Introduction

The Israel-Palestine Conflict is one of the deadliest conflicts that mankind has had to witness and pay the price for. People have lost their lives, properties have been destroyed, flora and fauna wiped from entire regions, and many more horrors unheard of. Economic means to support the people were also eroded amidst the political instability in both regions. Irregular conditions for the businesses to function also meant that the economies for all the parties did not see a healthy and conducive business environment. All of this had a massive bearing on the financial markets of all the parties to the conflict, something that is not talked about much.

Financial markets are a barometer for the economic growth of the country. The involvement of the countries, in question, in each other’s financial systems is also indicative of the political relationship that they share. Jordanian banks constituted 52.4% of the total number of banks in Palestine.

This report intends to dissect the various political events that have gone down in the history and assess the impact that they have had on the 2 main parties to the conflict, i.e. Israel and Palestine.

Impact on Palestine

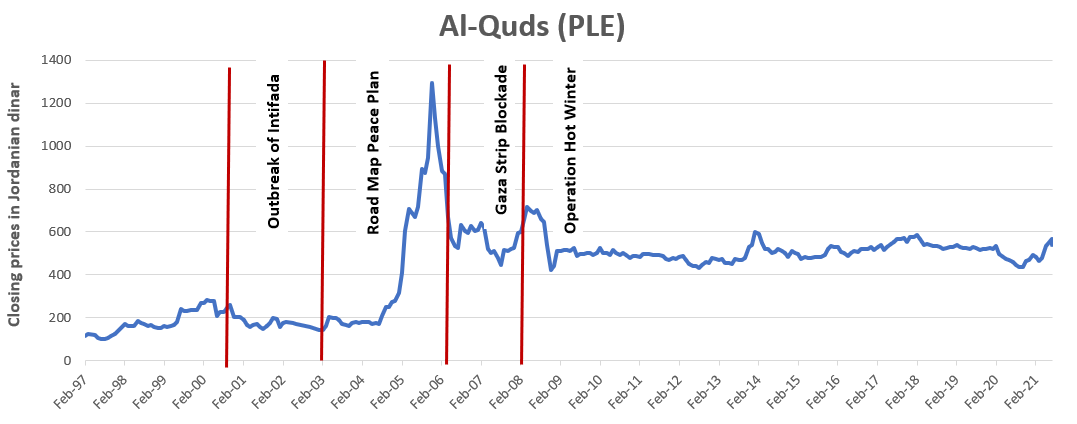

It is not a hidden fact that due to various factors including the lukewarm relations between Israel and Egypt, the religious similarity of Palestine and Egypt, participation of Egypt in the Oslo Peace Process, Egypt had a huge part in giving a boost to the Palestinian Stock Exchange when it was starting. This just goes on to prove that the parties rivaling Israel have consolidated in a way to help the notably weaker entity in bringing its crippled economy and businesses back on track. It is also notable that the simpler 5 sector stock exchange witnessed very high volatility in the years from 2005 to 2010, the reason for which is the blockade on the Gaza strip and the buildup preceding it.

Palestine’s economy depends heavily on Israel. The country purchases about two-third of its imports from Israel. Moreover, Palestinian sales to Israel account for about 81 percent of total Palestinian exports. The high numbers of Palestinian laborers working in Israel contribute over 13 percent to the Palestinian GDP. One of the major characteristics of Palestine’s economy is the absence of national currency and the use of three different foreign currencies (the New Israeli Sheqel -NIS, the Jordan Dinar – JD, and the United States Dollar – USD) (Hassouneh et al., 2017). Political instability and poor relations with its neighboring country ‘Israel’ have caused severe economic loss to the country. Moreover, blockades and airstrikes by Israel have led to the destruction of Palestine’s agricultural land and infrastructure. Hence, the economic performance of the country and its stock exchange relies greatly on Israel.

