Industry Overview

The insurance industry in India is a critical component of the nation’s financial landscape, providing a safety net for individuals and businesses alike. This industry is primarily regulated by the Insurance Regulatory and Development Authority of India (IRDAI), which ensures fair and ethical business practices.

Key Highlights :

- India’s insurance market is the 4th largest in Asia and14th largest globally.

- The current market values at $120 B with a projection of $200 B by 2027.

- The market is growing at a rate of 32-34%.

- India has 57 market players with 24 Life Insurance and 34 in Non Life Insurance.

- The Indian insurance market is the 4th largest in Asia and 14th largest globally.

Timeline for Indian Insurance Industry

1956-1972

In 1956, all insurance companies were nationalised to form Life Insurance Corporation. In 1972, all nonlife insurance were nationalised to form General Insurance Corporation.

1993-1999

Govt. was recommended to open industry for private players to end the monopoly of LIC. Acts were passed in 1999, making IRDAI the regulatory body to over watch the insurance Industry of India.

2000-2014

In 2014, the govt. approved the ordinance, increasing FDI limit from 26% to 49%. The no. of private players industry increased to 46 in 2017.

2015

In 2015, Pradhan Mantri Suraksha Bima Yojna & Pradhan Mantri Jeevan Jyoti Yojna were introduced along with Atal Pension Yojna & health insurance. This caused a surge in the insurance penetration rate for the country.

2017-Present

More than $6 Bn was raised through public issues. COVID-19, turned phase by introducing insurance as a necessity for consumers in their portfolio.

Segments of the Insurance Industry

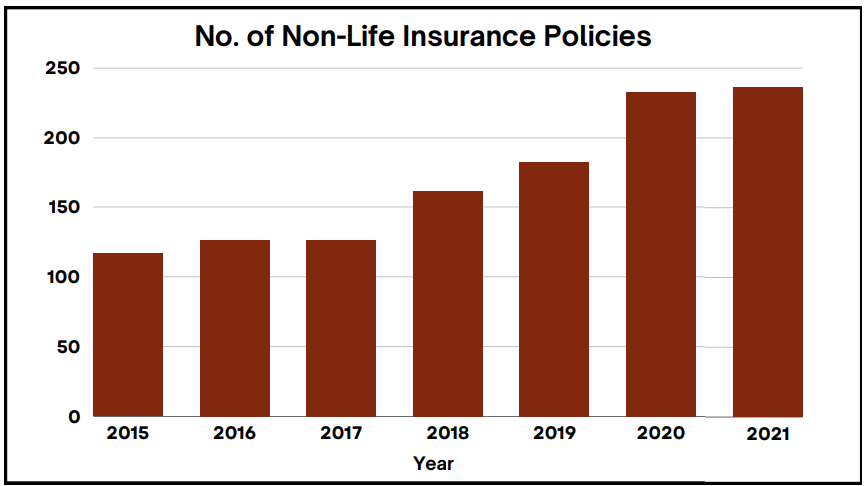

The life insurance premium registered YoY growth of 10.2% in FY22, with new businesses contributing 45.5% of the total premiums received by the life insurers.

In FY21, non-life insurers recorded a 5.19% growth in gross direct premiums.

There was a decline in gross premiums written by non-life insurers in FY23, plummeting from US$ 28.14 billion in FY22 to US$ 17.88 billion, which is predominantly linked to the repercussions of the COVID-19 pandemic. The economic slowdown, escalating inflation, and heightened competition from new market entrants can be directly traced back to the pandemic’s disruptive impact on consumer behaviour, business operations, and overall market conditions.

Investment Strategies

The substantial influence of the Market Risk Capital Charge, accounting for 86% and 68% of the Solvency Capital Requirements (SCR) in life and non-life insurance, respectively, highlights the paramount importance of market dynamics in determining insurers’ risk exposure. This underscores the significance of understanding this metric for stakeholders, offering insights into insurers’ risk management strategies and the broader implications for financial stability within the insurance industry.

