Abstract

In today’s world of technological advancement, while the whole world is talking about the “ease through the internet” we are expected to be digitally connected, Currency can not be left behind. Paper forex is certainly an aspect of the past, as digital currencies gain traction: Bitcoin today is poised and polished to reap this feat. Not only it will revolutionize how payments are made, it additionally can impact the aspirations of global currencies like the USD, which is already facing significant threats from EURO or the Chinese Yuan Renminbi (CNY) in the race to the throne for currency hegemony and is substantially affecting the status of the US dollar’s hegemony.

Bitcoin has the potential to impact the aspirations of global currencies like the USD, which is already facing significant threats from EURO or the Chinese Yuan Renminbi (CNY) in the race to the throne for currency hegemony and is substantially affecting the status of the US dollar’s hegemony.

In this report, we aim to analyze the growth trajectory of digital currency and if this growth is favorable or not. The current article has tried to portray how this currency is taking over everything and if it’s in a positive direction.

On one hand, the currency leads to the accumulation of wealth in the economy, while on the other hand, it has to be a people’s economy where they are free from barriers of the government and can function according to their own free will.

The environment will have to face the brunt of the escalating demand for digital currency, which has a bleak future for individual consumers of this currency. The fact that this currency is not under any regulation makes it susceptible to fraudulent activities like terrorism, theft, etc. and has the potential to damage the social environment at the global level. The data relating to Bitcoins has been scrutinized using the regression model and an analysis of the same is given in the following report which aims to provide extensive analysis on how the currency can define the future of global finance.

Bitcoin’s Impact on Global Economy

Bitcoin is a widely known cryptocurrency “going for walks over communities” without direct interference of any authoritative frame or monetary group; this involves a direct transaction between one party to another, without any interference from any intermediaries. It is likewise referred to as “coins going for walks over the internet”. The pseudo founding father of bitcoin “Satoshi Nakamoto” brought to life this idea of digital forex that is gaining widespread popularity. As a matter of fact, it can be observed that over the last few years, Bitcoins have gained palpable significance spherically in the sector. This currency evolved over the concept of retaining crypt evidence to facilitate direct transactions among parties, eliminating the need to trust any financial intermediary. Moreover, these financial establishments are commonly commercial banks.

It’s common knowledge that the international financial system inordinately relies on the US Dollar which is held as reserve forex by Economies all across the world. So any ups and downs in the US market have an immediate effect on the sector financial system, the 2008 financial crisis is an example of this. The conventional ideas of US dollar hegemony and all currency being regulated are being rebutted by the introduction of such up-and-coming currencies, and the escalating acceptance of Bitcoin verifies this fact.

Bitcoin’s Impact on Governments

Governments of many nations are dismissing the very idea of cryptocurrency or Bitcoins for their state’s financial system, whilst a few are on the brink of being given this worldwide monetary challenge. Every dismissal or acceptance by International Economies is accompanied by a set of legitimate reasons like: Bitcoins are more secure because it’s virtual, and much more stable because of excessive encryption whilst going for walks over the community and direct transaction amongst peers. But because it isn’t centralized or regulated, it isn’t secure enough to go with the drift of cash. The absence of any regulatory authority makes it susceptible to threats and fraudulent activities. Money laundering and the use of cryptocurrency in crime can also affect the safety of a state. These are a few reasons why economies are disparaging and dismissing the use of cryptocurrencies.