The Palestine Stock Exchange (PEX) was founded in 1995 to provide a platform for Palestinians to trade securities. As per the latest data, the market capitalization, or the total value of all shares of all securities traded on the Palestine Exchange is $3.45 billion. Al-Quds Index (QI) is a market value-weighted index and it was made up of 12 listed companies from different sectors in the Palestine exchange. This market index provides investors with a general idea about the direction and performance of the market. Political events in the contemporary world have a profound effect on the stock exchanges of almost all countries. Political risk is one of the major determinants of the market risk premium and domestic and foreign investment. Thus, the changes in the political risk level are reflected in the performance of the stock market. Moreover, developing countries like Palestine have a greater chance of political risk due to unstable and unconducive political situations.

As per the Johansen method, the Palestinian stock market is positively related to the Israeli stock market. Results show that a 1% increase/decrease in the Israeli stock exchange index will be followed by a 2.2% increase/decrease in the Palestinian stock market (Hassouneh et al., 2017). Furthermore, the tension and conflicts between Palestine and Israel have a negative short-run impact on the Palestine stock markets. However, no long-run impact on the Palestine Stock Exchange was recorded.

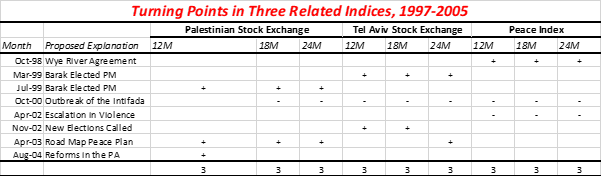

Wye River Memorandum (1998)

The Wye River Memorandum was negotiated between Israel and the Palestinian Authority at a summit in Wye River, U.S in October 1998. It was aimed to resume the implementation of Oslo Accords II i.e., the interim agreement on the West Bank and Gaza Strip. It was signed by Benjamin Netanyahu and Yasser Arafat, through negotiations led by U.S. President Bill Clinton. The PEX reacted positively to this agreement with an increase of 160.27 points on the Al-Quds Index.

Camp David Summit and Outbreak of Intifada (2000)

The 2000 Camp David Summit was a meeting that was between Israeli prime minister Ehud Barak and Palestinian Authority chairman Yasser Arafat with Bill Clinton as an intermediary. The summit aimed to reduce tensions between Israel and Palestine. However, the summit failed to reach a final agreement on the peace process. About 3,000 Palestinians and 1,000 Israelis, as well as 64 foreigners, were killed. Both TASE (Tel Aviv Stock Exchange) and PEX responded negatively to this event. Between 2000 and 2003, the PEX fell drastically.

The Road Map for Peace (2003)

In 2003, a plan was proposed by the Quartet on the Middle East: the United States, The European Union, Russia, and the United Nations to resolve the conflict between the two countries. It was composed of three phases. Its main goal was to end violence, accept Israel’s right to exist, establish a sovereign Palestinian state and halt settlement activity. The PEX reacted positively to this proposal.

Gaza Strip Blockade and Operation Hot Winter (2007-08)

After Hamas took control of the Gaza Strip, Israel and the Quartet on the Middle East set conditions before they would provide any aid to the PA. Hamas refused to recognize Israel as an independent state and previous agreements that were signed between the two countries including Oslo Accords (Wikipedia, 2008). In response to this, Israel and Egypt imposed air, sea, and land blockade in 2007. Tensions escalated between these two countries. In 2008, Israel launched Operation Hot Winter in response to Qassam rockets fired by Hamas onto Israelis. The stock market was adversely affected and the Al-Quds index dropped by 599 points.

(Zussman et al., 2008)

Impact on Israel

After acquiring the status of an independent state in 1949, Israel found itself in a deep economic crisis, enduring the devastating effects of the 1948 Arab-Israeli War and absorbing millions of Jews from different parts of the world. The financial markets were underdeveloped, unemployment was sky-high, and foreign currency reserves were scarce. The 1952 agreement between Israel and West Germany resulted in the latter paying reparations worth US$ 111.5 billion in the modern currency which accounted for as high as 87.5% of Israel’s income in 1956. The Tel Aviv Stock Exchange (TASE), colloquially known as ‘The Bursa’, founded in 1953 is Israel’s only public stock exchange. Currently, 544 companies are officially listed in the TASE. Dual listing is permitted as a result of which about 56 companies are also listed in the stock exchange of other countries, usually ‘New York Stock Exchange’ or ‘NASDAQ’.

