Introduction

Every country requires countless natural resources but in more ways than one oil is an indispensable resource. The price and availability of oil has an impact on the economic growth of a country and the price of oil is impacted by economic growth, thus forming an intricate and fragile relationship. Crude oil is a vital resource and any fluctuation in its price has widespread repercussions not only for transport but for almost every sector.

When it comes to crude oil, countries can be divided into two categories- importers and exporters. The producing countries have a competitive advantage over the rest of the world. These countries have the ability to impose their economic power and strengthen their positions in the global landscape. On the other hand, countries dependent on import of oil are perpetually vulnerable to global trends.

The following article will delve deeper into crude oil and its prices to help gain a better understanding of this pivotal resource.

Why does the price of oil fluctuate?

OPEC and OPEC+

To understand the dynamics behind the price of oil it is necessary to be familiar with OPEC. OPEC or Organisation of the Petroleum Exporting Countries is a permanent intergovernmental organisation. OPEC was set up in 1960 at the Baghdad Convention with 5 member countries. The purpose of OPEC is unification and stabilisation of oil markets in order to create an efficient and effective economic supply chain. As of 2021, it is an organisation of 13 countries: Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates and Venezuela. OPEC in 2016 allied with other top non-OPEC members to form an even more powerful consortium called OPEC+. OPEC+ consists of 13 members of OPEC along with 10 other major oil producing countries.

OPEC+ has a substantial contribution to the global prices of oil. The OPEC+ has the authority to regulate the production of crude oil with consent of member countries thus influencing global supply as OPEC controls 40% of the world’s oil production and 80% of oil reserves. Despite holding considerable power over the world’s oil supply, OPEC or OPEC+ can only influence the prices of oil in the short term and its ability to influence prices in the long run is meagre.

Supply and Demand

Supply and demand are primitive forces of economics. Just like prices of most commodities, the price of oil is also affected by the forces of supply and demand. The forces of supply and demand play a more pivotal role in determining prices of oil in the long run rather than short run. This is because demand and supply of oil are relatively inelastic in the short run. The global economy is highly dependent on oil as a result it isn;t possible to alter demand too much in the short run. Similarly, production of oil is an expensive and complicated procedure as a result supply cannot be changed too much in the short run. On the other hand, in the long run demand and supply are more elastic because of a longer time frame, governments, countries and companies can adjust their demand and allocate their resources better.

Supply and demand affect the prices of oil but it is actually futures contracts that set the prices of oil. A buyer under a futures contract has the right to buy a barrel of oil at a set price on a future date. A futures contract is a binding agreement.

Natural Disasters

Natural disasters can affect oil and petrol prices as well. For example, hurricane Katrina that hit the southern regions of the U.S.A in 2004 impacted 20% of the U.S. oil supply resulting in crude oil futures hitting $70/barrel briefly.

Political instability

Market for any commodity traded globally is impacted by the political conditions of the countries involved, especially when it comes to oil. One of the more recent examples for the same is the Russia-Ukraine war. With Russia, a major oil producer declaring war on Ukraine, oil prices skyrocketed due to uncertainty of oil resulting in worldwide turmoil. As a result of the war, WTI (West Texas Intermediate) rose by $37.14, an increase of 52.33% while Brent crude oil prices rose by $41.49, an increase of 56.33%.

Production Costs

The price of oil factors in the cost of extraction. The cost of extraction differs from one place to another. For example, it is relatively cheaper to extract oil in the Middle East whereas it is rather expensive to extract oil in Alberta’s oil sands in Canada.

Why do they shock the markets?

Fluctuations in prices of oil and petroleum have an impact on numerous elements of an economy such as investment patterns, economic health and consumer behaviour as well as various industries such as transportation, as is discussed below.

- Economic Health: The movement of petrol and oil prices indicate the global economic health. Increasing prices indicate inflation and reduce economic growth, while a fall in the prices boost the economy as a whole. In this kind of situation industries which use crude oil as raw material flourish.

- High Production Costs: There exists a direct relationship between oil prices and production costs. Oil is an important raw material in numerous production processes and is required to run machineries used in the production process. Hence, an increase in the price of oil can reduce profit margins for producers and make running businesses less profitable. Similarly, a fall in the price of oil makes production processes more profitable and hence, attractive.