The Market Risk Capital Charge is the money that banks must set aside to cover potential losses from changes in things like interest rates and asset prices. It’s a safety measure required by regulators to make sure banks can handle market fluctuations without risking their stability.

This notable contribution to the SCR motivated insurance undertakings to thoroughly reassess their asset and liability management (ALM) practices. The aim was not only to align with the new prudential framework but also to incorporate the stress tests regularly imposed by national and European regulators, as well as specific international organisations.

4 Innovative Investment Strategies

Convertible Bonds

Convertible bonds are type of corporate debt that can be converted into a predetermined number of the issuer’s common stock shares at the bondholder’s discretion.

High Yield Corporate Bonds

Often referred to as “junk bonds,” are debt securities issued by companies with lower credit ratings, but offer higher yield.

Danish Mortgage Bonds

Debt securities issued by mortgage credit institutions in Denmark. These bonds are typically backed by a pool of Danish residential mortgage loans.

Emerging Market Investment Grade Corporate Bonds

Debt securities issued by corporations in emerging market economies that have been assigned an investment-grade credit rating.

Evaluation of Different Strategies

Convertible Bonds

Higher convexity, making them more responsive to interest rate changes. This sensitivity can benefit insurance companies by enhancing financial returns through favourable shifts in interest rates.

Danish Mortgage Bonds

Higher returns with a strong credit rating and minimal default risk. Relatively safe investment with greater returns than other assets; high liquidity allows easy buying and selling.

Emerging Market Investment Grade Corporate Bonds

Gain access to emerging markets’ performance, diversification, higher returns, good credit ratings. Investing offers exposure to high-growth markets, portfolio diversification, and favorable credit ratings and returns.

High Yield Corporate Bonds

High yield corporate bonds are less sensitive to interest rate changes, making them appealing to insurance undertakings. Despite a high return potential, they exhibit increased risk due to a high return/volatility indicator.

