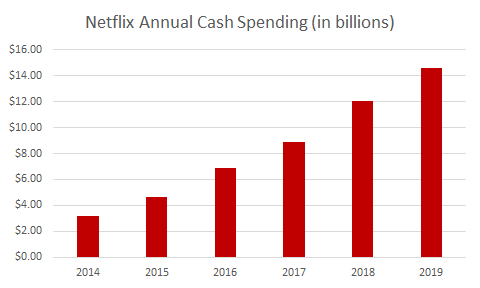

Increasing debt:

Since producing originals and increasing global reach takes a lot of capital, most companies borrow, and debt piles up. For instance, Netflix reported a debt of $14.17 billion as of April 2020 and plans to raise $1 billion more (Spangler, 2020) through a debt offering.

-

Lack of Green Initiatives:

Many companies are adopting green initiatives nowadays, as the use of renewable energy, promoting environmental sustainability, etc. But many popular streaming platforms lack such incentives. It is the need of the hour.

-

Rigid Pricing:

Customers always demand more options but most OTT platforms offer only 3-4 plans which acts as a weakness to such an arrangement.

-

Support Shortages:

An incessant period of shortage of customer service has been witnessed in the past few months on some streaming platforms due to higher audiences and augmented hacked accounts. This happens to be a significant weakness of such platforms.

-

Growing operational costs:

Putting up new content every day and marketing efficiently has elevated the operational costs of such platforms. However, earnings remain limited due to joined accounts and hackers.

(Parker, 2020)

Opportunities:

-

Exploit Ad-based model:

An ad-based model is very common to generate revenue from online applications. But many streaming platforms do not have it yet. It can act as a good opportunity to boost revenue.

-

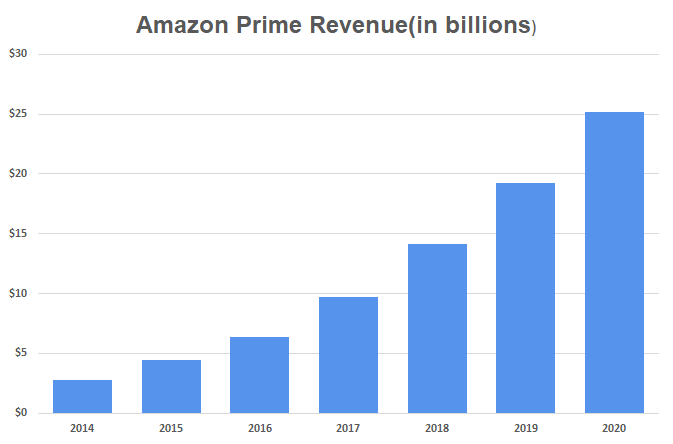

Expand global customer base:

Netflix operates in 190 countries but it still hasn’t tapped countries with huge customer bases like China, Syria, Crimea, North Korea, etc. Another giant player, Amazon Prime operates in only 17 countries. It happens to be a successful platform but has huge prospects of enlarging its customer base.

-

Refresh Content library:

The audience relishes content heterogeneity. The best way to smite the audience is to add more and better content, relatable to the audience. Surveys work the best to know audiences’ likes and dislikes, the most liked genre, etc.

-

Alliances:

Many businesses have succeeded in the past due to alliances as 2 or more companies share their technology, knowledge, and experience, which makes it better. Local broadcasters, telecom providers can be tapped for more content and better reach.

-

Niche Marketing:

Niche marketing refers to targeting a discrete set of audiences and marketing them according to their needs. Massive hits have been produced by some streaming platforms which are region-specific and in their local language. This practice can be continued and more such productions can be added.

Threats:

-

Piracy:

Most people find ways to download the content for free from various other sites due to lofty monthly costs. So digital piracy is the most extensive threat to streaming platforms these days.

-

Market saturation:

According to forecasts (Sherman, 2020): finding new subscribers in the future will be an arduous job for streaming platforms due to market saturation. Drastic differences have been discerned between targets and actual subscriber increase in the past few years. This is a consequence of market saturation.

