Overview

China’s Evergrande Group is the country’s second-largest property developer by sales. Evergrande borrowed more than $300 billion to expand quickly and become one of China’s largest enterprises. Economists warned China’s financial regulators years ago about the risk posed by rising debt levels. Authorities have stepped in to prevent the real estate enterprises from over-borrowing. Adding to the woes, the coronavirus outbreak wreaked havoc on the real estate market, and Evergrande’s problems only got worse from there. Regulatory agencies increased their efforts as total borrowing in the country climbed to around 300% of GDP in 2020, up from 270% in 2018.

As per reports, Evergrande reported total bank and other borrowings of 693.4 billion yuan ($108.7 billion) in 2020, down from 782.3 billion yuan ($122.6 billion) in 2019. Borrowings from trust organizations accounted for the majority of the total debt.

PBOC’s response

The PBOC is attempting to find a balance between stimulating the economy and avoiding asset bubbles with its cash infusions. The People’s Bank of China has yet to cut money market rates with its operations. The seven-day repo rate, which measures interbank borrowing rates, increased 12 basis points to 2.39% in September, its highest level since July.

Through 7-day and 14-day reverse repurchase agreements, the People’s Bank of China has already pumped 90 billion Yuan ($14 billion) in cash into the market on a net basis. The PBOC is expected to inject more money into the economy, according to reports. The response comes as Evergrande’s financial turmoil raises concerns about the country’s real estate and credit sector. A seasonal rise in demand for cash adds to the anxiety, as banks become less eager to lend around quarter-end as they prepare for regulatory checks.

In the central bank’s initial formal comments on the world’s most indebted developer since it defaulted on its international bond payments in September, a People’s Bank of China official said the spillover of the crisis at Evergrande on the financial system was “controllable.” The producer price index will remain high for a few months before declining by the end of 2021, as per the PBOC Governor’s remark in early October, while the consumer price index would continue to rise at a moderate pace.

