What are crowdfunding platforms?

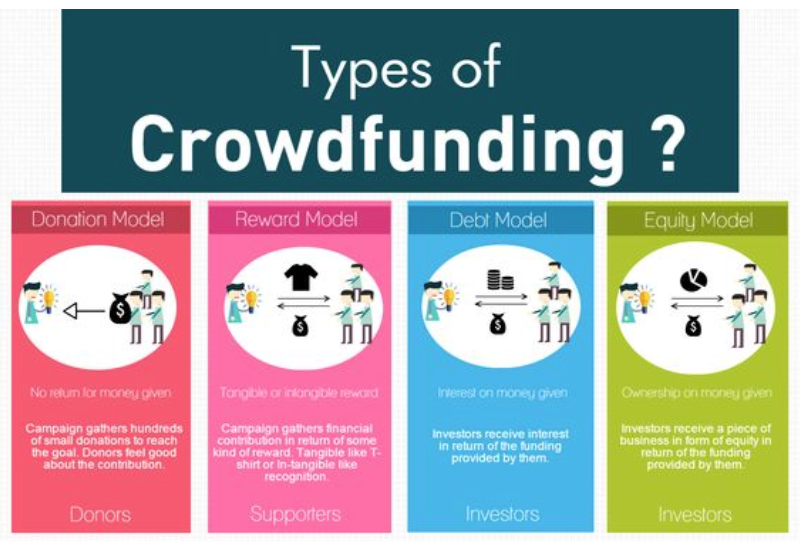

Crowdfunding is a dynamic online funding mechanism. It has burgeoned into one of the most rapidly expanding industries worldwide. By leveraging online platforms, individuals and startups secure financial backing for diverse projects. In 2005, the global crowdfunding sector raised $16.2 billion, with forecasts predicting an impressive surge to $96 billion by 2025. This growth reflects its pivotal role in democratizing access to capital. Crowdfunding platforms typically fall into four categories: debt-based, equity-based, rewards-based, and donation-based.

Debt-based platforms, exemplified by Funded Here and Crowdo, offer contributors interest payments. Equity-based platforms like AngelList provide contributors with shares in exchange for their investments. Rewards-based platforms entice contributors with exclusive perks, such as priority access to products upon launch. Meanwhile, donation-based platforms such as GoFundMe cater to charitable causes, often offering tax deductions for contributions.

Types of Crowdfunding | Source: https://www.crowdinvest.com/landingy

Revenue Model: My Money Don’t Jiggle Jiggle

The revenue model of a crowdfunding platform primarily comprises transaction fees and subscription fees. Transaction fees constitute a significant source of income for these platforms, as they typically charge a percentage of the funds raised by creators as a fee for utilizing their services. This fee structure varies based on the platform’s policies and the type of crowdfunding being conducted, whether it’s donation-based, reward-based, or equity crowdfunding.

Additionally, crowdfunding platforms may generate revenue through subscription fees, wherein creators or backers pay a recurring fee to access premium features or services offered by the platform. These subscription fees are often tailored to provide enhanced functionality, such as advanced analytics, marketing tools, or priority customer support, catering to the diverse needs of users. By leveraging transaction fees and subscription fees, crowdfunding platforms sustain their operations, invest in platform development and facilitate the realization of innovative projects and ideas.

Unveiling the Costs

Starting a crowdfunding platform involves understanding different types of costs. There are fixed costs, which stay the same no matter how much business you do, like building the website and following laws. These include expenses for making the platform, such as designing and testing the website. Additionally, fixed costs also include those required to meet legal requirements – data privacy laws, taxes, and user agreements, depending on the platform’s focus and location. On the other hand, variable costs change based on the volume of business activity. These include marketing efforts (e.g., Search Engine Optimization, social media deployment, and email campaigns))and transaction fees. Other ongoing costs cover maintenance and administrative expenses, and there may be additional costs for things like handling refunds or upgrading technology. Operating costs cover ongoing maintenance and administrative expenses, and miscellaneous costs include items such as refund processing and technology upgrades.