-

Account Hacking:

With the increased user base of OTT platforms in 2020 and 2021, the number of hacked accounts has also been multiplied. It is a significant threat to streaming platforms because if account hacking perseveres, the audience may switch to rival platforms.

-

Carbon Emission:

The world economies are constantly fighting a battle of choosing between climate protection and economic growth. Streaming platforms actively contribute to climate deterioration. According to a study by the Shift Project about Digital Sobriety (FERREBOEUF, 2019), digital technologies have a greater carbon footprint than the aerospace industry, which is astounding. Usage of such platforms must be restricted because about 1% of the total global emissions are produced by online video streaming services.

-

Government pressure due to capacity issues:

Most users aspire to watch content in HD which consumes a lot of infrastructure and resources. The government doesn’t approve of this as it is straining existing infrastructure.

The case of Amazon Prime Video

Amazon Prime Video was launched on September 7, 2006, as an OTT platform with an objective to create and distribute television series as well as films produced by Amazon Studios or licensed to Amazon(Prime Originals or Exclusives) in addition to content from other providers. This is how amazon entered the profitable industry of streaming platforms while remaining true to their fundamental business objective of being an online retail store.

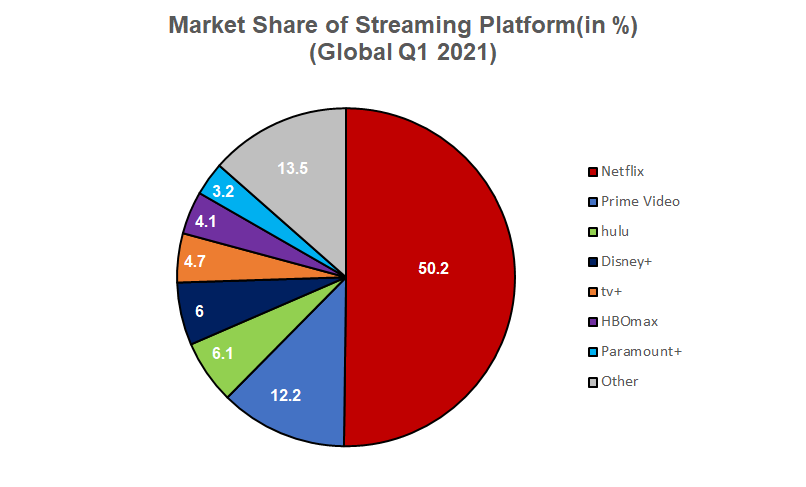

Amazon Prime Video (market share: 12.2%) has gotten on to become the second-largest player in the industry, finally challenging the monopoly structure of the industry by continuously taking away market share from Netflix (market share: 50.2%). This had been possible due to vast amounts of capital held by Amazon making it possible to acquire popular media like The Office tv series but more importantly due to the innovative integration of online streaming platforms with the online retail platform allowing Amazon to be a relatively cheaper option ($119 yearly) as it also provides faster delivery of items, various special discounts and other perks in comparison to Netflix ($8.99/month) which is a pure OTT.

(Dean, 2021)

Impact of COVID-19 on the Industry

The OTT Boom:

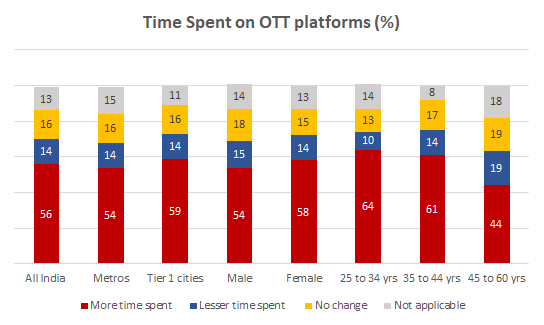

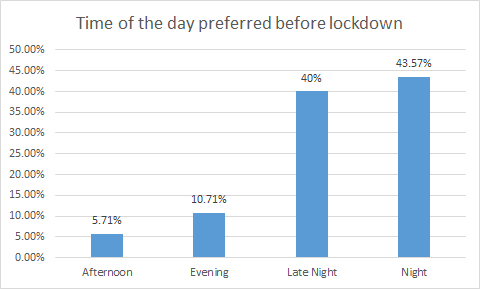

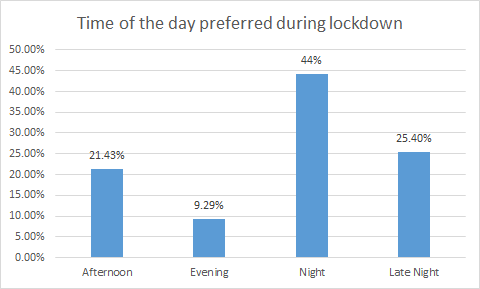

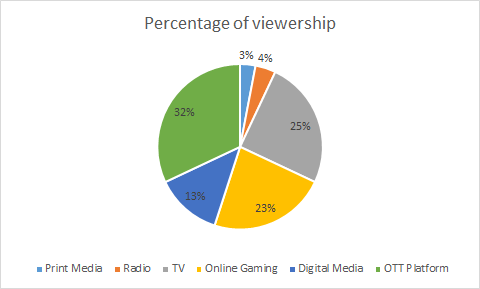

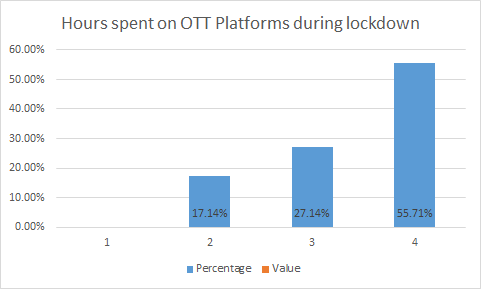

The outbreak of COVID-19 saw a robust increase in viewership of over-the-top (OTT) media platforms. The Omnicom Media Group Report, 2020 had aimed to investigate the impact of COVID-19 on OTT platforms in India, as it has led to reshaping consumer content preferences. They conducted primary research through a survey and focus group discussion. The first study focused on the impact of various factors such as time, content, convenience, satisfaction, and work from home (WFH) on OTT platforms during the COVID-19 crisis while the second study focused on change in behavior of people before and during lockdown using visual representation.

The findings of this study showed that lockdown has played a major role in the increase in viewership of OTT platforms, as people working from home are also using OTT platforms more. The average hours spent on OTT have increased from 0–2 to 2–5 h and the average spending that users are willing to make on OTT platforms is Rs 100–300 (per month). The satisfaction level of customers is directly related to space to watch with family, time to use OTT platforms, the quality of content on OTT platforms, and preference of OTT platform over television. Also, factors such as age group, occupation, city, and income groups also determine the usage of the OTT platform. The main contribution of this paper was to analyze the customer needs that impact their satisfaction level.

While OTT platforms were making a mark for themselves in the Indian market, the COVID-19 crisis accelerated the process. From just two OTT platform providers in 2012 to about 40 players now, the OTT revolution has come a long way.

(Omnicom Media Group, 2020)

A comprehensive analysis:

-

TV, online video & social media emerge as the key mediums where Indians are spending the majority of their time during these times of the pandemic.

-

Higher time spent on TV was observed for metros while Tier 1 cities drove consumption for YouTube content.

-

While we see an almost equal time spent on different social media platforms, higher time spent for Instagram in Tier 1 cities points towards the medium gaining traction beyond metros.

-

Online music streaming apps and online games are the other mediums where Indians are spending close to an hour daily.

-

With an average daily time spent of over 95 minutes, several OTT platforms are wooing Indians with Oscar-winning movies & top-rated IMDb series as OTT transitions into the go-to entertainment medium.

-

The increase in OTT consumption was driven by Tier 1 cities, females, and younger audiences.

(Madnani et al.)

(Madnani et al.)

