Introduction

Today, it is difficult to imagine how primitive the Indian Banking and Financial sector was, just over 30 years ago. Before the emergence of HDFC Bank, the Indian banking sector was dominated by state-owned banks. These banks monopolised the market and provided poor services to their customers. Budgeting was tight and there was little room for innovation. The major factors that contributed to deteriorating bank performance included:-

- Rigorous regulatory requirements: The CRR was as high as 15% and SLR was set at 38.5%, which made it very difficult for any bank to turn a profit.

- Low interest rates charged on government bonds

- Directed and concessional lending

- Administered interest rates

- Lack of competition: While the involvement of the government was justified in the initial stages of the development of the financial sector, the continuous and prolonged presence of increasingly large public-sector banks led to inefficient resource allocation and excessive concentration of power in a few banks.

These factors had dramatically affected the incentive of the bank to operate properly. The 1980s was a decade of an expanding balance of payment crisis as the government began to run larger fiscal deficits, with an astonishingly large revenue deficit by 1990. Coupled with the massive scams, the faith and ability of the Indian citizens to use these banks in a productive manner was decreasing day by day. During this period, the average return on assets in the second half of the 1980s was only about 0.15%, while capital and reserves averaged about 1.5% of assets. These banks also didn’t offer a variety of services, with the example of commercial banks, which stayed away from direct home loans and didn’t focus on growing their retail portfolios till late 1990s. It was clear that the state of the Indian Banking sector was in dismal condition. This led to the Economic Reforms in 1991, which opened up the Indian Banking Sector to the heights it soon achieved.

ORIGINS OF HDFC

Housing Development Finance Corporation Ltd was established in 1977 as India’s first retail housing company. It closely resembled a start-up at the time, with the only difference being that it was created as a post-retirement venture by the founder, H.T. Prakesh. He was 65 and had just retired as the chairman of ICICI. It remained the only housing finance player till late 1980’s when insurance companies and other housing players started emerging. In fact, HDFC created competition for itself by creating 4 other housing finance companies.

The business was simple -borrowing wholesale funds and then further lending them to retail customers at a reasonable rate of interest, typically around a modest spread of 2%. However, with the Gulf War, India’s depleting foreign currency, and unsustainably high fiscal deficits, RBI raised the interest rates sharply with the SLR reaching around 38.5% and CRR hovered around 15%. For a lending institution like HDFC, this was extremely stifling as the home loan approval process was getting stronger but the resource reservoir was depleting. With the loan rates as high as 18.5%, it realised that it had to find new avenues of raising resources. At this time HDFC realised that over the years, it had built significant trust within its consumer base due to their quality services, which contributed immensely to their goodwill in the market, and coupled with its strong brand name, HDFC decided to raise retail deposits.

EMERGENCE IN THE BANKING SECTOR

HDFC Bank was first set up in 1994 and became one of the first lenders in the country to receive the in-principle approval of RBI, which till then had largely been dominated by the state-owned entities in the banking sector. A year later the bank established its first branch in South Mumbai’s ChurchGate Sector. In the initial days, HDFC didn’t have enough deposits, because of which it couldn’t offer lucrative services to its customers. As a result, after extensive market research, it was able to identify areas where they could provide convenient services to their consumer base, and increase their depository.

One such area was the pain of cooperative bank transactions. Back in 1998, cooperative bank transactions were restricted to one state, and their customers in branches were only in that particular state so inter-state transactions took a lot of time, since they were entirely dependent on another bank in another state. However, in the case of HDFC, since it has branches all over the country, it was able to issue cheques and power to all cooperative bank customers, which dramatically reduced the transaction completion time. In return, HDFC asked these cooperative banks to keep their interest rate deposits with HDFC Bank. They used these deposits to give out car loans, home loans and eventually earn a profit.

The second area was the functioning of the Stock Market. Back in 1998, all transactions happened in the form of physical certificates but soon came the digital revolution, and shares were dematerialised. However, although the shares were transferred electronically, the fund transfer accompanying this transaction still happened physically. This system was a very inefficient system and caused major problems to all parties in the supply chain process. However, HDFC came up with a revolutionary solution, developed by a company called i-flex Solutions. HDFC made sure that not just the shares, but also the funds were also transferred in the supply chain and dramatically reduced the transaction period from 5 days to just 2 to 3 days. Along with this, now the balance in the broker’s account could be checked immediately and the broker required very little capital to operate because of the faster supply chain which increased their time to settle the transaction.