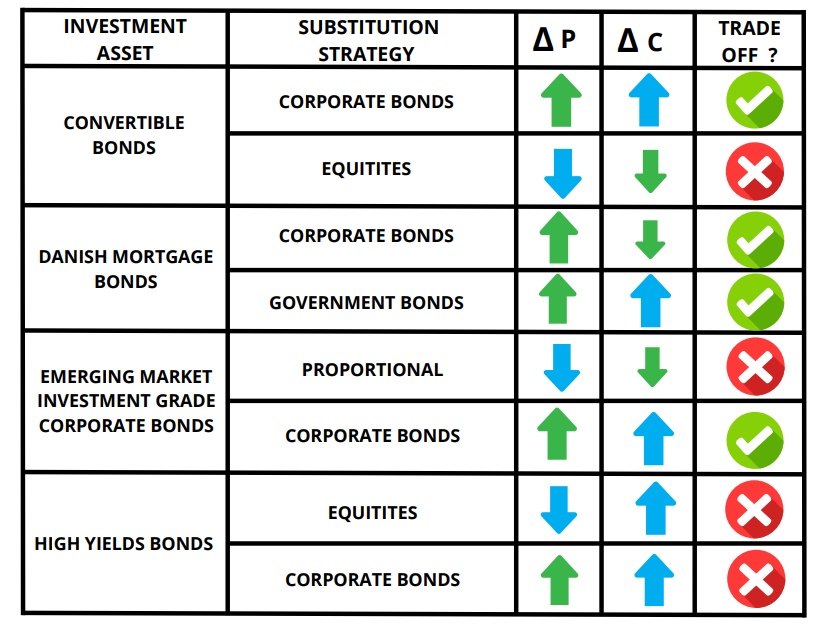

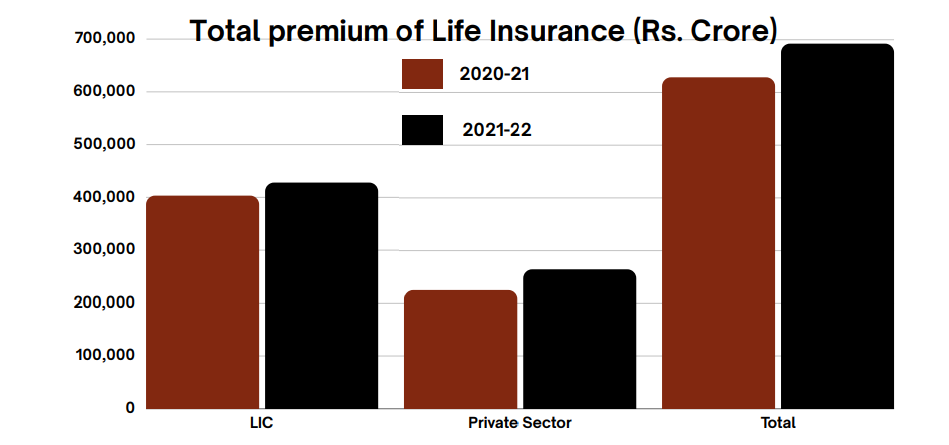

The table shows the impact of different substitution strategies on the profitability and cost of capital of insurance undertakings.

The Investment asset column lists the different types of investment assets considered in the analysis, including convertible bonds, corporate bonds, equities, Danish mortgage bonds, government bonds, and emerging market investment-grade corporate bonds.

The Substitution strategy column lists the substitution of traditional investment classes that is Corporate bonds, government bonds and Equities over new investment classes .

The Change in profitability column (ΔP) indicates whether each substitution strategy leads to a favourable or unfavourable change in profitability for the insurance undertaking.

The Change in the cost of the capital column (ΔC) indicates whether each substitution strategy leads to a favourable or unfavourable change in the cost of capital for the insurance undertaking.

Key performance Indicators

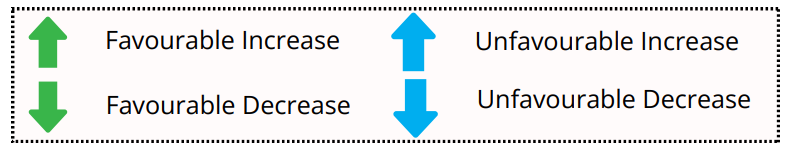

Insurance Penetration Rate

The Indian insurance scene is transforming, with the penetration rate steadily climbing. This upward trend owes a debt to several factors. Rising disposable incomes, coupled with growing financial literacy, are making people more receptive to the safety net that insurance provides. Additionally, product innovations tailored to diverse needs, accessible distribution channels reaching rural areas, and government initiatives like Ayushman Bharat are pushing insurance into the mainstream. This burgeoning market isn’t just a number on a chart; it’s impacting lives. Families are gaining financial resilience against health shocks and unforeseen events.

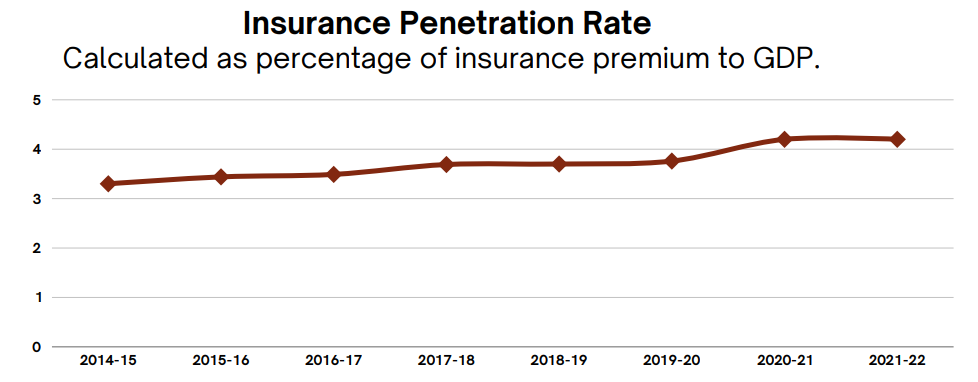

Total Premium of Life Insurance

This uptick in Premium is fueled by factors like medical inflation, demanding adjustments to cover rising healthcare costs. Simultaneously, technological innovations in healthcare and increased expectations for better facilities contribute to a growing demand for more comprehensive coverage, prompting insurers to recalibrate premiums. This trend suggests a necessary price correction, aligning insurance costs with the increasing complexity and expenses associated with modern healthcare practices.