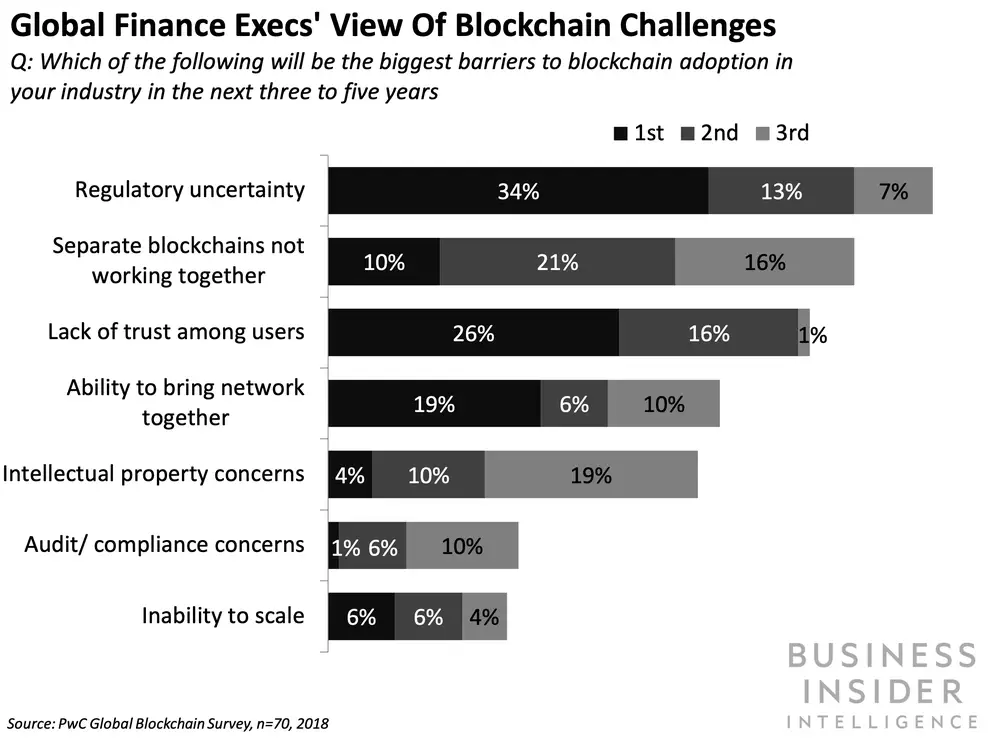

Fig. 1, Source: Global Blockchain Survey, n=70, 201

Bitcoin’s Impact on Banks

Banks are one of the first monetary establishments that took a serious blow from the emergence of cryptocurrency, specifically Bitcoin. Banks are gambling their crucial and foremost function of dealing with cash and its credibility. But with the arrival of Bitcoin, banks can forget about regulating cash flows in the economy. Moreover, Bitcoin is technically secure in terms of the safety of transactions and identity, which is not the case with traditional financial institutions. Banks all over the world are no longer playing a waiting game, but are in the game and ready to explore the various facilities this currency has to offer.

The Case of England

The Bank of England is set to introduce regulations. Bitcoin, in England, has already outperformed the smaller card network Discover, and the online payments pioneer Paypal, in online transactions volume. Overtaking the most successful payment network of the internet era is quite a milestone.

Fig. 2, Source: Bank of England

Bitcoin’s Impact on Stock Markets

It is an undeniable fact that Bitcoin has taken over the markets by storm, this is a remarkable feat considering the new and unfamiliar technology behind it. Also, it has proven its presence over the sector inventory exchanges with excessive price profits many times. International economies like China have banned Bitcoin due to its excessively unstable nature. According to reports, the stock market could crash if the demand for this cryptocurrency surged to great heights.

