Introduction

The FIFA World Cup, occurring every four years, is one of the biggest sporting events which has its fans spread all around the world. In fact for many countries, it is not just a meager tournament but rather a question of national pride. The fascination and fervor attached to this international tournament isn’t just limited to its fans, but also has a significant impact on the financial and economic spheres of the participating countries.This articles delves deeper on this impact, while trying to assess the effects of the FIFA World Cup on the Stock Market.

Economic Effects of the Tournament

Hosting the FIFA World Cup, generally leads to an upsurge in several sectors including hospitality, tourism, retail and even construction for the country, leading to subsequent rise in the host country’s stock market. Similarly, the winning country’s stock market usually outperforms compared to global markets, in the periods following the victory. The sponsorship and media companies enjoy a similar rise in the stock market prices of their companies, following the increased publicity and global exposure.

However, in case of a loss, the losing country’s stock market is at a substantial risk of a short-term dip. This is particularly true for countries that take football very seriously and have the aspect of pride attached to the sport. FIFA matches also tend to cause a decline in the trading volume of the participating country’s markets as a result of undivided attention, especially to home matches, leading to resultant reduction in liquidity as well.

Effects on the Hosting Country

The FIFA World Cup results in numerous benefits for the hosting country. There is an increased influx of tourists with global undivided attention on the country, as a result of the tournament. All of this implies a positive economic growth that follows foreign investments and investments in infrastructure. Since, stock market indices react to both good and bad economic news, it is expected that the hosting country’s stock markets see excess positive returns. And it is the case in some cases. For example, The Bovespa Index of Brazil in 2014, saw a rise of 6% in the months following the FIFA World Cup.

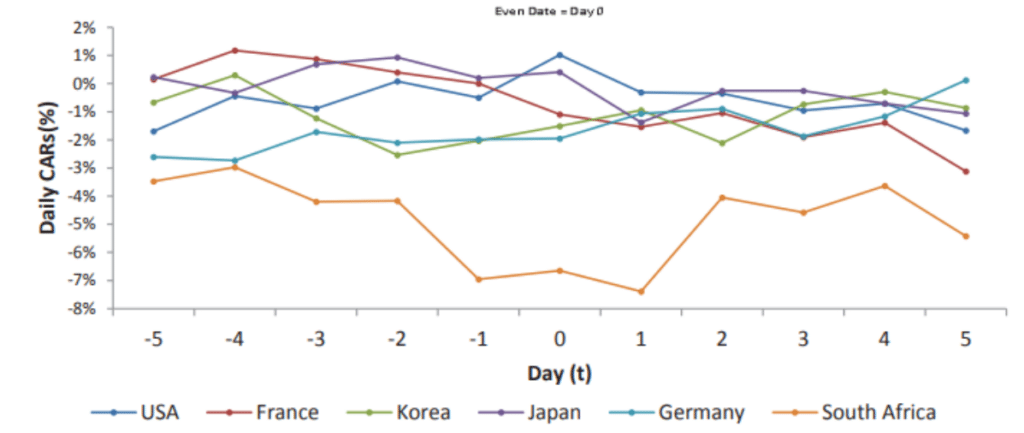

Studies from Allmers and Maennig (2009), Kasimati (2003) and Anton, et al. (2011) provide us with evidence as to how the FIFA World Cup gives rise to positive economic effects. However, there is no definitive relationship between the economic outputs and rise in stock markets. A study by Ramdas (2015), with a sample population of 5 FIFA hosting countries from the period of 1994 to 2010, concluded that FIFA results in different impacts on stock markets of host countries. Out of the pool studied, South Africa and Germany showed a positive reaction, while France and South Korea showed negligible reactions. Albeit, the aforementioned research has its own limitations, given that stock market returns are related to several other factors which might contribute to its increase or decline. It might also be the case that only certain sectors, such as hospitality, tourism etc see a rise in specific and not the domestic stock indices in general.

Effects on the Winning Country and Investor Behaviour

Studies over the years suggest an association between the winning of the World Cup and the respective country’s subsequent stock market performance. A study by Goldman Sachs (2014) reveals that FIFA does in fact affect the stock market, even though for a short period of time. Their findings concluded an outperformance by 3.5%, however, it only lasted for about three months.