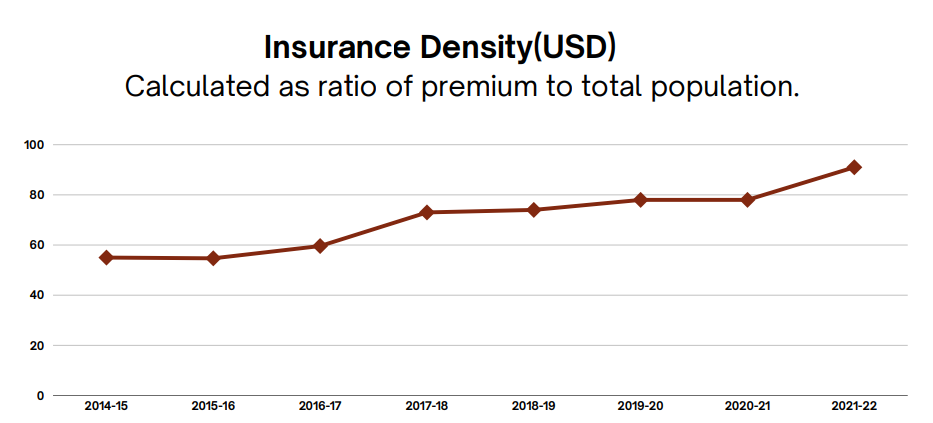

Insurance Density

The upward trajectory of the Insurance Density graph, illustrating the premium-to-population ratio, emphasizes an increasing commitment to insurance. This growth suggests a population becoming more risk aware and financially secure. Insurers can leverage this data to identify markets with expanding spending potential, while policymakers can assess the effectiveness of financial literacy initiatives. For consumers, the rising trend indicates a growing recognition of the importance of insurance, shaping spending patterns and influencing regional economic dynamics.