As a result of this, by late 1990 HDFC had captured 80% of the market share in the settlement business, and in addition to that, they even started offering lines of credit to brokers to settle their excess transactions, which increased their big ticket accounts and deposit reservoirs.

Let’s take a case:

If you are Mr. Patel and you are a buyer from Maharashtra using SBI. If you want to buy 10 shares at 500 rupees per share. You have to give a cheque for 5000 rupees to the broker. Who had an ICICI bank account? He then gave another check to the stock exchange for 5,000 rupees which had an account in Canara bank. And then assuming that the exchange has a seller it will then carry out the exchange by giving a 5,000 rupees cheque to the broker of the seller. Lastly, the broker of the seller then gives another check to the seller that is Mr. Singh. After this transfer was done the shares used were electronically transferred immediately to the buyer. However, the problem with the system was that this was a very inefficient system. It caused four major problems for the entities of the supply chain.

4 MAJOR PROBLEMS TO THE ENTITIES OF THE SUPPLY CHAIN:

- Each one of these transactions used to take two to three days, sometimes even five to seven days to be carried out; this was because each entity in the supply chain had a different bank that had different transaction times.

- This process became even more complex when a broker had multiple customers. Who again had different bank accounts with different processing times.

- From the seller’s end the broker had to settle the transaction for the volume of shares sold by Mr. Singh. So he had to pay 5000 rupees to Mr. Singh even if the money did not hit his bank account yet. This meant that the broker had to have a huge amount of working capital with lakhs of rupees in his account. Which will only be used to pay back the sellers.

- While this transaction was being carried out the exchange had no way to figure out if the broker had enough balance to execute the trade or not. This is why to mitigate this risk the exchanges had to send data on the dues of various brokers to the bank at the end of the day. To check whether the brokers had enough money to honor their trade or not. In this case, every single day in the evening Canara Bank used to send the data saying Mr. Singh and Mr. Sheikh have one lakh rupees and they are supposed to execute trades worth 80,000 rupees and 1.2 lakh rupees respectively. This further made the process extremely inefficient, tedious, and costly.

HOW HDFC SOLVED AND REVOLUTIONISED THE BANKING SYSTEM

HDFC Bank came up with a revolution and opted in for a software solution called the “Micro Banker”. Which was developed by a company called Iflex Solutions. The micro-banker was a fully integrated online banking automation system, whereas other banks either saw online banking as the way ahead of its time or they stuck with offline banking or they had a hybrid of both online and offline.

This gave HDFC the superpower to transfer funds electronically with minimal human interaction. What followed next was nothing short of a revolution. HDFC could make sure that not just the shares but even the funds could be transferred electronically to the entities of the supply chain in the stock market and hence the transaction time was reduced from 5 to 10 days to just two to three days.

This gave the entire supply chain three features that were nothing less than a superpower to the stakeholders.

FEATURES PROVIDED BY HDFC TO THE SUPPLY CHAIN

All the buyers and sellers could carry out the transaction within two to three days making this entire process extremely effective in terms of both ease of calculation and strategy.

The exchange could immediately check if the brokers had enough funds to carry out the transaction or not, which saved them a lot of headaches.

The broker needed very less working capital to operate. For example, instead of having three lakh rupees, he could operate with just one lakh rupees because the funds were coming in and moving out very quickly, and because of this, they had enough time to settle the transaction.

This is how HDFC revolutionised the stock market system in India. Some people might say “Yeah bro so what is the big deal with using a computer and the Internet for banking”

Well for those people I’m gonna tell you guys that this was not like ordering pizza online. We are talking about using a new-age technology to carry out critical transactions and that too in the stock market

This requires a ton of effort into reskilling your employees and setting up new systems and procedures that no one has ever used in India.

Most importantly it comes at the cost of putting the company itself at risk because you’re dealing with critical transactions. But in the case of HDFC, the meticulous execution of this strategy paid off dividends that were far beyond anyone’s expectations.