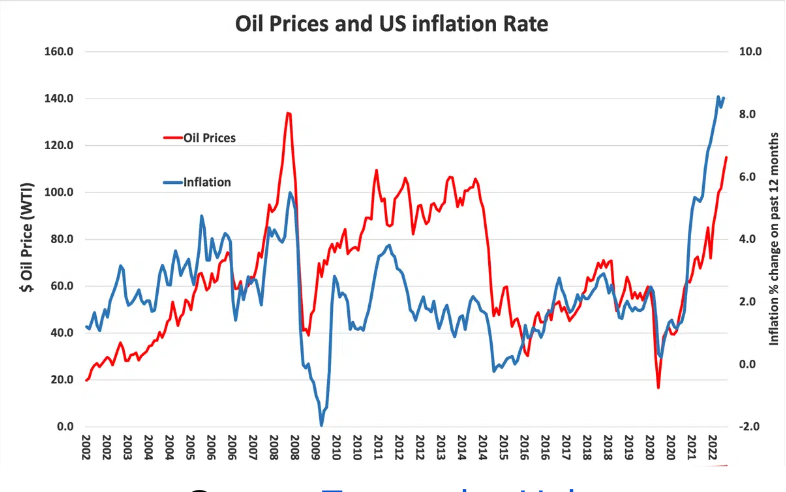

- Inflationary Pressures: An increase in the price of oil is directly linked with high production costs, and these increased costs are often transferred by the producers to the consumers in the form of high product costs, giving rise to inflationary pressures. However, it is significant to note that the correlation between high oil prices and inflation is less than it used to be in the 1970s, particularly in the case of developing nations such as the United States. Back then, the U.S. economy consumed more than a barrel of crude per $1,000 of gross domestic product (GDP). By 2015, it had reduced to around 0.4 barrels per $1,000 of GDP. As opposed to this, trends of disinflation can be observed due to reduced reliance on crude oil in the United States.

Source: Economics Help

- Political Concerns: Petrol and oil prices are volatile in nature in regard to international political relations. Disruption between nations, especially oil producing nations can cause petrol prices and coincidentally the market to rapidly fluctuate.

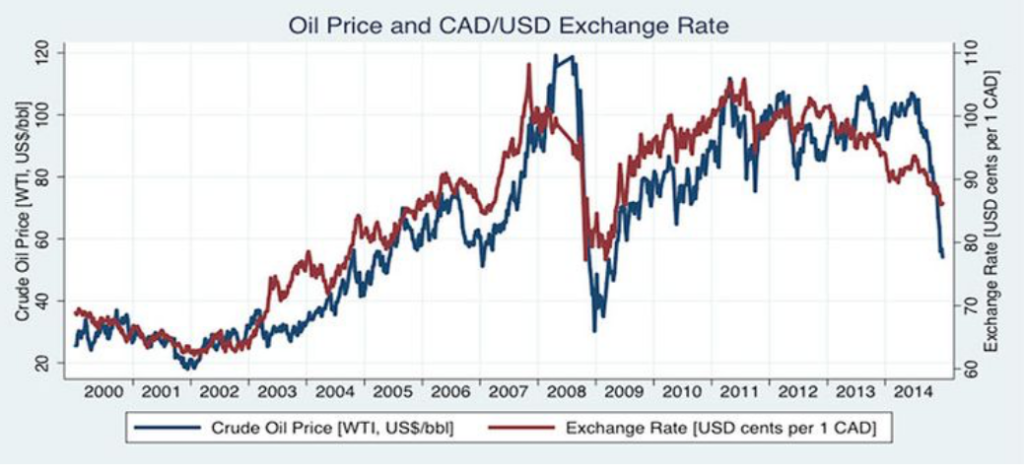

- Currency Exchange Rates: U.S. dollar is used to express oil prices. Certain countries and their currencies struggle significantly under the pressure of falling oil prices. A currency that is significantly impacted by the fluctuation in oil prices is known as a petrocurrency. Let us have a look at some of the world’s most important petro currencies. In August, the Canadian dollar hit an 11-year low due to a decline in global oil prices. Canada is the fifth-largest producer of oil in the world. Oil constitutes 14% of all its exports. Similar is the case with the US Dollar, as is shown below.

Source: PACIFIC Exchange Rate Service

Russia loses roughly $2 billion in revenue for every $1 that oil prices decline. Russia’s energy exports account for more than 70% of all exports, and energy incomes comprise more than 50% of the nation’s federal budget intake. Falling commodity prices have weakened South America’s largest economy, Brazil and the Brazilian real recently hit an all-time-low as against the U.S. Dollar. One point common to all of the above mentioned countries is that oil exports constitute a major portion of their exports, hence fueling their economic growth and development.

- Investment Patterns: A change in the investment patterns by the individuals as well as organisations is common and is often linked with fluctuation in oil prices. This is because unexpected and major variations in oil prices give rise to uncertainty in financial markets. Investors tend to withdraw and take lesser risks with respect to investments in cases of significant variations in the prices of petroleum and crude oil.