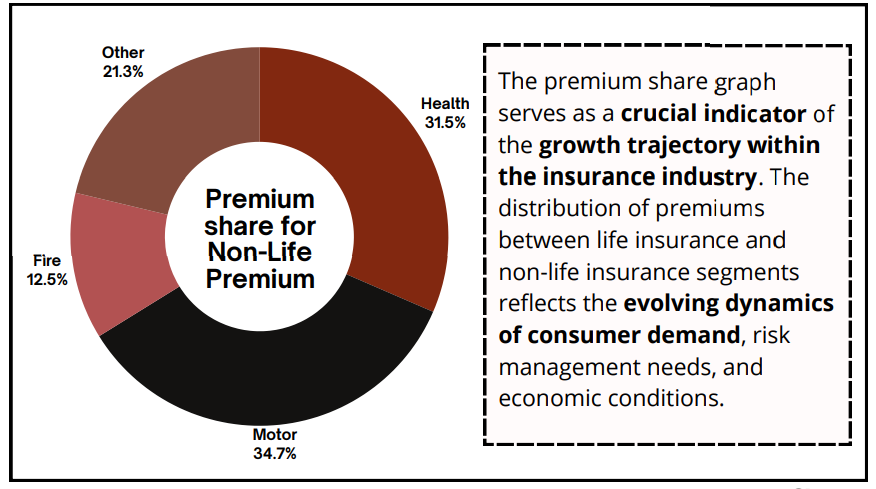

Market Players

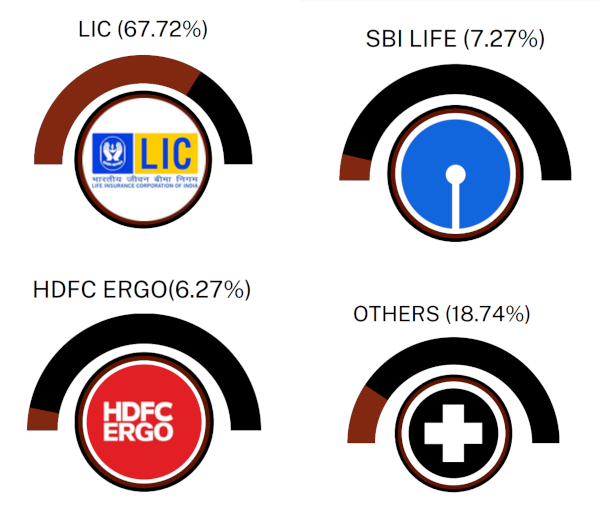

India’s insurance landscape features a dynamic battleground for market share. The undisputed heavyweight remains LIC, the state-owned behemoth, holding a commanding 67% in the life insurance segment as of September 2023. However, private players like SBI Life and HDFC Life are nipping at its heels, boasting impressive growth rates and cornering roughly 12% and 10% of the market respectively. In the non-life arena, the tide is turning towards private insurers. Their combined market share has surpassed 53%, with ICICI Lombard leading the charge at 8.7%, closely followed by Bajaj Allianz and New India Assurance. Interestingly, while health insurance dominates the non-life sector, motor insurance remains a traditional stronghold for PSU insurers. This dynamic landscape is fueled by several factors – aggressive marketing by private players, innovative product offerings tailored to niche segments, and a shift towards bancassurance partnerships. Expect the fight for market supremacy to intensify in the coming years, with both private and public players vying for a piece of the ever-growing Indian insurance pie.

Government Initiatives for Insurance Sector

Pradhan Mantri Jivan Jyoti Bima Yojna

Launched in 2015, is a one-year life insurance scheme renewable from year to year offering coverage for death. The scheme is administered through both public and private sector insurance companies in tie-up with scheduled commercial banks, regional rural banks and cooperative banks. Its affordability, with a minimal annual premium of ₹436, and automatic enrollment through bank accounts, have swept away enrollment barriers. As a result, over 16 crore individuals now enjoy ₹2 lakh life cover, a safety net that offers families financial cushioning in the face of tragedy. This has not only strengthened individual resilience but also fostered a culture of risk management, paving the path for wider insurance adoption. While challenges remain, like low claim awareness and penetration in rural areas, PMJJBY stands as a testament to the power of targeted government initiatives in making insurance accessible and impactful for the masses.

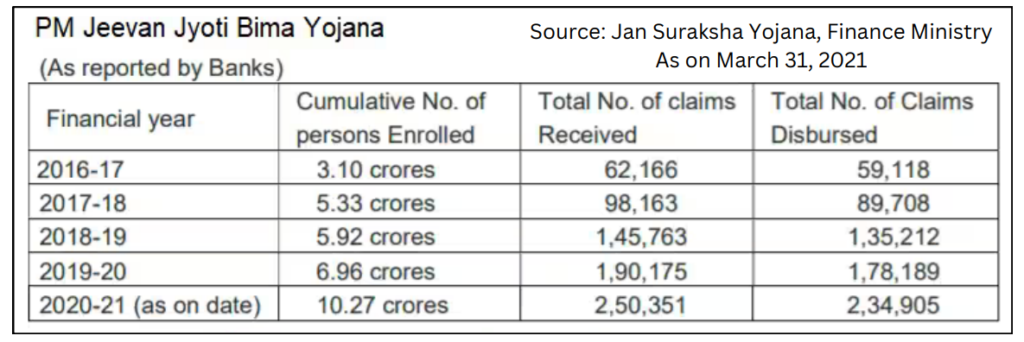

Total No. of Persons Enrolled: The consistent increase in enrollment suggests a successful outreach program, demonstrating that more individuals are recognizing the scheme’s value and opting for life insurance coverage.

Total No. of Claims Received: The progressive growth in the number of claims received suggests that the insured population is actively availing the benefits of the scheme, emphasizing its importance in providing a financial safety net and indicating a growing understanding and utilization of the insurance coverage offered.

Total No. of Claims Disbursed: The upward trajectory in the total number of claims disbursed, reflects the scheme’s efficacy in settling claims promptly, ensuring that beneficiaries receive financial assistance when needed and enhancing its credibility and reliability.