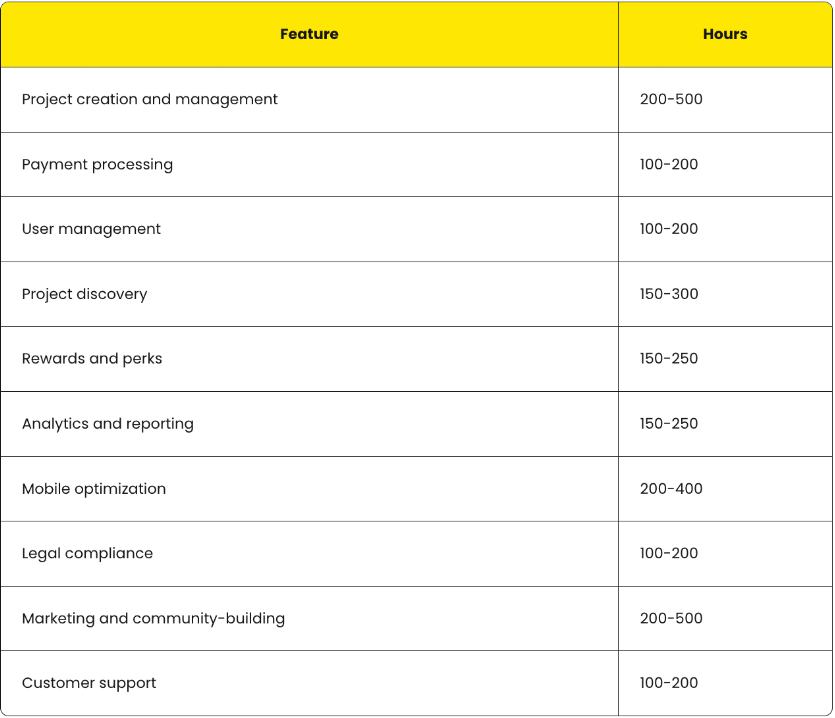

According to estimates, the number of hours needed to develop some common features of a crowdfunding platform is:

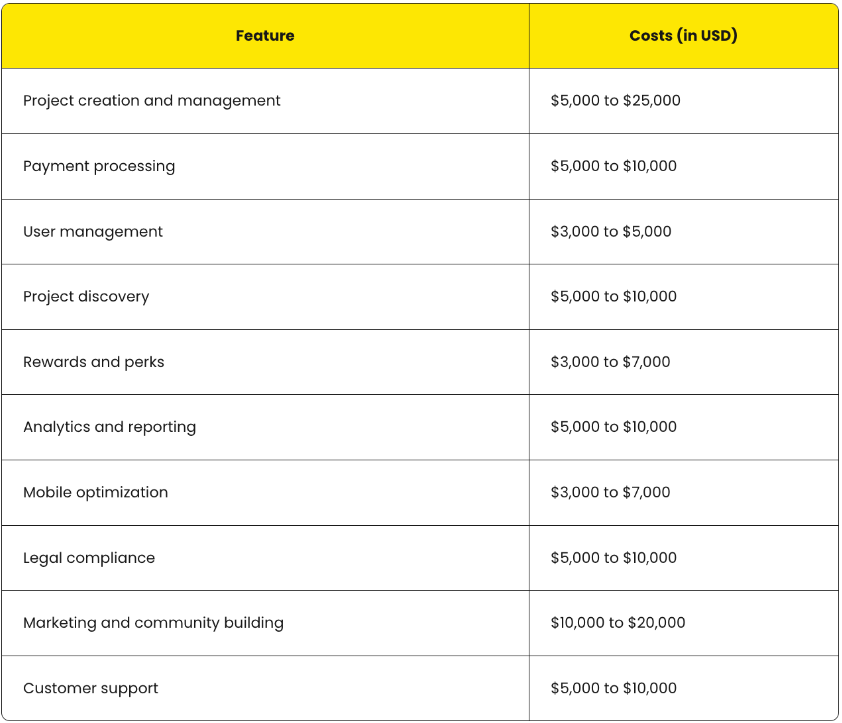

When we translate the time into money, the costing appears as:

Costs Incurred | Source: https://yellow.systems/blog/crowdfunding-platform-development-cost

Understanding these cost categories is essential for maintaining the financial health and sustainability of the crowdfunding platform, ensuring it can provide a valuable service to project creators and backers while managing its economic viability.