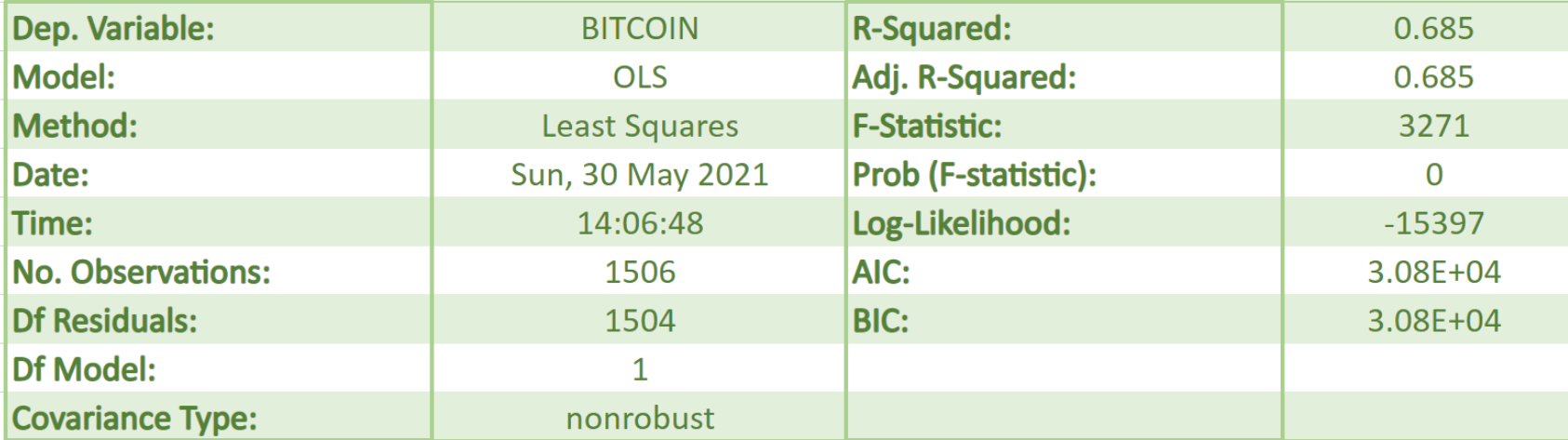

REGRESSION MODEL

Notes:

-

Standard Errors assume that the covariance matrix of the errors is correctly specified.

-

The condition number is large, 1.39e+04. This might indicate that there are strong multicollinearity or other numerical problems.

Key Observations:

-

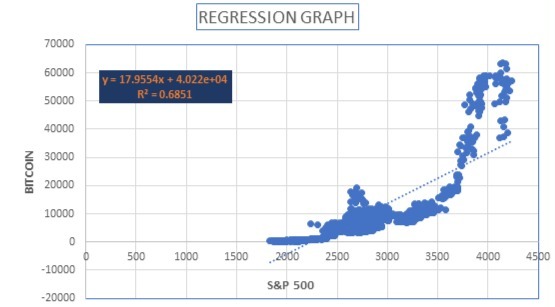

R-Squared shows that 68.5% of variance in Bitcoin is attributable to S&P 500

-

P-value: A predictor that has a low p-value is likely to be a meaningful addition to a model so a p-value of 0.000 shows that the predictor variable of Bitcoin is significant.

-

The coefficient indicates that for every additional dollar in the S & P 500 you can expect Bitcoin to increase by an average of 17.9554 dollars.

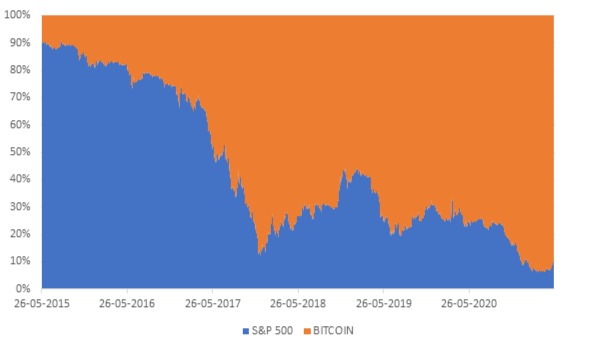

The above graph normalizes the total dollar value of S&P 500 and Bitcoin to 100 and shows their respective percentage share in each year.

Fig. 4, Source: Digital Assets Data

Bitcoins and the disappearance of the traditional Banking System

-

Cryptocurrency poses a significant threat to traditional and standard banks if they don’t keep up with the new and evolving consumer behavior and investment opportunities. Bitcoin users can manage their daily expenses and bills themselves, without the interference of any intermediary and avoiding incurring any costs levied by financial institutions. Similarly, the savings associated with using wallets and apps such as PayPal deprives banks of precious revenue, since these transactions take place out of the banking ecosystem.

-

And what are conventional banks doing to counter this threat? Massive banks are trying to hop on the bandwagon and want to end up digitized and provide comparable real-time offerings to what Crypto Consumers are being offered.

-

Conventional banks have frequently been responsible for purchaser-unfriendly account manipulations, which include making use of debits earlier than credit then charging prices for inadequate funds. In a virtual age, clients can simply see this going on through glancing at their cell phones – such banks won’t be able to get away with such malpractices for a long period.

-

Traditional banks want to up their sport in regions that include purchaser service, virtual services, and prices charged. If they’re now no longer considering virtual answers past the usual cell banking app, they run the threat of being left at the backend.