- Consumption Pattern: An increase in petrol price can severely affect the consumer as his overall budget will become tighter due to the increased expenditure on fuel. This will in turn prevent him from spending on miscellaneous goods and services, which would be disadvantageous to those businesses and services.

- Effect on the Transportation Sector and related services: Petroleum and crude oil are required to run a large number of vehicles ranging from bikes to huge trucks, thus playing a prominent role in the transportation sector. An increase in the prices of petroleum is directly linked with high transportation costs and thus the industries which are heavily reliant on this sector, tend to be hit negatively. Since transportation forms a major part of most business cycles, a fluctuation in oil prices impacts businesses in this way as well.

Case Study

To get a deeper and better understanding of the points discussed above, let us study one of the most recent yet prominent global events, the COVID-19 pandemic. With the inability of people to move out of their homes and connect with one another, the pandemic had a negative impact on most industries and put a halt to many such as hotels and airlines.

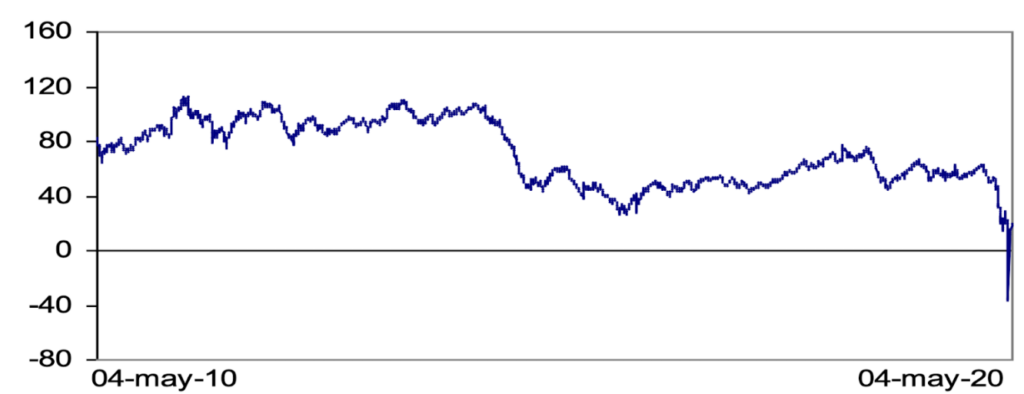

Oil was not spared and the prices of oil drowned beyond control. An excess supply of oil led to a collapse in oil prices in April, which caused the contract futures price for West Texas Intermediate (WTI) to fall from $18 a barrel to around -$37 a barrel.

The graph given below shows the time period, as depicted on the X-axis and the prices of oil, as depicted on the Y-axis. As can be seen, there was a sharp fall in the prices of petroleum and crude oil.

Source: Energy RESEARCH LETTERS – Scholastica

The main reason behind this sharp fall in prices was the excess supply of oil in markets. As governments of various countries imposed lockdown, made it necessary for people to stay at home and restricted travel, the demand for oil fell drastically. With people locked inside their homes, consuming only necessary commodities, production levels fell, further reducing the demand for oil.

The fall in prices aggravated due to the oil price war between Saudi Arabia and Russia, started in March after the two countries failed to agree on oil production levels.

In April, the price war between the two countries ended when the Organisation of the Petroleum Exporting Countries (OPEC) and its allies agreed to reduce crude oil production by 9.7 million barrels per day for a period of two months from May.

