INTRODUCTION

Climate change is turning into a significant risk to the economy, as extreme weather patterns are increasingly affecting global supply chains. Rising temperatures, hurricanes, floods, and wildfires threaten the infrastructure of every business, thereby delaying production and driving up operational costs. The monetary impact of such disruptions goes beyond immediate damages, altering trade flows, commodity prices, and market stability.

With the increase in the interconnection between supply chains, a local weather event can have cascading global effects, which may lead to shortages, increased costs, and reduced profitability. The quantification of such risks is important for businesses and investors as well as policymakers in framing their resilience strategies to ensure economic stability and mitigate losses going forward.

CAUSES OF CLIMATE CHANGE

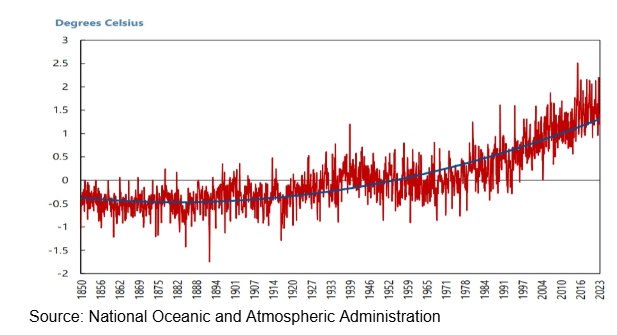

Climate change is caused by the buildup of greenhouse gases, primarily CO₂, CH₄, and N₂O, in the atmosphere. From the 19th century, researchers have known about the world’s consequences as a result of these gases, but since the previous century, their effects have become more imperative as a result of heightened emissions that escalated climate-related disturbances to be more recurrent and intense. Scientific consensus holds that current global warming trends are caused by human activities like the burning of fossil fuels, deforestation, and industrial emissions. Other factors include intensive agriculture, which emits significant levels of methane and nitrous oxide, and land-use changes that decrease the world’s ability to sequester carbon. Urbanization at a fast pace, along with increased production of energy-intensive industries, has accelerated the heat island effect and electricity demand from non-renewable sources. Additionally, the production and consumption of high-impact resources like coal and petroleum emit pollutants, which not only trap heat but also lower air quality. Feedback loops—such as melting polar ice reducing the Earth’s albedo and thawing permafrost releasing methane—accelerate warming, making climate change a self-reinforcing process unless urgent mitigation measures are implemented.

VULNERABILITY OF SUPPLY CHAINS TO EXTREME WEATHER

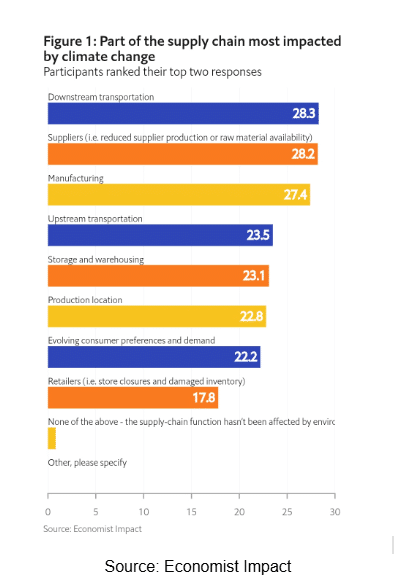

Most supply chains are designed for efficiency, with little buffers and low inventories. These are exposed to climate risks. In the semiconductor and heavy rare earth markets, for example, disruptions from intense weather events are expected to grow. Heavy rainfall, floods, droughts, hurricanes, and heatwaves can destroy strategic assets, disrupt production, and disrupt transportation, causing cascading effects on several sectors. Because many supply chains are based on geographically concentrated production centers, a single climatic disruption in one area can unleash global scarcity and price variability. In addition, recovery is long because there is limited redundancy and dependence on just-in-time delivery systems. With intensifying climate change, the likelihood of simultaneous disruptions in multiple areas rises, raising systemic risk. Firms that don’t diversify procurement, invest in climate-resilient infrastructure, and incorporate climate risk management into supply chain planning will most likely experience increasing operational, financial, and reputational costs.Historical events such as the 2011 floods in Thailand highlight the vulnerability of global supply chains to localized extreme weather. Industries with concentrated manufacturing centers are particularly susceptible, as disruptions can halt production and delay deliveries across multiple sectors. The reliance on lean inventories and just-in-time processes means that recovery from such events is often prolonged, exposing systemic risks within highly optimized supply networks.