-

As a matter of fact, the roles banks “should” play encompasses processing bills, presenting escrow offerings, facilitating worldwide coins transactions, assisting clients in trading their cash for Bitcoins, or even making loans withinside the currency.

-

While there are questions on the volatility of virtual currencies and their capability to run afoul of economic regulations, their growing reputation indicates a shift going on in patron options. Traditional banks want to be on board with virtual and providing the instant, cell offerings that many find stressful.

-

Does conventional banking face a threat from cryptocurrency? Yes and no. Most mammoth banks at the moment are acknowledging that the era of cryptocurrencies ought to be handled as the subsequent massive thing, possibly just like the invention of the motorized vehicle to the railroad.

-

But at the same time, virtual currencies have downsides like perceived volatility and a few uncertainties around whether or not regulators will want to step in.

However, banks don’t need to handle this the way the early Twentieth Century folks did by failing to recognize the motorized vehicle as a hazard, it might be clever to take note of patron options now. Getting on board with virtual traits might also additionally assist in mitigating the cryptocurrency hazard.

Bitcoin’s Impact on Environment

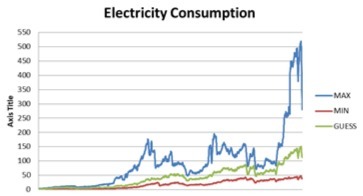

A study stated that the Bitcoin network could consume as much energy as all data centers globally, with an associated carbon footprint matching London’s footprint size. A 2021 estimate from the University of Cambridge suggests bitcoin consumes more than 178 TWh annually, ranking it among the top 30 energy consumers if it were a country.

Fig. 5, source: Cambridge Bitcoin Electricity Consumption Index

Such comparisons make the numbers look more gruesome than they actually are. Comparing the energy consumption of miners spread all across the globe with that of a country is inappropriate, as bitcoin miners are not a country. While the comparison is under question we shall focus on the figures available. Due to the anonymity of miners, most studies have been conducted using sample data and assumptions, with each study having its own limitation.

We have used the Cambridge bitcoin electricity consumption index for reference which clearly shows an increase in the use of electricity and it estimates the consumption to be around 110 TWh/year, which is 0.55% of global electricity production. Also, one thing common among all the studies is the fact that there is an upward rising graph and the numbers are quite alarming.

Therefore, we cannot deny the fact that the energy consumption by miners is increasing at a very high rate. This is so because as more miners join the network, they try to be faster and speed is directly proportional to the heavy machinery they use, which requires more energy.

As a result of this, Tesla recently made an announcement terminating vehicle purchases using Bitcoins, which plunged down bitcoin prices in May 2021.

Fig. 6 source: wikipedia.com, Fig. 7 source: coindesk.com

76% of the hashers (hash functions are part of the block hashing algorithm which is used to write new transactions into the blockchain and hashers engage in writing and cracking those hash functions to mine Bitcoins) use renewable energy as a part of their energy mix and 39% of hashing’s total energy consumption comes from renewable resources with hydropower being the leader followed by solar energy.

Iceland, Sweden, and Norway have been popular mining locations because of an abundance of geothermal, hydro, and wind power. In countries like Iceland, the abundance is slowly turning into scarcity which has alarmed the authorities.

But most mining is done in China where the renewable energy source is hydropower. The problem with hydropower is that its generation capacity varies over different seasons. This leads to fluctuations in prices because of which miners use it only during certain periods. For the rest of the year, they use coal-generated electricity as it’s cheaper and their main objective is to earn more.

PoW mining is primarily powered by non-renewable energy sources

Fig. 8 Source: 3rd global Crypto Asset benchmarking study – CCAF publications

Availability is not the only problem but also the accessibility of these renewable resources. Thus in a coal-driven world, renewable resources remain to be a lost child.

For Bitcoin mining, CO2 emitted for generating electricity is equal to the CO2 emissions produced in one hour by a Boeing 747 commercial plane. A single transaction of bitcoin, for example, has the same carbon footprint as 680,000 Visa transactions or bingeing YouTube for 51,210 hours.