Impact on Businesses and Supply Chain

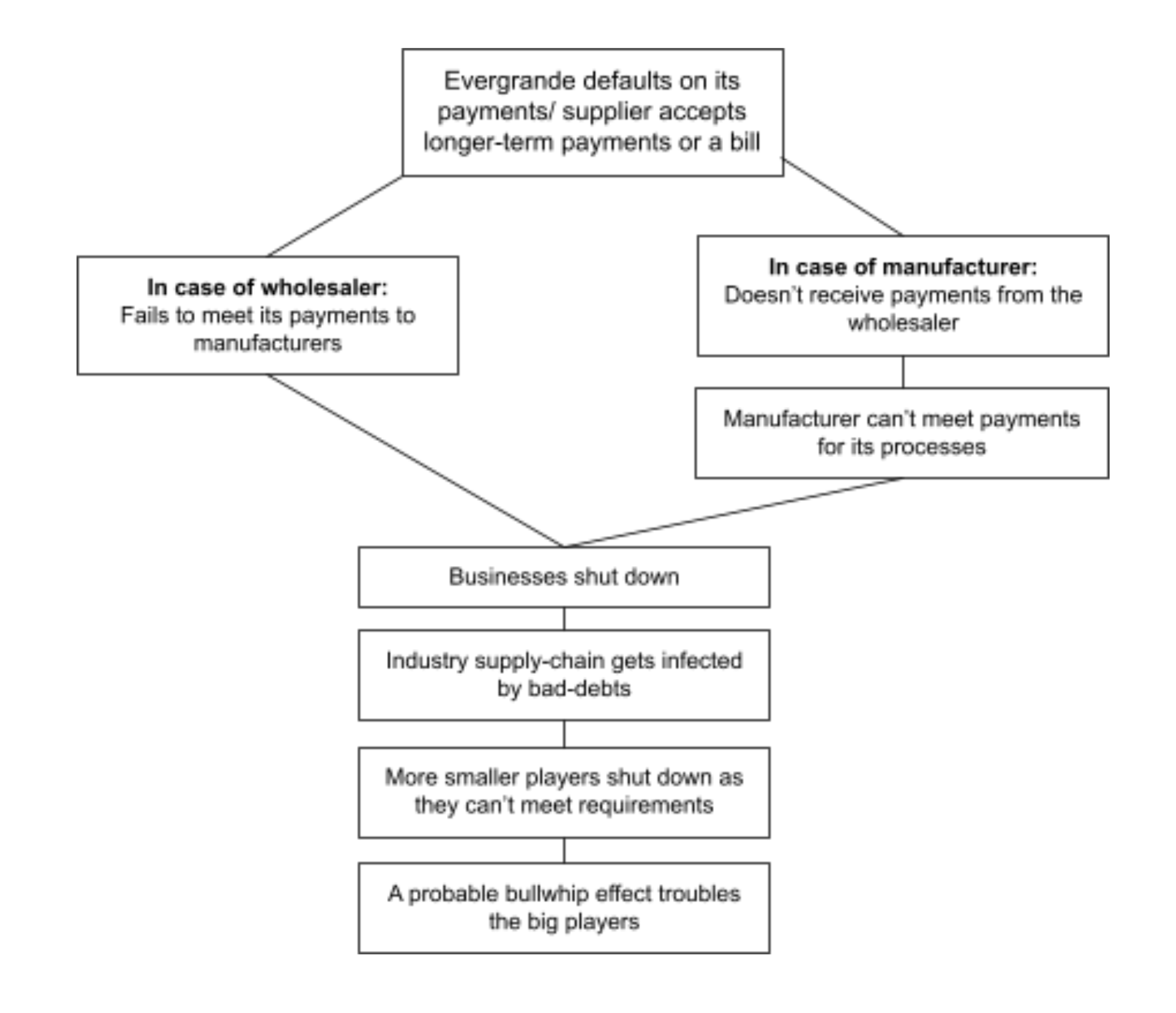

While Evergrande owes ~$37.5 billion of its current liabilities to financial institutions, with limited per-bank exposure, the rest, that is about $182 billion, of what it owes is of paramount importance to the Chinese Real Estate Industry. The majority of the liabilities are owed to suppliers. That constitutes a range of suppliers from small and medium to large ones. However, most of them are small and medium enterprises whose business depends largely on orders placed by large enterprises like Evergrande. For every enterprise that depended considerably on Evergrande, a chain similar to the following will work its way up to potentially crack the business:

The crests and troughs of the whip travel through Evergrande to its suppliers and from the suppliers to other players in the market due to a possible shortage of useful raw materials for the business. It was due to similar reasons that Ford Motors had to lobby the US bureaucrats to bail out General Motors and Chrysler, proving that this is not sheltered and focused damage, it is an infection that can spread. Some useful raw materials that are needed in construction are bricks, steel, sand, wood, etc. A far yet probable stretch is the collapse of major suppliers that have a global presence, which might lead to damage at a global level. If money is the blood that flows through businesses, giant tumors like Evergrande have the capacity to make the whole system collapse. Just like medical intervention though, central banks and the government can meaningfully intervene to save the day (and probably the livelihood of thousands).

Impact on Stock markets

Fears that the struggling Chinese real estate company might fail, promoting a wave of defaults in the inflated property market and causing a financial contagion in the world’s second-largest economy, drove down global stocks early in September. In mid-September, New World Development (NDVLY) and Chinese Estates Holdings, two Hong Kong developers well known as Evergrande’s long-time allies who frequently supported the business by buying its bonds or parts of its stakes, plummeted 12.3% and 8.5%, respectively. Country Garden, another Chinese property developer, has lost more than 6% of its value.

Stocks of Chinese banks and insurance businesses were among those hit by the sell-off. Ping, an Insurance company, the country’s largest insurer and one of the country’s leading property investors, fell over 6% to its lowest level in September 2021. Ping asserted that the company has “zero exposure” to Evergrande and that the dangers to its other property holdings are “controllable,” according to Chinese state media. However, In early October 2021, the Hong Kong stock market closed down with selling driven by concerns over China’s financial system after the suspension of trading of ailing Evergrande Group. The benchmark Hang Seng Index fell 2.19% or 539.27 points to 24,036.37 at the closing to 8,521.19. The Hang Seng China Enterprises Index lost 2.35% or 205.19 points.