THE SUCCESS OF HDFC BANK:

This resulted in a viral opening of HDFC accounts from 1999 onwards not only did all the brokers switch to HDFC but also asked their customers to switch to HDFC accounts. Starting with the NSE in 1998 the HDFC bank became the clearing member of all major exchanges by Financial Year 2000. In total 800 broker accounts and a majority of custodians were using HDFC bank services by FY2000.

By the late 1990s, HDFC Bank had captured 80% of the market in the settlement business. In addition to that HDFC even started offering lines of credit to brokers to settle their excess transactions giving them one more reason to win the big-ticket accounts of the stock brokers of India.

This is how HDFC Bank ended up getting the most valuable current accounts and savings accounts. Giving them a huge chunk of funds to utilise for financial services.

HDFC also monetised on the huge potential of corporate accounts by using a digitised employee salary system. This rolled in crores of rupees (in the form of current accounts of these large corporations).

It is because of these above reasons that within a span of just six years (1994 to 2000), HDFC overcame the preexisting banking monopolies and went from being an ordinary bank to a legendary company in the Indian banking sector.

HDFC BANK ANALYSIS:

SWOT ANALYSIS:

Strengths:

- One of HDFC’s hallmarks is its impressive customer service which can be attributed to its efficient and dedicated team in charge of handling customer complaints and feedback.

- The company operates with the customer as its focal point, focusing on 24×7 customer support, personalised banking solutions, and a user-friendly mobile app to enhance the overall user experience.

Weaknesses

- Currently, HDFC Bank is experiencing hurdles in establishing an equally strong presence in the rural parts of India.

- In addition to that, the bank faces fierce competition from other large banks such as ICICI, SBI, Kotak, etc.

- When compared to its competitors like Kotak Bank, HDFC Bank has an inactive marketing strategy and markets less aggressively. However, studies show that this lack of effective marketing strategies has not affected the bank’s growth and expansion.

Opportunities:

- HDFC Bank is expanding its SOM i.e. Serviceable Obtainable Market by establishing a dominant position in the foreign country markets like Bangladesh, Nepal, and Sri Lanka by partnering with their local players.

- After analysing the market trends, HDFC has identified affordable housing as a potential growth driver and a means of maintaining their leading market position.

Threats:

- As a result of rapid digitisation, more and more client data and software systems are being stored in the cloud, making them vulnerable to cybercriminals, making cybersecurity a vital issue in the banking industry. Therefore, HDFC will need to ensure the safety of its IT infrastructures to be able to avoid any losses and casualties.

- Banking industry is one of those industries whose performance and trends are closely attached to the pulse of the Indian economy. Therefore negative macroeconomic factors like the slowdown in economic growth, and high inflation, could have a grave impact on the bank’s profitability and growth potential.

FINANCIAL HIGHLIGHTS:

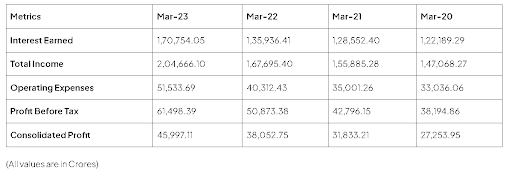

1. Income Statement

The income statement highlights a consistent increase in topline and bottom-line figures. The figures translate to better margins.

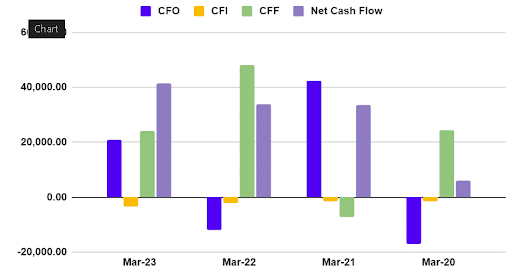

2. Cash Flow Statement

Cash Flow Statement indicates a turbulent atmosphere as the company has experienced significant negative CFO twice in the past 4 years. The CFI has been consistently negative over the years, which indicates a higher-than-average investing habit of HDFC.