CO2 remains to be the major contributor to air pollution and nearly 3 million people die due to air pollution around the world every year. It also poses a threat to the Paris Agreement which was signed to reduce Co2 emissions and control global warming.

As we upgrade our iPhones every year, so do miners to increase their efficiency. The mining equipment used to obtain Bitcoin becomes obsolete in about 1.5 years. This leads to E-waste generation whose amount can be compared to the electronic waste generated by Luxembourg.

Fig. 9 Source: medium.com

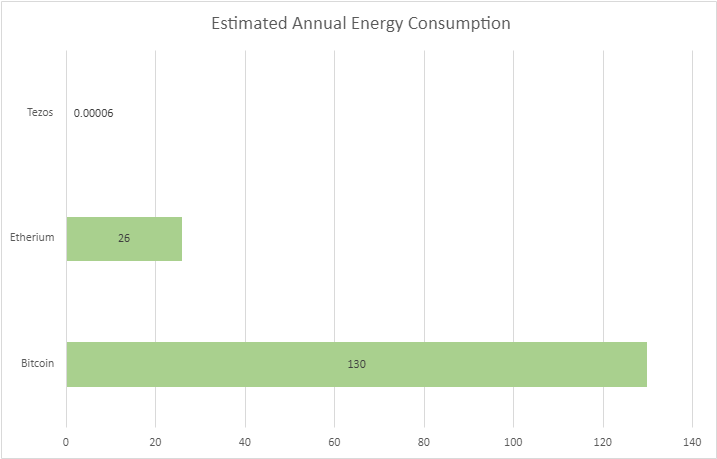

Bitcoin is not the only cryptocurrency but is the one facing the most criticism. This is so because cryptocurrencies like Tezos rely on the “Proof of stake” rather than the “Proof of Work” algorithm, and thus comparatively require less energy. Few studies suggest that if bitcoin has to become environment friendly it shall be left with no option but to shift to proof of stake or proof of authority.

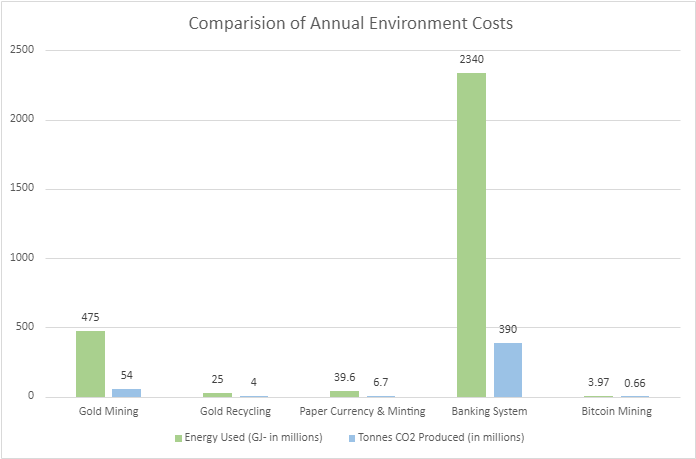

Figure 10: Hass McCook, An Order-of-Magnitude Estimate of the relative Sustainability of the bitcoin network, 3rd Edition – February 11, 2015

The other types of money in our system today include printed currency, gold, and the banking system. When compared to their electricity consumption data, a study revealed that bitcoin is more sustainable than the rest and can be considered as an alternative for the existing system.

The study conducted by Taskinsoy starts from the premise that if paper money could be removed from global circulation, being replaced with cryptocurrencies, approximately one billion trees could be saved from deforestation and these trees would be allowed to continue absorbing CO2 through photosynthesis. Completely replacing paper currency has its limitations, such as access to the internet everywhere being the most common one. Even then the amount of electricity consumed remains to be a problem and shall get worse.

Bitcoin is a type of cryptocurrency, which is one of the several uses of blockchain technology. Another up-and-coming digital asset that makes use of blockchain technology is NFT, i.e, Non-Fungible Token, and for creating an average NFT, it generates around 200 kg of carbon, the equivalent of driving 500 miles in the average petrol-powered car.

