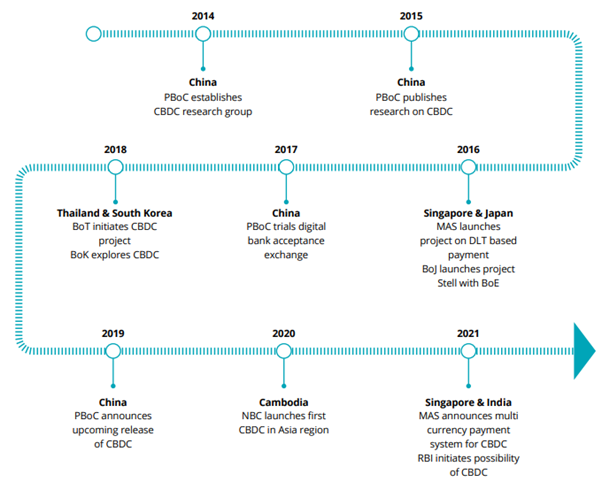

A phased implementation plan for the introduction of a CBDC was announced by the Reserve Bank of India (RBI) in 2021. In order to introduce CBDCs, the RBI has been researching a number of factors, including security, the effect on financial institutions, monetary policy, and the amount of money in circulation.

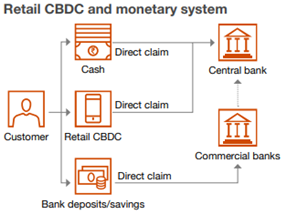

Central Bank Digital Currency (CBDC), as defined by the Reserve Bank of India (RBI), is the legal tender issued by a central bank in a digital form. A CBDC is a digital version of fiat currency issued by a nation’s central bank in place of paper or metal money which is the institution’s direct liability because it is pegged to the country’s unit of account. By expelling all claims that arise during a transaction, a CBDC serves as a secure, backed by the government, and final medium of settlement.

CBDC can be split generally into two categories:

- Wholesale CBDC – It typically facilitates transactions between a nation’s central bank and its public and private banks. In the Indian context, it will enable the RBI to communicate more quickly with and among its intermediaries and contribute to the improvement of the real-time gross settlement (RTGS) system already in use.

- Retail CBDC – This subcategory of CBDC serves as the digital equivalent of fiat currency, which is intended for usage by regular customers in day-to-day financial transactions.

Source: Central bank digital currency in the Indian context, PWC, 2021

Source: Central Bank Digital Currencies, Deloitte, 2022

Benefits of CBDC

The RBI has also highlighted some of the benefits of the CBDC in its report on currency and finance, including the ability to monitor transactions, and the distribution of ‘helicopter money’ as a form of aid during emergencies. Additionally, it has been asserted that CBDCs have the ability to distribute funds specifically for certain products and services, as well as for aid and subsidies.

The RBI Deputy Governor recently emphasised that CBDC will shield the general public from the atmosphere of volatile virtual currency in addition to bringing about desirable benefits for payment systems.

In addition to these, CBDC serves as a highly secure method for cross-border transactions, aiding in the implementation of anti-money laundering (AML) and countering financial terrorism (CFT) procedures. Due to the DLT’s presence, high-value transactions can move more quickly because no post-reconciliation is required. By serving as a platform for offline payments using digital tokens, it can also be advantageous to numerous societal groups.

Effect on the Economy

1. Cashless economy: As a result of digitization, there will be less currency available to support economic activity. The economy will become more formalised, which will increase government revenue that may be used for development initiatives and lower the government’s fiscal deficit.

2. Promote Financial Inclusion: Financial inclusion refers to the ability of people and enterprises to receive financial services at fair prices. With the evolution of technologies, it will be possible to travel the benefits to all parts of the country at an affordable price. People can access the financial system without opening a bank account, increasing financial inclusion. Government initiatives to contact the targeted population can be watched. The intended use of currencies by recipients of government programmes can be tracked with precise coding.

3. Increased digitalization of payments would eliminate the need for physical cash and increase the efficiency of monetary transfers. The transmission would be further improved if central banks issued interest-bearing currencies since the direction of interest rates would be reflected in the market. Additionally, there wouldn’t be a lower bound on interest rates to support economic development and counteract deflationary market forces.

4. The digital revolution is transforming the payment environment; therefore, efficiency should be increased by encouraging innovation and competition. Banks’ ability to act as payment intermediaries would be eliminated under CBDC. Everything will be handled centrally. This would make it possible for new Fintech businesses to enter the market and challenge established ones like banks and card payment network providers. Long-term benefits would arise from innovation and technological advancement, which will also prevent monopolisation by payment providers.

5. Protect the payment system from the rise of private digital currency: This will prevent the emergence of speculative private digital currencies. As transactions made using private digital currencies might escape unnoticed by KYC and AML, they may be used to finance illegal and terrorist operations that represent a threat to society and the economy.

Banking Sector Implications

1. Amplification of bank runs since money would be transferred with the press of a button. Therefore, central banks should act quickly to support banks’ liquidity needs.

2. Increasing competition will make banks’ cost of financing higher (depending on the currency’s design). Banks will rely on wholesale funding to finance corporate activity, which will raise the cost of funds. On the other side, about Rs 30 lakh crore ($30 trillion as of August 12, 2022) in cash in circulation will return to the banking system and improve the channel’s liquidity, which might lower banks’ costs.

3. Cybersecurity: When building and implementing the architecture of digital currencies, cybersecurity is of utmost importance. As digitization progresses, cyberattacks have the potential to stop payments, endangering the privacy of users’ personal information. Additionally, it can undermine consumer confidence in payment systems and cause the economy to become unstable.

4. Using digital currency for cross-border transactions will do away with middlemen in the payment process. Transaction times will be shortened because settlements will take place directly without middlemen. Additionally, settlement will be accessible around-the-clock and transaction costs will be decreased. Some nations use SWIFT to impose financial sanctions on particular nations or people, which have an economic impact on them. It will be challenging to impose such limits when using digital currencies for cross-border transactions since, unlike the current payment system, where transactions are resolved through intermediaries like SWIFT, those transactions will be directly settled between Central Banks.

Conclusion

To determine how and when CBDC can be implemented, continuing conversations and efforts are being made in the Indian context. The ecosystem participants will have a lot more opportunities to develop services that make it simpler and more comfortable for people to transact and make digital payments for a variety of use cases and requirements as a result.

References:

- India, P. (2021, September). Central bank digital currency in the Indian context. PwC India. Retrieved November 4, 2022, from https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/point-of-view/pov-downloads/central-bank-digital-currency-in-the-indian-context.pdf

- Pacific, D. A. (n.d.). Central Bank Digital Currencies: Building Block of the Future of Value Transfer. Deloitte. Retrieved November 4, 2022, from https://www2.deloitte.com/content/dam/Deloitte/in/Documents/financial-services/in-fs-cbdc-noexp.pdf

- Joshi, R. (2022, November 1). Mint Explainer: Why central banks are building digital currencies. Mint. Retrieved November 5, 2022, from https://www.livemint.com/opinion/online-views/why-central-banks-are-building-digital-currencies-11667301008837.html

- Ray, A. (2022, October 31). RBI CBDC: Digital Rupee pilot starts from November 1; SBI, HDFC, 7 other banks to participate in wholesale launch. The Economic Times. Retrieved November 5, 2022, from https://economictimes.indiatimes.com/wealth/save/rbi-cbdc-digital-rupee-pilot-to-start-from-november-1-sbi-hdfc-7-other-banks-to-participate/articleshow/95205659.cms