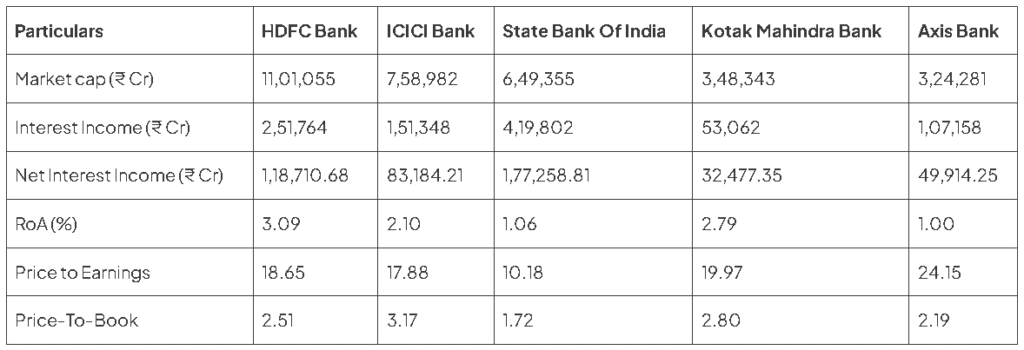

3. Peer Comparison:

Prudent Approach of HDFC in the Face of Potential Risks

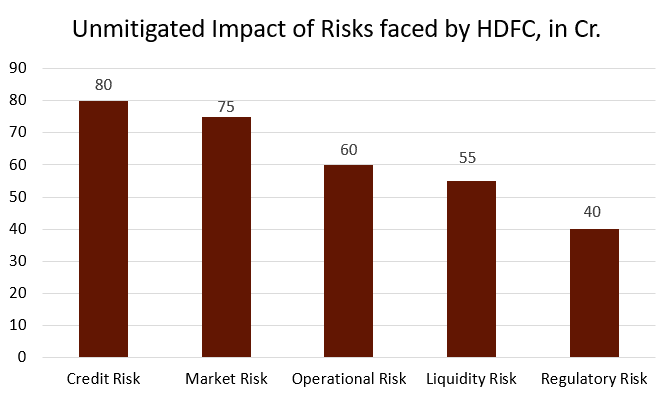

Risks, in terms of operational weaknesses that boil down to legal penalties and fraudulent activities, reveal a contravention of the provisions of the Reserve Bank of India stand together with the market risk that prevailed. The major concern is about competitive insights that demonstrate the impact on profitability of the bank while avoiding fines and penalties, and market power, so as to emerge as a bank with scrutinized regulatory compliances.

Geographic Expansion: HDFC Bank expanded its operations PAN India is directed towards managing economic downturns and regional risks that are associated with compensation of lesser profits in a particular state by another estate established for offering similar services.

Diversification: The diversification of service portfolio beyond retail banking to incorporate companies, wealth management, and commercial banking helps in reducing its reliance on a single line of business so as to mitigate risks with business cycles.

Stress Testing: Measuring resilience to unpredictable economic situations and identifying potential vulnerabilities in order to be prepared for the adverse events that may prevail. This helps HDFC in maintaining financial stability, ensuring survival and growth.

Advanced Risk Analytics: Assessment of risks is the first step of a risk management approach. HDFC utilises advanced risk analytics tools to manage and mitigate credit and liquidity risks. This enables proactive response to market fluctuations of the dynamic world.

Corporate Social Responsibility: HDFC holds an unstaggering focus on Corporate Social Responsibility (CSR) that helps in avoidance of reputational risks that are probable to arise with negative publicity or non-compliance with legislative provisions. Additionally, this builds goodwill and trust in the banking economy of India.

Strategic Partnerships: The strong ties of HDFC with technological companies and financial institutions around the globe improvises its offerings and deployment of versatile techniques to innovative solutions. The formation of such partnerships helps in mitigating risks associated with technology disruptions and market changes.

Partners in its Journey

Sequretek is a global cybersecurity company offering end-to-end security to enterprises in areas of threat monitoring and incident response that drives automation in the banking technology of HDFC in all aspects. The use of the platform, Natural Language Processing (NLP), as claimed by Softcell Technologies serves as an ultimatum. It is even after the eighth major failure that HDFC exhibited loyalty in a long period of bearish market. It pulled its retail assets as non-seasonal followed by a commitment up to a fierce level.