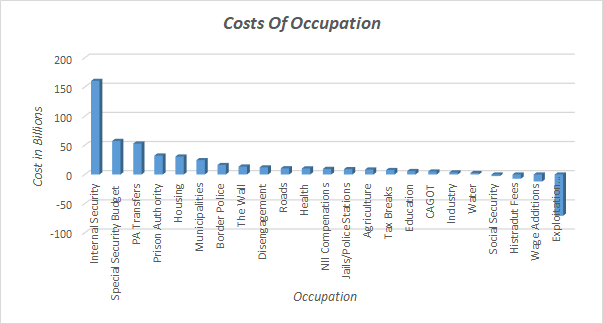

The 1967 Six-Day War

The third Arab-Israeli war was followed by the Israeli victory against the United Arab Republic (UAR). Israel ended up occupying the Gaza Strip, Sinai Peninsula, West Bank, and Golan Heights. However, the overwhelming costs of the war, along with the costs of occupation forced the Israeli economy into a deep financial crisis. Economists estimate the cost of occupation to be around US$ 100 Billion around the time frame 1970-2008, accounting for about 8.7% of Israel’s 2008 budget. There has always been an investor line of reasoning that the right move during conflicts is to reduce holdings as no one likes uncertainty that comes with escalating violence, however, Israel is confident that it can protect its sovereignty against these attacks. Although the 1967 war caused short-term fluctuations in the stock market, the market soon recovered after the war ended, entering a period of boom lasting until the early 1980s.

The Camp David Accords (1978)

Camp David Accords was a peace agreement signed between Israel and Egypt in September 1978 that led, in the following year, to a peace treaty between the two countries. Upon the conception of the accords, which marked the beginning of a peaceful co-existence of the two countries, the TASE rallied through the late 1970s as well as the early 1980s. In 1982, the TASE had a record year when stock prices rose by 113%. However, in 1983, the stock boom ended in a crash and Israel’s bank stocks bubble burst, following which the TASE closed for 2 weeks.

The First Intifada (1987-93)

The First Intifada was an infamous Palestinian uprising in the West Bank and Gaza Strip against the Israeli occupation in those territories which resulted in a series of Palestinian protests and violent riots, bearing huge financial costs for both sides. The Israeli minister of economic planning has put the total cost of the Intifada at $1.5 billion, a severe burden for an economy whose annual output is about $27 billion. The costs were related to direct military and ammunition, construction of detention centers, feeding and clothing detainees, loss of revenue from taxes, and loss of sales and production.

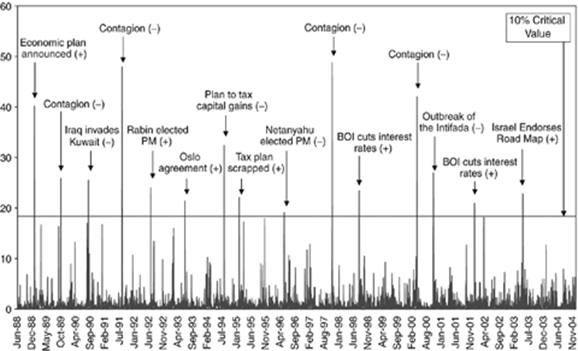

The Oslo Accords (1993)

The Oslo Accords was a peace treaty between the Government of Israel and the Palestine Liberation Organization (PLO). The Israeli Stock market, TASE responded positively to the Oslo Agreement, mainly because it was viewed as one of the most important developments in the Israeli-Palestinian conflict in recent decades. In the June of 1993, the Israeli Finance Minister surprisingly announced that a tax reform proposed in the summer of 1993 which recommended imposing a tax on capital gains will not be implemented for at least two years. As a result, the Israeli Stock market rose sharply the following day, establishing a turning point, however, the breakpoint in the series did not actually occur till the end of August, upon the unanimous approval of the Oslo Accords by the Israeli cabinet on August 30, 1993. The following graph tracks the effects of major events that took place in Israel from 1988-2004 on the Tel Aviv Stock Exchange. The positive reaction of the stock market for the Oslo accords also reflects the want for peace and tranquility among the Israelis.