Scaling Success: Investigating Economies of Scale

It is the cost advantage that businesses incur when the costs are spread over a larger volume. The larger the size of the business, the more the cost savings. When more people join a crowdfunding platform, the cost for each transaction goes down, making better use of resources. The platform becomes more efficient in building, following laws, and advertising when there are more users. More transactions allow the platform to negotiate lower fees for processing payments. Also, the costs of running the website and handling paperwork become less for each person involved. This cost-effectiveness not only helps the platform stay financially healthy but also lets it offer better prices, attracting more people to start projects and support others. This cycle of efficiency helps the platform grow and remain financially strong.

Navigating Growth: Marketing User Acquisition

As a financial dimension of crowdfunding platforms, marketing and user acquisition play a pivotal role in driving growth and sustaining operations. These platforms allocate resources towards marketing efforts aimed at attracting both project creators and backers, which incurs customer acquisition costs. The cost of acquiring new users is a critical financial consideration. It directly impacts the platform’s profitability and overall financial performance. Balancing effective marketing strategies with efficient customer acquisition costs is essential for crowdfunding platforms to maximize their return on investment, expand their user base, and generate sustainable revenue streams for long-term success.

Safeguarding Success: Legal and Financial Considerations

While crowdfunding offers many benefits, it also comes with legal and financial considerations. Understanding these considerations can help you navigate the crowdfunding process and avoid potential pitfalls.

From tax implications to intellectual property rights, these considerations can impact the success of your crowdfunding campaign and the viability of your project. It’s important to seek professional advice and conduct thorough research before launching your crowdfunding campaign.

Fiscal Footprints: Tax Implications

The revenue generated through crowdfunding can have tax implications. Depending on the type of crowdfunding and the nature of the rewards offered, the funds raised may be considered income, sales, or donations for tax purposes.

It’s important to understand the tax implications of your crowdfunding campaign and plan accordingly. This may involve setting aside a portion of the funds raised for tax purposes, issuing tax receipts to backers, or reporting the funds as income on your tax return. Consulting with a tax professional can help you navigate these issues and ensure compliance with tax laws.

Credibility: Examining Trust

Protecting your intellectual property rights is crucial when launching a crowdfunding campaign. Sharing your idea or product with the public can expose it to potential copying or infringement. Before launching your campaign, consider applying for patents, trademarks, or copyrights to protect your intellectual property. It’s also important to be mindful of the information you share publicly and consider using non-disclosure agreements when discussing your project with potential partners or collaborators. It is very difficult to build credibility amongst potential backers. There have been several instances of fraud. For example, in 2014, a campaign was run by Healbe GoBe that advertised as being based in San Francisco, but research found them to operate out of Russia.

Many potential donors need to become more familiar with the concept of online crowdfunding and may be hesitant to contribute due to concerns about the legitimacy and transparency of campaigns. Building trust and educating people about the benefits and safeguards of crowdfunding is crucial to overcome this challenge.

Ketto: A Comprehensive Case Study Analysis

Ketto, an Indian online crowdfunding platform, offers the opportunity to secure funds for social, personal, and creative causes. It has modernised the conventional approach of garnering small contributions from a community to achieve a collective goal. The company’s name, “Ketto,” derived from its business model, signifies “Key to Tomorrow.” What distinguishes Ketto is its innovative transformation of the traditional offline crowdfunding model into a sophisticated, transparent, and cost-effective solution, ensuring the attainment of shared objectives with efficiency in the digital era.

With over 72 lakh donors and more than 3.2 lakh fundraisers, Ketto, established by Varun Sheth, Kunal Kapoor, and Zaheer Adenwala in 2012, has successfully raised over INR 1100 crore through more than 2 lakh campaigns. Users can initiate and share fundraisers at no cost, benefit from personal fundraiser managers, and access round-the-clock customer support. Ketto’s inclusive platform spans various fundraising categories, including creative, entrepreneurial, NGO, educational, and personal projects.