The reasons for this correlation are simplistic yet psychological- Investor behavior. Investors experience euphoria and pride when their country wins and are depressed in case of a loss. Hirt et al. (1992) Edmans et al. (2007) revealed a strong correlation between the results of FIFA games and excess stock returns. According to them, the factor determining the changes in the stock market is the pre-match expectations of the investors. This can be explained by the fact that football fans do not just invest their money in security markets but are in fact themselves involved emotionally and psychologically. They have their expectations of desired outcomes and hence form biased predictions. In any case, when things don’t go as desired, they lose hope and divest from most of their investments leading to stock price depressions. However, when they do, it can lead to increased consumer confidence and spending. This stimulates economic activity and positively impacts the companies listed on the stock market.

Apart from this, there are several other factors as well including increased international attention, enhanced brand image of the country, increased government spending and many more, that welcomes foreign investments, investments in infrastructure and other booming sectors, thus resulting in the positive stock market returns.

Effects on the Hospitality Sector

Hospitality sector includes hotels and other places providing accommodation services, travel companies, tourist places, restaurants, casinos etc. FIFA has a significant impact on the stock market of the hospitality sector, especially of the hosting countries. The hospitality sector of the hosting countries faces numerous hotel bookings, crowded food courts and other tourist places are often pre-booked. Thus, this increase in demand leads to the increase in Average Daily Rates (ADR) of each hotel room. As per the reports, there was a significant boost in Qatar’s hospitality sector in 2022, with around 92% of one and two star hotels being fully occupied.

With the exception of Brazil, the average growth of the MSCI country stock market index of host nations, saw a rise of 21.8% in the year preceding the World Cup and 13.4% in the year following it. Qatar specifically benefited from hosting FIFA by making its hospitality sector more developed and made visitors’ stay during the world cup as comfortable and as hustle-free as possible. According to Saugata Sarkar, head of research at QNB Financial Services, “Qatar’s objective was to use the event as a springboard to showcase its offerings, and hopefully boost international tourist arrivals from 2.1 million in 2019 to 6 million per year by 2030”.

Effects on the Entertainment Sector

Entertainment sector includes various industries which provide leisure activities to people. It can include film, television, gaming, broadcasting etc. Due to the popularity of FIFA, broadcasting saw a huge growth. Also, there were many people who visited for the World Cup. Thus, the nearby recreational spots saw a major skyrocketing trend in their revenues. Financial analysts noticed Qatar’s GDP rose by 4.1% by the end of the year, thanks to the World Cup. Furthermore, for the time period between 2022 and 2030, the GDP is predicted to be at an average of 3.2%. Reports point out that the 2022 FIFA World Cup contributed over $20 billion to Qatar’s economy. Additionally, it is known that the QSE Index, which provides a measure for the twenty most liquid and largest stocks on the exchange, increased nearly around 24.7% in the beginning of 2022, up until the month of April. However, while the INDEX dipped and flatlined for some time, it saw an upsurge again by 12.1%.