Discussions (some promising statistics):

The result of the study tells us that there has been an increase in the usage of OTT platforms during the lockdown. The quality of content, free time, convenience, free content, and no advertisements have increased the satisfaction level of people. People working from home during lockdown are also spending more time on OTT platforms. The KPMG India report titled “Media and Entertainment Post COVID-19” (add citation) states that the increase in the usage of OTT platforms will continue post lockdown as well as this “lockdown behavior” will result in habit formation. In-home consumption in OTT streaming services and gaming will see enhanced growth. Also, post-COVID-19, digital subscription revenues could also see an increase in OTT video consumption (KPMG, 2020). In early March 2020, Telefonica reported an increase in the number of accesses to its operator by 8% and an increase in viewing time by 14%. The launch of Disneyþlus outside has overlapped with the lockdown, which has been beneficial for them, as it leads to an increase in the number of paying customers. It had more than 50 million paying customers in April 2020 (Telefonica, 2020). Research done by Rono and Mugeni (2019) reveals that various facilities offered by OTT services such as convenience, preference, flexibility, and cost-benefit affect TV providers. The die-hard OTT audience, which does not watch TV, is on an average of 23 years and around 70% of them are students. There is no significant demographical difference between them and other audiences (Chen, 2017). BARC Nielsen report states that there has been a significant hike in the consumption of TV and new platforms during the lockdown. Social distancing, quarantining, and staying at home have a significant impact on OTT platform usage. As consumers spend more time inside, their media behavior has changed. The time spent on smartphones has increased by 1.5 h and consumers are accessing more social media.

(Sunitha & Sudha, 2020)

(Madnani et al.)

(Madnani et al.)

Conclusion:

Through the application of Porter’s Five Forces analysis, the findings have brought into light the multiple facets of the streaming industry in a very holistic manner.

Followed by the SWOT analysis, which was a four-pronged approach to ponder upon the business environment around the OTT industry. A comprehensive yet brief analysis through the Amazon Prime Case study brings to the table a very realistic example.

Lastly, the OTT Boom which we’re all familiar with in our days of quarantine poses threat to the Television industry causing dwindling audiences as the industry hands down had an edge and was minting millions out of the new normal.

Bibliography

- Bhasin, H. (2020, June 16). SWOT Analysis of Prime Video. Marketing91. Retrieved June 23, 2021, from https://www.marketing91.com/swot-analysis-of-prime-video/

- Dean, B. (2021, March 4 Thursday). Amazon Prime User and Revenue Statistics (2021). Backlinko. https://backlinko.com/amazon-prime-users

- Madnani, D., Fernandes, S., & Madnani, N. (2020). Analysing the impact of COVID-19 on-over-the-top media platforms in India, 16(5), 19. https://www.emerald.com/insight/content/doi/10.1108/IJPCC-07-2020-0083/full/html

- Omnicom Media Group. (2020). COVID-19: The Impact on Media Consumption of Indians. COVID_19__Newsletter__Impact_on_Media_Consumption_OMG_India. https://www.omnicommediagroup.com

- Paliwal, A. (2021, May 26). Global Video Streaming Software Market Estimated to Hit $19,537.1 Million and Grow with a Significant CAGR of 20.4% from 2020 to 2027. globenewswire. https://www.globenewswire.com/news-release/2021/05/26/2236548/0/en/Global-Video-Streaming-Software-Market-Estimated-to-Hit-19-537-1-Million-and-Grow-with-a-Significant-CAGR-of-20-4-from-2020-to-2027-Exclusive-COVID-19-Impact-Analysis-261-Pages-Rep.html

- Parker, B. (2020, September 07). Netflix SWOT Analysis 2020 | SWOT Analysis of Netflix. Business Strategy Hub. Retrieved June 23, 2021, from https://bstrategyhub.com/swot-analysis-of-netflix-2019-netflix-swot-analysis/

- Sherman, A. (2020, January 21). Netflix paints a happy face on growing threat of US competition. CNBC. Retrieved June 5, 2021, from https://www.cnbc.com/2020/01/21/netflix-q4-2019-earnings-report-downplays-competition.html

- Spangler, T. (2020, April 22). Netflix Plans to Raise $1 Billion Through Debt Offering. Variety. Retrieved June 5, 2021, from https://variety.com/2020/digital/news/netflix-raise-1-billion-debt-offering-1234587050/

- Sunitha, S., & Sudha, S. (2020). Covid-19 Conclusion: A Media and Entertainment Sector Perspective in India. Vichar Manthan( A Peer Reviewed Journal), 8(3), 3. https://www.researchgate.net