In today’s world, the skyrocketing prices of crude oil have sent shockwaves across various industries, affecting almost everyone. But there’s one industry that feels the pain immediately and intensely – the paint and polymer sector. This industry relies heavily on crude oil as a vital ingredient, and when oil prices go up, it directly hits their costs.

Let’s break down how this works.

Crude oil is like the building block for many chemicals needed to make paints and polymers. So, when crude oil prices shoot up, the prices of these important raw materials go up too.

This has significant consequences for both businesses and consumers.

First, it puts pressure on the profits of paint and polymer makers. They’re left with a tough choice: either they absorb the higher costs, which cuts into their profits, or they raise the prices of their products, passing the burden on to consumers.

But there’s more to the story.

The expensive oil also disrupts the supply chain for these raw materials. Many of them come from oil-based sources, and when oil is costly, it’s less profitable to make them. This leads to shortages, which in turn, drives prices up even more.

For regular folks, this means they have to shell out more money for paints and polymers, which are used in everything from building houses to making everyday products. So, this isn’t just a problem for the industry; it can affect the whole economy by making things more expensive and potentially slowing down economic growth.

To sum it up, the connection between crude oil prices and the paint and polymer industry is like a tangled web of challenges. As crude oil prices keep going up, it causes a domino effect – it hurts the manufacturers, who then raise prices, and this ultimately affects consumers.

Crude Oil Prices Soar: Unpacking the Forces behind the Surge in 2023

In the realm of global economics, few metrics have as far-reaching implications as the price of crude oil. 2023 has witnessed a remarkable surge in these prices, sending shockwaves through various industries and impacting consumers worldwide. This meteoric rise in crude oil prices can be attributed to a confluence of influential factors, each playing a pivotal role in shaping the dynamics of the energy market. In this comprehensive analysis, we delve deep into the driving forces behind this surge and explore the intricacies of this complex situation.

OPEC+ Supply Tightening: A Calculated Move

One of the most significant contributors to the surge in crude oil prices in 2023 is the deliberate reduction in supply orchestrated by the OPEC+ alliance. This alliance, led by key players like Russia and Saudi Arabia, has taken substantial measures to curtail oil production. Russia, in particular, initiated this move by slashing its oil exports by 300,000 barrels per day in September. This action came on the heels of a prior reduction of 500,000 barrels per day in August.

Simultaneously, Saudi Arabia, another heavyweight in the oil industry, announced its intention to further cut exports by a staggering 1 million barrels per day in October. These actions have generated a sense of anticipation in the market, propelling oil prices upward. What’s crucial to note is that these countries have exhibited no signs of reversing their decision to reduce supply, thereby applying sustained pressure on rising prices.

Impact of China’s Economic Resurgence

China’s economic indicators have introduced an additional layer of complexity into the situation. The unexpected positive growth in China’s manufacturing sector, as revealed by Caixin’s manufacturing PMI survey for August 2023, has injected optimism into the market. This surprising expansion hints at a brighter economic outlook for the world’s largest oil importer, fueling hopes of sustained oil demand.

Across the Pacific, the United States has also played a significant role in the surge of oil prices. Robust economic data, including the creation of 187,000 jobs in the nonfarm sector in September, surpassing expectations, has boosted confidence. Historically, strong economic performance in the U.S. has correlated with increased oil demand. However, this heightened demand coincides with reduced supply, exacerbating inflationary pressures on oil prices.

Other Contributing Factors

Beyond the influence of OPEC+ and economic data, several other noteworthy factors are at play in the surge of crude oil prices in 2023.

Geopolitical Tensions

Geopolitical tensions have been unsettling global markets, leading to supply disruptions and increased price volatility. Sanctions imposed on major oil-producing nations, including Russia and Iran, have further constricted the global oil supply. These political manoeuvres have had a cascading effect on oil prices, pushing them to new heights.

Speculative Trading Activities

The commodities market has witnessed a surge in speculative activities, driven by investors seeking refuge amid economic uncertainties. This influx of speculative capital has added considerable momentum to the oil price rally. As traders and investors look for safe havens, commodities like crude oil have become an attractive option, further fueling the surge.

To measure the impact more practically, let’s draw up two companies operating in these sectors – Asian Paints in the paint industry and Polyplex in the polymer and films industry. Both these companies have heavy dependence on imported crude and thus measuring the impact of previous years when crude oil prices skyrocketed, we get an idea of what is coming for them.

Impact on Balance Sheet and P&L of Asian Paints

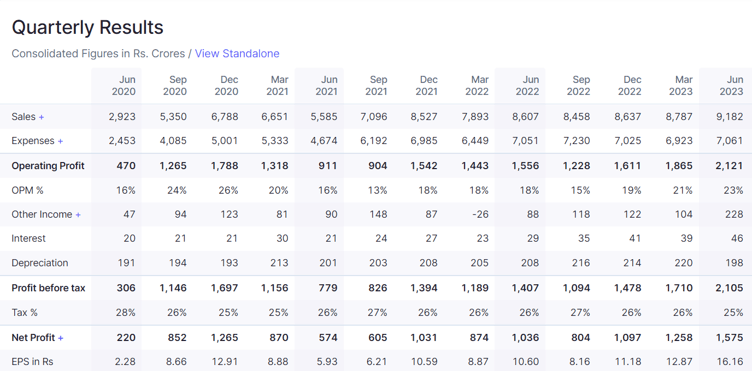

We’ll take a look at a comparison of performance of Asian Paints across quarters.