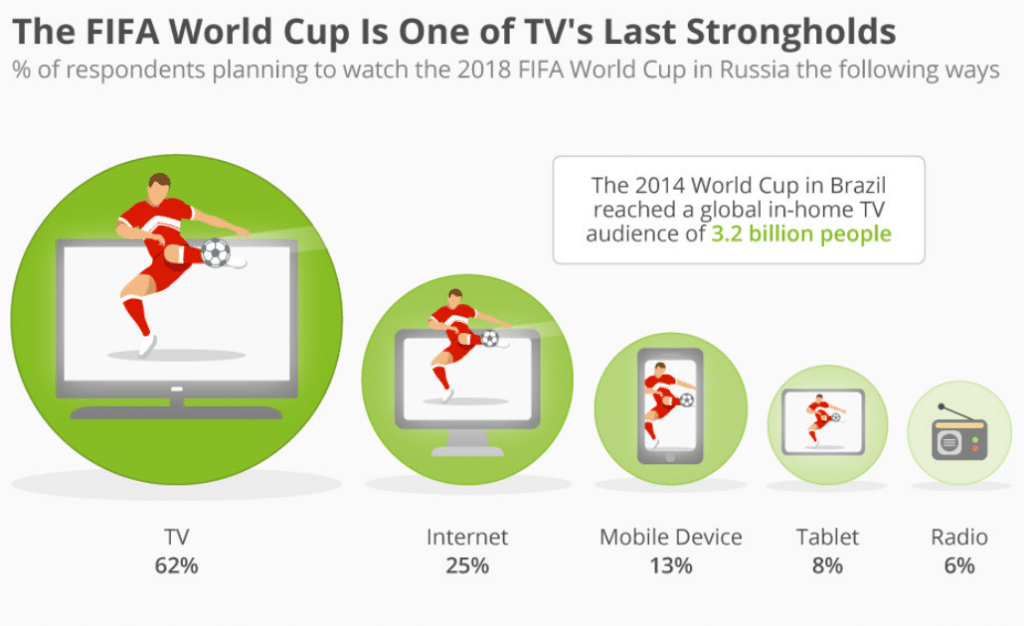

The FIFA World Cup 2018: One of TV’s Last Strongholds. https://www.statista.com/chart/14201/devices-used-to-watch-the-world-cup/

Effects on the Sponsorship Sector

Since FIFA is one of the most popular sporting events, most of the money comes from the investors and sponsors. There is a direct relationship between the results of the match and the stock market returns for the sponsoring companies. A win ensures positive returns while a loss promises negative returns on the stock market for the companies involved. For example, during the 17th FIFA World Cup, Nike was the sport sponsor of Brazil. When Brazil won the match on its first day, the stocks of Nike shot up by 1.3% but went down by 5% when it lost a subsequent match.

Additionally, a 2007 study by Edmans, Garcia and Norli noted a strong relation between the results of important soccer games and stock returns.Considering a pool of around 39 stock markets they concluded an asymmetric effect, wherein while losses had substantial effect on the losing countries but on the other hand, successes at the match has far less substantial impact on the winning countries.

Conclusion

The aforementioned research concludes that there exists an indefinite correlation between the FIFA World Cup and subsequent stock market results for the countries involved. While some countries do experience a positive upsurge post a win, some do not. These upsurges and depressions in the indices are subject to a number of other social, cultural and economic factors that coincide with the tournament.

The effect of the tournament is definitely noticeable on specific burgeoning sectors like hospitality and sponsorship, especially for the host countries. However, these are constrained by their short-term nature and depend heavily on investor behavior and prematch expectations.

Conclusively, the effect of the FIFA World Cup on the stock market remains a vastly unexplored topic.To obtain a definitive correlation between the two requires looking beyond empirical data and analysis and focusing on investor sentiment and behavior. Understanding the potential, constraints and the numerous elements at the center of this association would help the investors to build a way through the sophisticated game, without depending exclusively on data and numbers.

References

- Al Jazeera (2022) Qatar gears up for FIFA World Cup Equity Market Boom, Al Jazeera. https://www.aljazeera.com/economy/2022/11/20/qatar-gearing-up-for-fifa-world-cup-equity-market-boom (Accessed: 12 February 2024).

- Anas Alsaadi and Sayan Banerjee (2020) The Impact of FIFA World Cup on Sponsoring Companies and the Host Country Stock Market Index. https://www.diva-portal.org/smash/get/diva2:1433880/FULLTEXT01.pdf (Accessed: 12 February 2024).

- FIFA – also scores an economic goal (no date) Investment Letter for November, 2022 ” Ace Lansdowne Investments. https://acelansdowne.com/blog/investment_letter_november2022.html (Accessed: 12 February 2024).

- Harjito, D.A., Alam, Md.M. and Dewi, R.A. (2021). Impacts of international sports events on the stock market: Evidence from the announcement of the 18th Asian Games and 30th Southeast Asian Games. International Journal of Sport Finance, 16(3). doi:10.32731/ijsf/163.082021.03.

- McCabe, M. (2021) The FIFA World Cup effect on stock markets, Medium. https://medium.com/white-grass/the-fifa-world-cup-effect-on-stock-markets-e37221b1510d.

- Mohammed, A. (2023). Qatar receive huge economic boost after hosting 2022 FIFA World Cup, Olympic, Paralympic and Commonwealth Games News. https://www.insidethegames.biz/articles/1134087/qatar-economy-fifa-world-cup.

- Ramdas, B., van Gaalen, R. and Bolton, J. (2015). The announcement impact of hosting the FIFA World Cup on host country stock markets. Procedia Economics and Finance, 30, pp. 226–238. doi:10.1016/s2212-5671(15)01290-3.

- Stockmarkets and the World Cup effect (2022) IFA Magazine. https://ifamagazine.com/the-world-cup-effect.