Impact of Evergrande crisis on India

When it comes to the impact of the entire crisis on India, two sides are forming. One side emphasises the negative consequences and the other the positive implications.

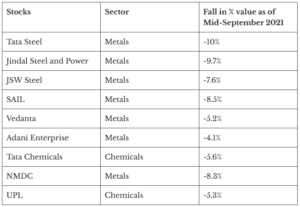

If China experiences an economic slowdown and the Yuan depreciates, India’s exports will face stiff competition from Chinese firms. Several leading Indian steel, mining, and chemical businesses, including some of the index’s best-performing stocks including Tata Steel, Jindal Steel, SAIL, JSW Steel, Tata Chemicals, NMDC, and DCW, have had their stock prices fall by 10-15%.

Source: Business Insider

Metal companies, which had been among the top gainers during the post-pandemic stock market boom, have suddenly reversed their fortunes. As of September 2021, The BSE Metal index has gained nearly 234% from March 2020, compared to 98.5% for the Sensex, and the sell-off in metal equities left investors with a ₹57,000 crore ($7.67 billion) hole in their pockets. The BSE Metal index’s ten stocks had a total market capitalization of ₹8,85,000 crore ($119.04 billion), down from Rs 9,42,000 crore ($126.71 billion) the day before.

However, in the long run, India will benefit from Evergrande’s demise. Multiple events, such as the Trump-Xi trade war and the Coronavirus outbreak, have led global firms to explore alternatives to China, such as Apple’s plans to build a factory in Tamil Nadu. The impact of such exploration may be distributed among developing nations as after witnessing China’s crunch worldwide and experiencing major disruption, putting all eggs in one good basket may not seem good enough. They are simultaneously looking for alternate investment options in emerging economies like Vietnam, Indonesia, and other middle eastern countries to minimize the risk of supply chain disruption. They might not want to rely solely on India, but being one of the most popular global manufacturing hubs in the world has its advantages.

Sources

- Hong Kong stock exchange suspends trades of debt-ridden Evergrande. (2021, October 4)France24.https://www.france24.com/en/asia-pacific/20211004-hong-kong-stock-exchange-suspends-trades-of-debt-ridden-evergrande

- China’s central bank says spillover from evergrande crisis ‘Controllable. (2021, October). Ft.Com. https://www.ft.com/content/3d797dac-85f4-409d-b1e9-6e8ffb9fcc78

- Makwana, B. (2021, September 21). The collapse of Evergrande, one of China’s largest home developers, is “not a Lehman moment” but the fear may haunt steel and metal stocks in India. Businessinsider.In.https://www.businessinsider.in/stock-market/news/collapse-of-evergrande-may-haunt-tata-steel-jspl-nalco-and-other-metal-stocks/articleshow/86387294.cms

- Chen, T. (2021, September 17). PBOC Injects $13.9 Billion as Evergrande Debt Woes Roil Market. Bnnbloomberg.Cahttps://www.bnnbloomberg.ca/pboc-injects-13-9-billion-as-evergrande-debt-woes-roil-market-1.1653448

- Hong Kong Market falls on Evergrande concerns. (2021, October 4). Business-Standard.Com. https://www.business-standard.com/article/news-cm/hong-kong-market-falls-on-evergrande-concerns-121100401207_1.html

- Live Mint. (2021, November 1). How an Evergrande collapse could cascade through china. Livemint.Com.https://www.livemint.com/opinion/columns/how-an-evergrande-collapse-could-cascade-through-china-11635785166937.html

- BBC. (2021, December 9). Evergrande: China property giant misses debt deadline. Bbc.Com. https://www.bbc.com/news/business-58579833

- China Evergrande Group Interim Report 2021. (2021). China Evergrande Group. https://doc.irasia.com/listco/hk/evergrande/interim/2021/intrep.pdf

- www.evergrande.com.(2021).ChinaEvergrande Group Annual Report 2020. https://doc.irasia.com/listco/hk/evergrande/annual/2020/ar2020.pdf