Business Model: Ketto is a donation-based crowdfunding platform. “Crowdfunding” refers to the practice of giving monetary funds to overcome specific social, cultural, or economic hurdles that users face in their day-to-day lives.

- Step 1: Sign up on Ketto by submitting valid documents needed for verification.

- Step 2: Fill up the form by providing details about you and the one for whom you are going to raise funds.

- Step 3: Create a crowd-funding campaign to raise the funds

- Step 4: Share the fundraiser with your friends and family through WhatsApp, Instagram, Twitter, Facebook, and email.

- Step 5: Track the incoming funds.

- Step 6: Withdraw the raised funds directly to your bank account.

Ketto operates under the “Commission-based Revenue Model” to generate income. The platform earns revenue by imposing a small fee on every successfully hosted campaign. Ketto charges 5% transaction fees on the total funds raised by the campaigner. There are also payment gateway charges incurred by backers who choose to donate This fundraising platform employs third-party payment gateways, namely PayU, Paytm, and Razorpay, to handle payment processing. These trusted third-party apps impose a nominal fee, typically in the range of 2-3%, for each transaction. This fee is levied by the payment gateway provider and is subsequently transferred to the campaigner. Consequently, when a campaign is initiated on Ketto, there is a 5% fee on the total funds raised and a 3% payment gateway fee applied to the amount collected. This constitutes the fundamental revenue stream for Ketto. Further, Ketto engages in collaborations with corporations, aligning with their Corporate Social Responsibility (CSR) objectives. The platform connects companies with non-profit organizations in need of financial support. Ketto, in turn, levies a fee for these corporate partnerships, deriving substantial revenue from a percentage-based commission model.

An example of such a partnership involves Practo, a prominent integrated healthcare entity in India. Practo and Ketto collaborated to implement Practo’s Social Impact Plan reward program. Within this partnership, premium users of Ketto gained access to unlimited complimentary online consultations from verified physicians and specialists associated with Practo.

The Way Ahead

The new way to raise money has arrived! In recent years, the crowdfunding industry has experienced exponential growth, attracting millions of investors worldwide. The future of crowdfunding looks promising, with new technologies and platforms emerging to support a wider range of projects and causes. The developments are expanding the possibilities of crowdfunding, opening up new opportunities and boosting the economy.

As sustainability gains prominence, crowdfunding platforms may witness a rise in projects emphasizing environmental, social, and governance (ESG) criteria. To enhance user engagement, crowdfunding platforms may incorporate gamification elements, such as badges, rewards, and interactive challenges, encouraging backers to participate actively.

References

- Yellow (2023) How Much Does it Cost to Create a Crowdfunding Platform? https://yellow.systems/blog/crowdfunding-platform-development-cost

- Merehead (2023) How Much Does It Cost to Start a Crowdfunding Website? https://merehead.com/blog/how-much-does-it-cost-to-start-a-crowdfunding-website/

- Investopedia Economies of Scale: What Are They and How Are They Used? https://www.investopedia.com/terms/e/economiesofscale.asp

- Thriday Crowdfunding revenue model https://www.thriday.com.au/glossary/crowdfunding-revenue-model#:~:text=Crowdfunding%20Revenue%20Model%2C%20raising%20capital,investors%2C%20typically%20via%20the%20Internet.&text=The%20Crowdfunding%20Revenue%20Model%20is,raise%20funds%20for%20their%20ventures

- White Label Crowdfunding Software (2023) The Future of Crowdfunding Regulation: Trends and Predictions, LinkedIn. https://www.linkedin.com/pulse/future-crowdfunding-regulation-trends-predictions-fundraisingscript/

- Script, F. (2023) What’s the future of crowdfunding software?, Crowdfunding software https://www.fundraisingscript.com/blog/whats-the-future-of-crowdfunding-software/#:~:text=Crowdfunding%20platforms%20may%20become%20more,a%20broader%20range%20of%20backers

- Bloomberg The future of crowdfunding Bloomberg Live https://www.bloomberglive.com/the-future-of-crowdfunding/

- Supekar, D. (2023) Simplifying the future of crowdfunding in India, Ketto. https://www.ketto.org/blog/future-of-crowdfunding-in-india