(Zussman et al., 2008)

The Second Intifada (2000-05)

The second Intifada or Al-Aqsa Intifada broke out in September 2000, as a repercussion of the visit of the heavily-guarded Israeli opposition leader, Sharon, in the Al-Aqsa Mosque in Jerusalem. The visit instigated clashes between the Palestinians and Israeli security forces which were followed by mass demonstrations and suicide bombing campaigns in Israel and the other occupied territories. It claimed the lives of thousands of Israelis and Palestinians and eventually impacted the economies of both countries to a great extent. It was one of the major turning points in the financial markets of Israel.

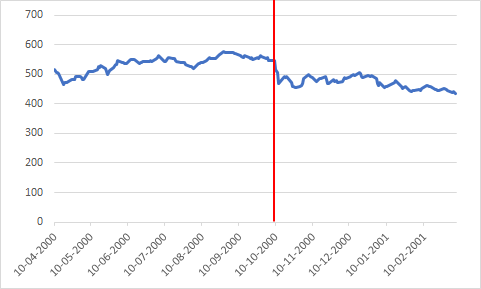

The following chart uses Tel Aviv-25 Index to depict the impact of the Intifada outbreak on the Israel stock market:

The Road Map (2003)

Israel endorsed the Middle East Peace Plan, known as the Road Map, on May 25, 2003, which called for the establishment of an independent Palestinian state living side by side with Israel in peace. The TASE responded positively to this proposal which was clearly visible in the 240 days, 360 days as well as the 480 days window, although the plan was put on the back burner as the Iraq crisis intensified in late 2002 and early 2003.

Operation Protective Edge (2014)

Another major incident was the launch of Operation Protective Edge by Israel on 8th July 2014 in the Hamas-ruled Gaza Strip which precipitated the outbreak of seven-week-long skirmishes between the Israeli military and Hamas. It was one of the deadliest conflicts between the two countries as Israel was attacked by 3000 rockets, killing about 73 Israelis and more than 2000 Palestinians. As per a report by Moody’s Investor Service, Israel had to incur a cost of about NIS 3 billion or 0.3% of GDP during the war. Once again, the financial markets responded with a short-term decline. The TA-25 index decreased by 1.5% and the TA-100 index decreased by 2.1% during the second week of July.

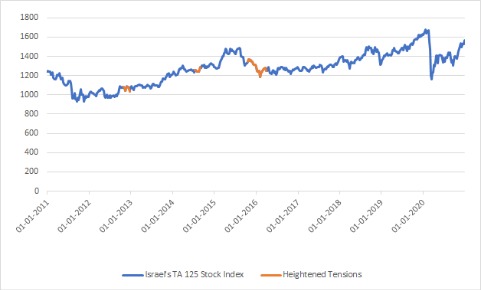

The following graph represents the effects of various conflicts, which occurred between Israel and Palestine during 2011-2020, on Israel’s stock market:

Recent Confrontation (2021)

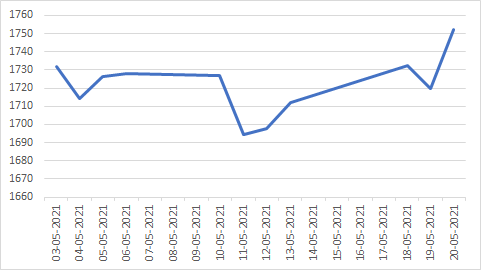

The recent confrontation which flared up on May 7, 2021, at the Al-Aqsa Mosque in Jerusalem was also one of the turning points in the financial market of Israel. The violence escalated on May 10 when Hamas fired more than 200 rockets on Jerusalem which infuriated Israel and it responded with several airstrikes on Gaza. This had a substantial impact on the Israeli Stock market as well as its currency.