The thing to note here is that the Russia-Ukraine war started in the last quarter of FY22 in February and then soon after, the crude oil price shot up. Therefore the impact was in the second quarter of FY23. The numbers are staggering, take a look.

In the September quarter, there was a decrease in sales compounded by the increase in operating expenses thereby reducing the operating profit from 1556 Cr to 1228 Cr and the Operating profit margin from 18% to 15% within a quarter!

However, the prices stabilised and decreased after that and 19% OPM could be reached.

Impact on Balance Sheet and P&L of Polyplex

The Polymer Industry has also suffered due to the unstable demand and supply of oil and have been less profitable businesses than they were 2 years ago, the growth in the industry has slowed down slightly only in the short term. There are several companies with medium sized balance sheets out of which Polyplex stands out.

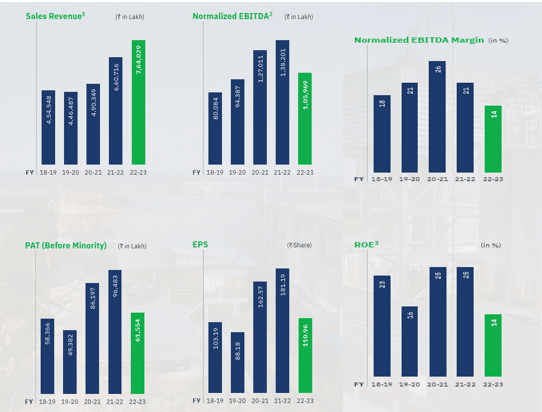

The above is the financial performance of Polyplex Limited in the previous financial years compared to this financial year.

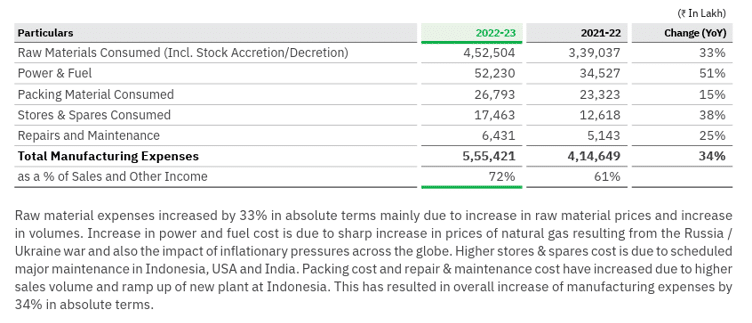

Noticeably the sales have increased due to the shutdown China has been facing, the supply chain is intact, however the input cost has become very high for the requirement of Crude Oil and its derivatives.

PAT has almost decreased by 37% which is not a small number for a small cap company while ROE has seen a significant decline only due to earnings change, the capital structure remaining the same.

In the company’s annual report, the management has highlighted the fact that due to high input costs of raw materials and fuel costs (in Europe), the P&L has been affected by about 30%. The fluctuation in the forex market has also been a concern since the company also has operations outside a country, they have had to book net loss on the currency exchange.

Possible Alternative Solutions

There are a number of alternative solutions that could be used to tackle the problem of rising oil prices in the paint and polymer industry. If the prices do not ease in the near term then that could further poke a hole in the consumers’ pockets as in the long term they would bear the cost.

One solution is to use smart coatings.

Smart coatings are a type of paint that is designed to be more efficient and effective than traditional paints. They can be used to reduce the amount of energy used in buildings, and they can also be used to protect surfaces from damage. Smart coatings are made from a variety of materials, including water, minerals, and polymers. They do not use oil-based raw materials, which makes them a more sustainable option.

Another solution is to use recycled materials. Recycled materials can be used to produce paints and polymers that are just as effective as those made from virgin materials. This can help to reduce the demand for oil, and it can also help to reduce the amount of waste that is produced.

Finally, it is also possible to develop new technologies that can produce paints and polymers without using oil. This is a long-term solution, but it is one that has the potential to make a significant impact on the paint and polymer industry.

In conclusion, the surge in crude oil prices in 2023 is not a result of isolated incidents but rather a complex outcome of various intertwined factors. The concerted efforts of OPEC+ to limit supply, surprising economic data from China and the United States, geopolitical tensions, sanctions, and speculative trading activities all contribute to the mounting costs of oil.

As businesses and consumers grapple with the economic implications of rising oil prices in 2023, it becomes increasingly important to closely monitor these dynamics and develop strategic responses to navigate this challenging terrain. Understanding the multifaceted nature of these forces is key to making informed decisions in a volatile energy market!