TYPES OF SUPPLY CHAINS AT RISK: SPECIALTY VS. COMMODITY

Supply chains can be classified broadly into two categories: specialty supply chains and commodity supply chains, each carrying its own risks.

For highly specialized industries like semiconductor production, supply chains are less easily disrupted. Because these industries heavily rely on just-in-time manufacturing processes and tight supply networks in many cases, even small disruptions can have huge impacts. More standardized commodity-based supply chains are more susceptible to disruptions that often cause price rises and production schedules to be interrupted, such as in the heavy rare earth industries.

In the semiconductor industry, the probability of a major hurricane significantly affecting manufacturing in the western Pacific may double or quadruple by 2040. This could translate to hundreds of days of lost production for companies that are not adequately prepared—for example, for a hurricane disaster, those without “buffer inventories” or alternative suppliers might lose up to 35% of revenues. For heavy rare earths that are mined in south-eastern China, extreme rainfall could lead to an increase in chances of mine and road closures. For downstream industries relying on these commodities, disruptions could lead to higher prices.

INCREASING FREQUENCY OF EXTREME WEATHER EVENTS: PROJECTIONS AND IMPLICATIONS

Global temperatures are expected to increase by 1.5°C to 4.8°C at the end of the 21st century, relative to pre-industrial levels, according to the Intergovernmental Panel on Climate Change (IPCC) report. This warming trend leads to extreme weather events such as hurricanes, floods, wildfires, and protracted droughts, which threaten the global supply chains.

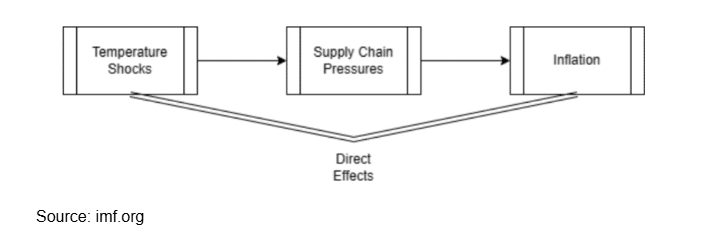

From an economic perspective, climate change is a negative externality and a global common problem. The emission of GHGs forces planetary warming and has costs that are borne by societies rather than the polluters themselves. This is a form of market failure that generates inefficiency in the economy since businesses and individuals continue to overuse the atmosphere as a dumping ground for emissions without direct financial consequences. Economic cycles influence carbon emissions, which in turn heighten climate risks to global supply chains.

ECONOMIC CONSEQUENCES OF SUPPLY CHAIN DISRUPTIONS

The economic effects of supply chain disruptions caused by extreme weather events could be numerous and extensive. Apart from the damage to infrastructure, these disruptions create conditions whereby commodities cannot be produced on time, which causes shortages of various goods, affecting the commodity prices drastically. The interconnectedness of modern supply chains means that one disruption in a single area can start “a domino effect” throughout the world, impacting everything from consumer goods to industrial production. Such interruptions add to the operational costs and erode the profit margins for any business dependent upon an unhampered supply chain.

THE DROUGHT DEBACLE (CASE STUDY)

Drought conditions have severely decreased water levels on many major waterways such as the Mississippi, Rhine, and Yangtze rivers in 2023. Water levels continue to recede within the Panama Canal, which accounts for roughly 5% of the world’s annual trade by volume, which has led to a slowdown in the flow of goods through it.