Overall Implications: The consistent increase in enrollment, coupled with a progressive rise in claims received and disbursed under the Pradhan Mantri Jivan Jyoti Bima Yojana, signifies not only the program’s success in enhancing life insurance accessibility but also underscores the scheme’s effectiveness in promoting financial inclusion, safeguarding individuals, and contributing to broader social and economic resilience.

Current Trends

Strengths

With 57 insurers, the market is well-supplied but consolidation may be on the horizon as the top players command over 60% market share. M&As could improve efficiency in the market. Steady growth in insurance penetration (2.7% to 4.2%) over two decades indicates rising consumer demand. Product innovation and distribution expansion can further tap into this demand.

Weakness

Low insurance density of $91, well below the global average of $874 indicating affordability challenges in semi-urban and rural areas. Customized, small-ticket size plans will be key for deeper penetration. Opaque policy terms and claims settlement procedures have damaged consumer trust. Simplified language and leveraging technology like AI for faster settlements can help rebuild trust.

Opportunities

Government sponsored health schemes like PMJAY widen the insurable population to 107 Mn+ poor households. Preventive care and outpatient coverage can complement the existing inpatient focus. Tax incentives for life insurance premiums up to Rs 5 lakh can boost uptake. Population segments like middle classes are particularly promising target markets here.

Threats

Increasing frequency of floods, droughts and cyclones in India pose risk management challenges. Granular climate impact modelling and risk-based pricing will be critical. Younger, tech-savvy demographics are more inclined to agile insurtech platforms rather than traditional models. Incumbents will need digital capabilities to compete.

Growth Ahead

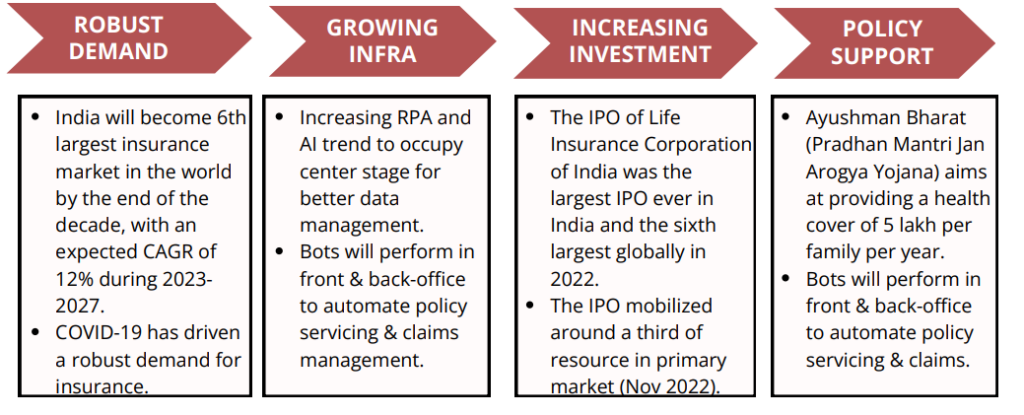

Five trends affecting the future of insurance industry in India:

A widening trust gap in an uncertain world: According to the 2022 Edelman Trust Barometer, only 54% of respondents trust the financial services industry, 10 percentage points lower than the average for other industries in the report.

Rapidly evolving customer needs and preferences: Customers expect insurers to go beyond their risk-transfer obligations and offer end-to-end solutions, covering risk prediction, prevention and intervention.

An increasingly digital and AI-driven world: In their 2021 Technology and innovation report, UN analysts estimated that the size of the frontier technologies market will multiply by a factor of nine by 2025, with innovations in the internet of things (IOT), big data, solar panels and robotics contributing to a US$3.2tn market.

Climate risk and a focus on sustainability: The growing threat of climate change poses systemic physical and transition risks for the insurance industry. To protect against and prevent these risks, insurers will need to create new climate related products and services.

Convergence, collaboration and competition: A digital, data-rich economy is allowing organisations to share and collaborate within and across industry boundaries in new ways and create new value propositions for customers.