As we continue to develop the technology for its use in several sectors such as mining, transportation, and supply chain. The energy consumption figures are going to be beyond our imagination, even though this technology can be used to conserve the environment. For example, researchers have recently simulated the application of blockchain technology to electronically trace timber through its life cycle and several such applications are being worked upon. But these advantages cannot outweigh the damage that shall be done. Today bitcoin is like a warning for what lies ahead. If we take the necessary actions today, we can adopt this technology and create a better and sustainable world tomorrow.

Bitcoin’s Impact on Society

-

Bitcoin’s social impact involves a psychological effect on how people handle their money. In today’s world, even if it is your money, you will have to painstakingly handle the meddling from the banks and authorities that exercise control over your own money. And this is where bitcoins come to the rescue, the centralized nature helps in eliminating these things.

-

No one is easily able to transfer money through bitcoins instantly anywhere in the world which platforms like PayPal and Western Union would charge around a 16% fee for a considerable amount of time.

-

Even though cryptocurrencies like bitcoins possess a lot of potential to dominate the banking industry, it threatens the economy in inflationary and deflationary situations because there exists no one to control it unlike the government in the case of fiat currencies.

-

Bitcoin is built keeping scarcity in mind (limited to a supply of 21 million) with the idea that it would ensure the upward valuation of the currency as there is no central bank that can print more money as and when the economy requires. But this would eventually give rise to the problem of deflation that encourages hoarding.

-

When Bitcoin was experiencing its upward trend, many experts noted that a rise in value meant that it had entered a hyper-deflationary spiral which made it unsuitable to use as a currency because there was no reason to spend bitcoins if the price would continue to rise. For instance, in the early days of Bitcoin, an individual spent 5,000 BTCs to buy a burger. In a deflationary economy, this person psychologically feels that he loses greatly as the currency’s value goes up, and would be less willing to part with their currency in the future.