On the other hand, Slovenia suffered from severe flooding while it further disrupted manufacturing activities that created ripples in the European supply chains. Besides this, severe flooding in the Chennai area of India led to the forced shutdown of many manufacturing plants. Weather disruptions are likely to be a major source of risk in 2024. Many such interruptions will lead to long lead times, higher costs, and less output. The economic risks associated with climate change on global trade range around US$81 billion. With the economic activity linked to industry output and consumption, it raises the figure to at least US$122 billion. Such losses are exorbitant, surpassing the individual GDP of nations including Slovakia, Ecuador, or Kenya.

MITIGATING CLIMATE RISKS IN SUPPLY CHAINS: KEY STRATEGIES AND RISK MANAGEMENT APPROACHES

1)Diversify Suppliers: Don’t put all your eggs in one basket. Ensure a continuous supply of materials and products in case of extreme weather.

2)Invest in Buffer Inventories: Build buffer stocks of key raw materials and inputs to avoid short term disruptions due to extreme weather.

3)Climate resilience infrastructure: Commitment to invest in infrastructure that can withstand extreme weather and continue operations.

4)Using data analytics: This application of predictive data analysis, enabled by a new breed of sensors and software (such as efficient weather forecasting systems), anticipates potential interruptions that may cause disruptions from upcoming climatic changes for follow-up strategies to be in place and save on losses.

5)Insurance as an armour: To procure insurance that protects against damages caused by weather, different insurance products could also be bought in protection of supply chain disruptions; this would serve as a protective measure for companies.

WALMART’S APPROACH (CASE STUDY)

Walmart fulfilled its ambitious Project Gigaton goal about six years ahead of schedule by mobilizing over 100,000 suppliers worldwide to adopt sustainable practices and cut 1 gigaton of emissions from its supply chain. This milestone was equal to annual emissions from Japan and was reached by identifying emission “hotspots,” as well as optimizing fertilizer use across millions of U.S. farm acres. This project was supported by partnerships with EDF and WWF. These efforts helped suppliers scale energy efficiency and invest in climate-smart agriculture by partnering up with Schneider Electric and HSBC. Supply chains account for 90% of corporate carbon footprints, which makes Walmart’s initiative an economic imperative for climate action. Unstable weather events threaten supply chain efficiency, posing an estimated $178 trillion risk to the global economy by 2070. On the other hand, proactive climate strategies could boost the economy by $43 trillion.

CONCLUSION

With increasing severity of climate change, supply chains become highly susceptible to extreme weather events. There is a need for resilience in order to protect against economic fallout, rising operational costs, and changes in commodity prices and global trade flows. Management of companies should pay attention to supply diversification, preservation of buffer stocks, development of the infrastructure able to withstand a climate impact, and application of effective data analytics in order to minimize any interruptions. Insurance can also provide protection against weather-related losses. Besides this, governments are required to develop policies promoting sustainable behaviour and facilitating adaptation measures. Through the application of these strategies, we will be able to build the resilience and durability of a world supply chain to climate threats, thereby providing long-term economic stability and growth.

References:

- Environmental Defense Fund. 2021. “Walmart’s Project Gigaton Win Shows How to Cut Emissions with Speed and Scale.” EDF Business Insights.https://business.edf.org/insights/walmart-project-gigaton-win-shows-how-to-cut-emissions-with-speed-scale/

- The Economist Impact. 2023. “Climate Change’s Disruptive Impact on Global Supply Chains and the Urgent Call for Resilience.” Trade in Transition. https://impact.economist.com/projects/trade-in-transition/climate_change/.

- Global Development And Environment Institute. n.d. “Global Development And Environment Institute.” Tufts University. http://ase.tufts.edu/gdae.

- McKinsey & Company. 2022. “Climate Risk and Response: Physical Hazards and Socioeconomic Impacts.” https://www.mckinsey.com/capabilities/sustainability/our-insights/climate-risk-and-response-physical-hazards-and-socioeconomic-impacts.

Recent Comments