In 2021, India faced a severe energy crisis, with coal stocks falling to unprecedentedly low levels. Coal-fired plants generate 72% of the country’s electricity. Government data shows that as of 6th October 2021, 80% of India’s 135 coal-powered plants had less than 8 days of supplies left — more than half of those had stocks worth two days or fewer. This article discusses the factors that led to the power crisis, steps taken by the government in response to the power shortage and potential long-term solutions to avoid a similar situation in the future.

What led to the Crisis?

As the economy regained momentum following a devastating second wave of Covid-19, India saw a spike in power demand. India’s peak electricity demand recorded an all-time high of 200.57 giga watt (GW) on 7 July 2021. The all-India energy demand recovered 11% YoY to 124.8 billion units (BU) in July 2021, the highest demand since July 2019.

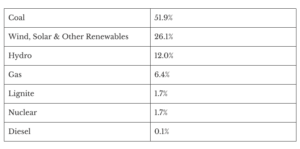

Installed capacity by source in India as of 30 September 2021 was as follows:

Coal accounts for the majority of electricity generation in India. Thermal power companies have had lean coal inventories and did not anticipate the spike in power demand this year. Coal India Ltd.’s (accounts for over 80% of India’s coal output), monthly production dropped to a record low as the heaviest rains in 25 years flooded mines and hindered shipments. It produced 30.77 million tons of coal in September, down 24% from a year earlier and the lowest in data back to 2013. Shipments dropped 20% to 35.18 million tons, the lowest in five years. Other sources of electricity generation — such as hydropower, gas and nuclear — also declined. An unevenly distributed monsoon season was also one of the factors as less rainfall in some areas adversely affected the production of hydropower. Some other factors included a sharp increase in gas prices as well as maintenance shutdowns at nuclear power plants. All of that led to a further increase in coal-fired power generation.

Logistical issues due to the monsoon season also constrained coal supply, despite there being enough pithead stocks available at Coal India (a pithead refers to the top of a mineshaft where most of the mined coal is kept before being transported to power companies). Rainy season typically makes that transportation more difficult as many routes tend to flood. Further, a widening gap between soaring international coal prices and domestic coal prices saw imports decline sharply in recent months.

Coal imports by power plants fell 45% in July and August 2021 compared to the same period in the previous year while India’s non-power sectors grew more dependent on domestic coal. Non-power industries such as aluminum, steel, cement and paper typically burn large quantities of coal to produce heat. The decline in electricity generation by coastal power plants, which rely on imported coal, added more pressure on domestic coal-based power plants to ramp up output. Even then, coal imports were hamstrung by supply disruptions due to the pandemic and logistics issues. For example, transportation costs are rising due to a higher demand for shipping and congestion at ports as the world economy slowly recovers from the pandemic. India’s domestic coal is also of a lower heating value — which means more of it is needed to substitute imported coal, thus adding further pressure on domestic power plants.

Hence, with demand for power unexpectedly rising and sources of supply of power falling, India experienced this power crunch.

Situation in Other Countries

As India is opening its economy, so is the case with other countries. There has been an extensive increase in demand as they come out of lockdown. Countries in Europe have seen their natural gas prices increasing multifold to 400-500% on YoY (see graph below). Due to reduced levels of gas reserves EU has been heavily reliant on Russia for imports. Russia has been the biggest exporter of gas making 43.4% of total imports of Europe. There has been a substantial decline in exports of Russia too. Extreme weather events, supply chain disruptions and rising prices of coal have put a lot of pressure on the gas prices making the Brent crude prices reach a 5 year high.

Source: tradingeconomics.com

China too faced the worst power crisis in years due to coal shortage. 70% of its energy production is met by coal. Since mid-August 2021, 20 provinces across the country reported power cuts, reduced production hours and severe blackouts. The country’s economy heavily relies on goods exported by its industrial sector. As economies around the world rebound themselves, demand for Chinese products has surged. China’s focus on low-end products, like cheap electronics, is a particularly power-hungry endeavour. China is the world’s top consumer of coal and is also the world’s biggest producer of greenhouse gases. It has recently made reducing the country’s carbon emissions a top priority, with the aim of reaching carbon neutrality by 2060. This led to the country curbing domestic coal production. So, coal prices skyrocketed, accompanied by a proportionate increase in electricity price. Unlike other countries where consumers are worried about high billing costs, utilities’ prices in China are largely regulated by the government. This keeps power companies from passing on the cost to consumers and suppliers alone have to bear the high cost of coal. To cope, many companies have decided to scale back production, curbing the country’s supply of energy.

The Present Scenario

The demand-supply imbalance in the energy market required efforts by the government to augment energy supplies. A short-term solution to India’s energy crunch was to accelerate the supply of coal to power plants having very few days of inventory left. Further, prices of other fossil fuels could be lowered to ease the situation a bit. This would lower the inflationary pressure as well. To tackle the crisis, the Indian government allowed thermal power generators to import coal for up to 10% blending with domestic coal, to soften the high coal price. The Union Ministry of Power ordered the states to use the unallocated power provided to them to supply electricity to the consumers of the state. In case of surplus power, it had to be reallocated to other states in need of it.

Source: International Energy Agency

The long-term solution is to invest in logistics and supply chains to avoid supply-chain failures. Secondly, there is a need for a policy focusing on the mix of coal and clean energy sources. The International Energy Agency, in its report titled “India Energy Outlook 2021” projected under the Stated Policies Scenario that by 2040, solar power can account for 30% of the power generation in India (currently it is 4%). This dramatic turnaround is driven by India’s target to reach 450 GW of renewable capacity by 2030, and the extraordinary cost-competitiveness of solar power. If we achieve this, not only will we be able to reduce our dependence on coal (72%) and reduce power crunches like this but also lower emissions substantially. Extraordinary efforts, innovative vision and viable solutions need to be implemented to tackle the increasing demand for energy while maintaining an eco-friendly approach.

Sources

- Iea, I. E. A. (2021). India Energy Outlook 2021 – analysis. IEA. https://www.iea.org/reports/india-energy-outlook-2021

- Ministry of Power. (2021). Policies and publications. Ministry of Power. https://powermin.gov.in/en/content/power-sector-glance-all-india

- Coal2022 data – 2008-2021 historical – 2023 forecast – price – quote – chart. Coal – 2022 Data – 2008-2021 Historical – 2023 Forecast – Price – Quote – Chart. (2021). https://tradingeconomics.com/commodity/coal

- Matthews, C., Eaton, C., & Faucon, B. (2021, October 17). Behind the Energy Crisis: Fossil Fuel Investment Drops, and Renewables Aren’t Ready. The Wall Street Journal. https://www.wsj.com/articles/energy-crisis-fossil-fuel-investment-renewables-gas-oil-prices-coal-wind-solar-hydro-power-grid-11634497531

- Jai, S. (2021, October 13). Power Ministry asks thermal units to import coal for minimum 10% blending. Business Standard. https://www.business-standard.com/article/economy-policy/power-ministry-asks-thermal-units-to-import-coal-for-minimum-10-blending-121101201226_1.html

- Das, B. (2021, November 8). Energy crisis: Expensive, unreliable source of electricity, coal in spotlight. Down To Earth. https://www.downtoearth.org.in/blog/renewable-energy/energy-crisis-expensive-unreliable-source-of-electricity-coal-in-spotlight-80087

- Mint. (2014, June 14). Govt may privatise mining, sale of coal. https://www.livemint.com/Industry/ZFxoKziRwMg8rGxc9kfCHO/Govt-may-privatize-mining-sale-of-coal.html