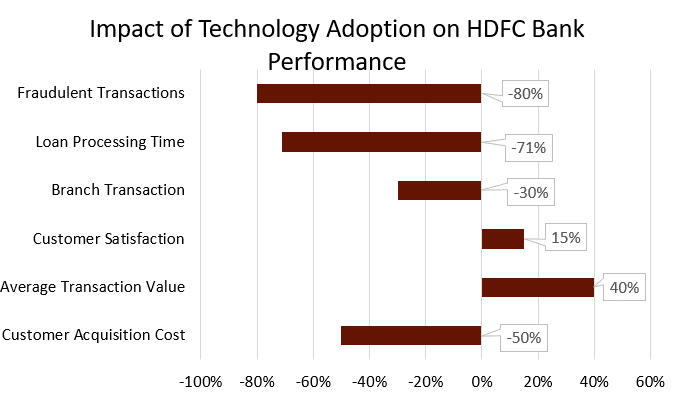

In the technological face of it, HDFC has been a pioneer in adopting unique practices as innovative management solutions that differentiate it from other established Indian banks. This acts as a pivot around which the entire competitive edge is maintained by exploring IoT, and blockchain technology, for instance.

Internet of Things (IoT): The use of this tech-driven strategy enables personalised user experience and contactless transactions. HDFC is one of the few major banks in India that considers itself capable of experimenting with this emerging technology with prudent means.

Cloud Computing: In order to assist business growth and continuity, HDFC scales its operations via IT infrastructure. It leverages its efforts by adopting cloud computing and stands at par in the use of this technology.

Big Data Analytics: Big data makes use of tailored products specific to the needs of its customers. This is the force that drives the success of HDFC Bank. It enhances user experience in terms of better application and customer satisfaction. This is, thence, a key to business profits for the company i.e. by catering to the broad market by minutely feeding their interests and preferences helps to increase the user base.

Blockchain Technology: A bank as potent as HDFC Bank aims to streamline its cross-border payments and receipts for the improvement of supply chain financing with utmost efficiency. HDFC remains at the forefront of the Indian banking industry in exploring technological options for the ease of the banking phase in a user’s life.

Artificial Intelligence and Machine Learning: A heavy investment in AI helps HDFC in risk management, and fraud detection that in turn offsets various types of losses. Customer service is another side of AI-powered chatbots for instant resolution of queries through well-trained automotive technology for all kinds of banking tasks.

Conclusion

HDFC’s rise in the country’s sector of banking is concerned with an innovative approach and technical-driven aim clubbed with environmental regulations and an extreme focus on efficiency. There is a loyal customer base of credit cards and other banking services that helps HDFC rise further in its goals. Its strong inclination towards maintaining high standards of customer services provides a seamlessly integrated mechanism for restructuring its financial landscape.

References

- HDFC Bank – Integrated Annual Report 2021-22

- Reserve Bank of India – Press Releases (rbi.org.in) Available at: https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=51650

- HDFC Bank Parivartan Available at: https://v.hdfcbank.com/csr/FY-2018-19/digitisation.html

- Why HDFC Bank is India’s first ‘Make in India’ catalyst – Express Computer Available at: https://www.expresscomputer.in/news/why-hdfc-bank-is-indias-first-make-in-india-catalyst/25163/

- HDFC Bank: How a 23-year-old Indian bank became “too big to fail” (qz.com) Available at: https://qz.com/india/1069409/hdfc-bank-how-a-23-year-old-indian-bank-became-too-big-to-fail

- (16) The Genius Strategies of HDFC That Killed Banking Monopolies in India | LinkedIn Available at: https://www.linkedin.com/pulse/genius-strategies-hdfc-killed-banking-monopolies-india-garv-garg/

- Think School, How HDFC’s Genius Strategies Killed the Banking Monopolies in India? , YouTube. Available at: https://www.youtube.com/watch?v=5LGvQaYB67I (Premiered on: 1 February 2022)

- Regulatory changes and productivity of the banking sector in the Indian sub-continent (sciencedirect.com) Available at: https://www.sciencedirect.com/science/article/abs/pii/S1049007807000280

- Deepak Parekh: Long before it became a bank, HDFC was one of India’s earliest startups (qz.com) Available at: https://qz.com/india/1045269/deepak-parekh-long-before-it-became-a-bank-hdfc-was-one-of-indias-earliest-startups

- Sachin Thakur (2023). HDFC Bank Case Study. Available at: https://www.sachinthakur.in/blog/hdfc-bank-case-study/#google_vignette

- HDFC Bank Case Study: Business Model, Financial Highlights (pocketful.in) Available at: https://www.pocketful.in/blog/hdfc-bank-case-study-business-model-financial-highlights-and-swot-analysis/