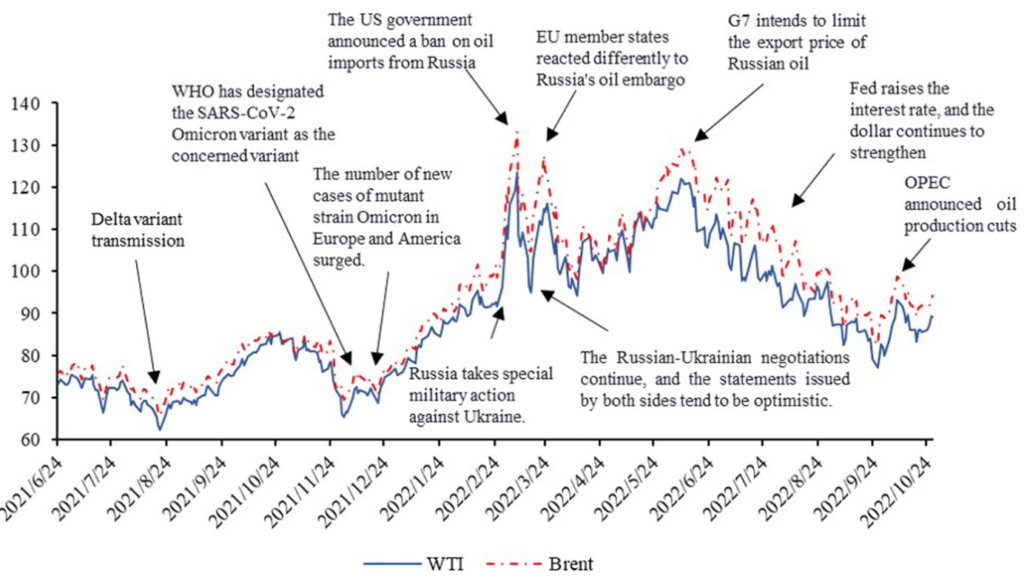

In complete contrast to the Covid phenomenon, the Russian invasion of Ukraine sent the prices of oil soaring. The price of crude oil, which was already inflated fueled by economic recovery at the beginning of 2022 at $76, rose to $110 by March. Europe, the major consumer of Russian oil and gas, was the most impacted.

Keeping in mind the humanitarian impact of the war, the U.S. banned the imports of Russian oil followed by the United Kingdom and even the European Union cut imports by two-thirds. This further triggered the oil markets as supplies reduced drastically and yet demand remained constant or increased motivated by economic recovery following the pandemic.

The sharp rise in oil prices further added to already rising inflation rates being faced by almost all countries across the world.

The rise in oil prices affected India as well. India is the world’s third largest consumer of oil and a net importer. The rising oil prices had an adverse impact on the balance of payments of the country. Moreover, since oil is purchased using dollars, rising prices reduced the reserve of dollars for imports of other commodities. In January of 2022, inflation crossed the upper band of RBI’s inflation tolerance range i.e. 6%, instigated in part by the rising oil prices.

Source: Nature

Conclusion

The repercussions of fluctuation in oil prices can be seen in various elements constituting an economy, ranging from foreign exchange rates to inflation rates. The impact can be seen on the individual as well as the economy as a whole.

This article has examined the reasons behind the fluctuation in oil prices. While the Organisation of the Petroleum Exporting Countries (OPEC) plays a major role in the same, natural disasters which are unpredictable and beyond the control of humans cannot be overlooked as another major reason behind determination of oil prices. Naturally, the prices of oil rise when natural disasters occur in countries exporting oil. This is because of the inability of such countries to cope up with the market demand for oil. The market forces of supply and demand play an obvious but significant role. As discussed above, the demand and supply for oil tends to be more elastic in the long run. Varying production costs and instability of government within the country also needs to be taken into account.

Changes in prices of oil have far-reaching effects, not just in terms of the magnitude but also in terms of the number of sectors impacted. High petrol prices play a major role in adding to inflationary pressures and high production costs. Variations in petroleum and crude oil prices play a crucial role in giving shape to market dynamics and impact the global economic growth and currency exchange rates. Not only this, but the individual consumer also tends to consider his spending and investments while taking into account the fluctuations in oil prices. This of course, is a pretty indirect effect.

Furthermore, a case study has been presented wherein two contrasting situations have been presented. One is the case of the COVID 19 pandemic due to which the prices of oil plunged. In contrast to this, the other case is of the Russian invasion of Ukraine which gave rise to a drastic increase in the prices of oil.

The phenomenon of the variations in prices of oil and petroleum and the role it plays in the economy, indeed, cannot be overlooked.

References

- How do supply and demand affect the oil industry? https://www.investopedia.com/ask/answers/040915/how-does-law-supply-and-demand-affect-oil-industry.asp

- What causes oil prices to fluctuate? https://www.investopedia.com/ask/answers/012715/what-causes-oil-prices-fluctuate.asp

- What happened to oil prices in 2020? https://www.investopedia.com/articles/investing/100615/will-oil-prices-go-2017.asp

- What is the relationship between oil prices and inflation? https://www.investopedia.com/ask/answers/06/oilpricesinflation.asp

- The currencies most affected by falling oil prices. https://www.investopedia.com/articles/investing/102015/currencies-most-affected-falling-oil-prices.asp

- Impact of Russia-Ukraine war on oil and gas industry. https://www.gep.com/blog/mind/russia-ukraine-wars-effects-oil-and-gas-industry

- Russia-Ukraine war: How rising crude oil prices impact us in ways we don’t quite notice. https://www.indiatoday.in/world/russia-ukraine-war/story/russia-ukraine-war-how-rising-crude-oil-prices-impact-us-in-ways-we-don-t-quite-notice-1925206-2022-03-14