On May 11, the benchmark TA-125 index declined by about 2.7% whilst the TA-35 index of blue-chip companies was down by 2.6%.

The impact of the recent conflict on TA-125 can be construed from the following graph:

Conclusion

After several tests and assessments being done on the nature of the correlation between the PXE and the TASE, it is clearly indicated that there exists a positive correlation between the two. That is to say that when the PXE showed a decline, the TASE replicated the same with empirical evidence and observations to back the conclusion. It is fit to say that when any such instance of tiff takes place, investor behavior on both sides of the border tips more towards the saving preferring trends.

The uncertainty of the political atmosphere stimulates a more survivor-based approach where all the income available is protected and investment infrastructure loses the trust it is able to garner.

However, that has also gone on to prove that the economic growth of Israel has simultaneously trickled down upon Palestine too, on the premises of having shared resources and borders.

Thus, it can be concluded from the aforementioned instances that the Tel Aviv Stock market has always been highly resilient during the previous conflicts, be it the launch of the Operation Pillar of Defense in 2012 or the wave of violence of 2015, which had a devastating impact on the economy of Palestine. It was only during the 2014 Gaza war that the TASE performed significantly worse. In fact, the previous literature available also suggests that the political instability caused due to the Israel-Palestine conflict generally does not have any considerable impact on Israel’s economy.

Bibliography

- Bhasin, H. (2020, June 16). SWOT Analysis of Prime Video. Marketing91. Retrieved June 23, 2021, from https://www.marketing91.com/swot-analysis-of-prime-video/

- Dean, B. (2021, March 4 Thursday). Amazon Prime User and Revenue Statistics (2021). Backlinko. https://backlinko.com/amazon-prime-users

- Madnani, D., Fernandes, S., & Madnani, N. (2020). Analysing the impact of COVID-19 on-over-the-top media platforms in India, 16(5), 19. https://www.emerald.com/insight/content/doi/10.1108/IJPCC-07-2020-0083/full/html

- Omnicom Media Group. (2020). COVID-19: The Impact on Media Consumption of Indians. COVID_19__Newsletter__Impact_on_Media_Consumption_OMG_India. https://www.omnicommediagroup.com

- Paliwal, A. (2021, May 26). Global Video Streaming Software Market Estimated to Hit $19,537.1 Million and Grow with a Significant CAGR of 20.4% from 2020 to 2027. globenewswire. https://www.globenewswire.com/news-release/2021/05/26/2236548/0/en/Global-Video-Streaming-Software-Market-Estimated-to-Hit-19-537-1-Million-and-Grow-with-a-Significant-CAGR-of-20-4-from-2020-to-2027-Exclusive-COVID-19-Impact-Analysis-261-Pages-Rep.html

- Parker, B. (2020, September 07). Netflix SWOT Analysis 2020 | SWOT Analysis of Netflix. Business Strategy Hub. Retrieved June 23, 2021, from https://bstrategyhub.com/swot-analysis-of-netflix-2019-netflix-swot-analysis/

- Sherman, A. (2020, January 21). Netflix paints a happy face on growing threat of US competition. CNBC. Retrieved June 5, 2021, from https://www.cnbc.com/2020/01/21/netflix-q4-2019-earnings-report-downplays-competition.html

- Spangler, T. (2020, April 22). Netflix Plans to Raise $1 Billion Through Debt Offering. Variety. Retrieved June 5, 2021, from https://variety.com/2020/digital/news/netflix-raise-1-billion-debt-offering-1234587050/

- Sunitha, S., & Sudha, S. (2020). Covid-19 Conclusion: A Media and Entertainment Sector Perspective in India. Vichar Manthan( A Peer Reviewed Journal), 8(3), 3. https://www.researchgate.net