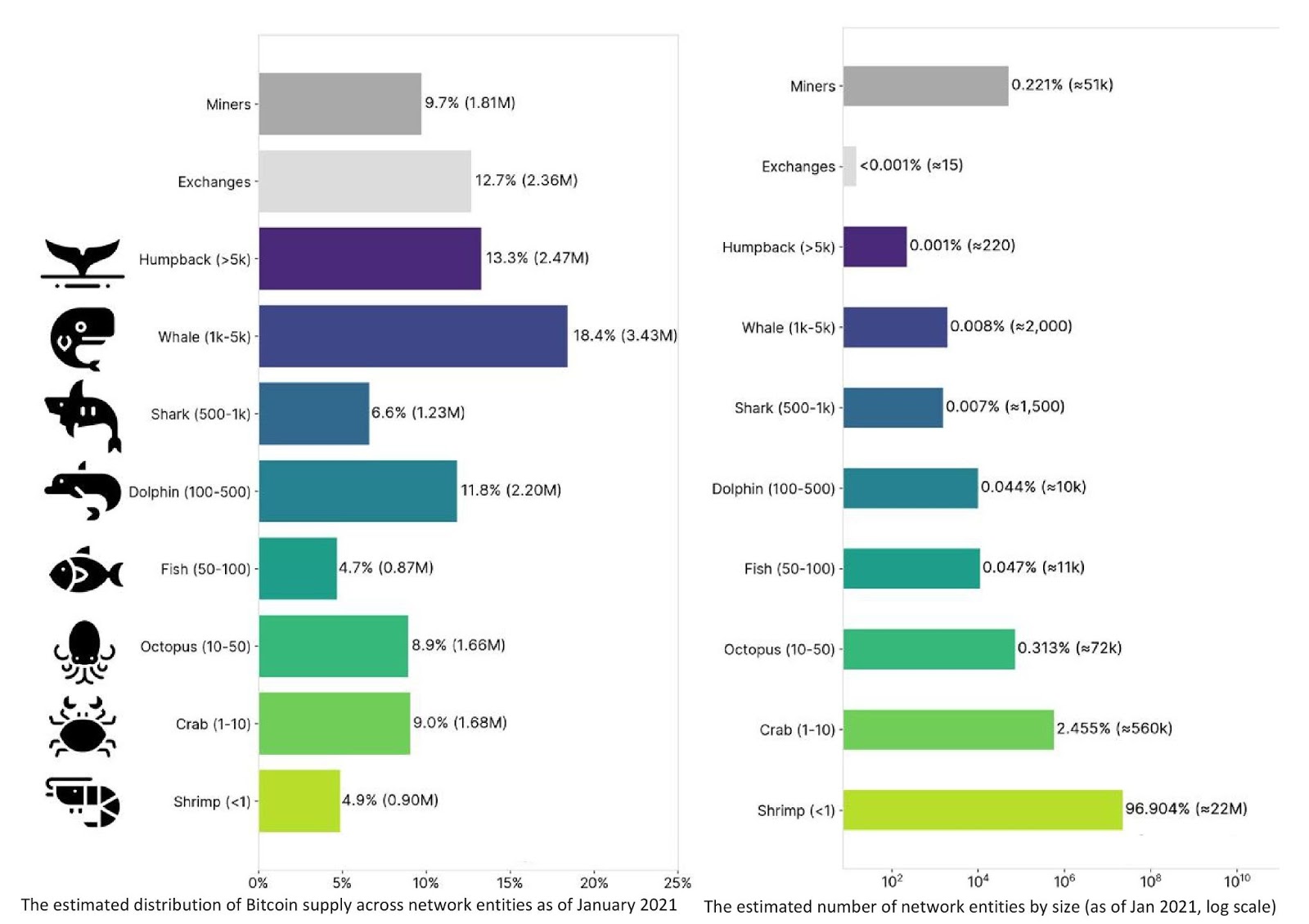

Fig. 11 Source: insights.glassnode.com

After analyzing the above data of bitcoins supply across network entities and the number of network entities, it is derived that around 2% of network entities control 71.5% of all Bitcoins. Hence, the common notion that “Bitcoins are controlled by the people” is a myth because these are the group of people who actually control the network.

Bibliography

-

Filcak , R., Považan , R& Viaud.. “Blockchain and the Environment.” European Environment Agency, 25 Mar. 2021, http://www.eea.europa.eu/publications/blockchain-and-the-environment.

-

Köhler, Susanne, et al. “Life Cycle Assessment of Bitcoin Mining.” Environmental Science & Technology, 20 Nov. 2019, http://pubs.acs.org/doi/full/10.1021/acs.est.9b05687.

-

DİLEK, Şerif, and Yunus FURUNCU. “Bitcoin Mining and Its Environmental Effects.” Atatürk Üniversitesi İktisadi Ve İdari Bilimler Dergisi, 7 Feb. 2019, http://dergipark.org.tr/en/pub/atauniiibd/issue/43125/423056.

-

Blandin, Apolline, et al. “3rd Global Cryptoasset Benchmarking Study – CCAF Publications.” Cambridge Judge Business School, 21 Jan. 2021, http://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/3rd-global-cryptoasset-benchmarking-study/.

-

L. Badea, M. C. Mungiu-Pupӑzan, “The Economic and Environmental Impact of Bitcoin,” in IEEE Access, vol. 9, pp. 48091-48104, 2021, doi: 10.1109/ACCESS.2021.3068636.

-

Co, Alison. “The Social, Political and Economic Impact of Bitcoin On The World.” Invision Game Community, 10 Apr. 2020, http://invisioncommunity.co.uk/the-social-political-and-economic-impact-of-bitcoin-on-the-world/#:%7E:text=Bitcoin’s%20social%20impact%20also%20involves,control%20over%20your%20own%20money

-

Schultze-Kraft, Rafael. “No, Bitcoin Ownership Is Not Highly Concentrated – But Whales Are Accumulating.” Glassnode Insights – On-Chain Market Intelligence, 2 Feb. 2021, http://insights.glassnode.com/bitcoin-supply-distribution.

-

Blockchains and Bitcoin: Regulatory responses to cryptocurrencies by Andres Guadamuz and Chris Marsden. First Monday, Volume 20, Number 12 – 7 December 2015 https://firstmonday.org/ojs/index.php/fm/article/download/6198/5163doi: http://dx.doi.org/10.5210/fm.v20i12.6198

-

“Why Do Bitcoins Have Value?” Investopedia, 2020, http://www.investopedia.com/ask/answers/100314/why-do-bitcoins-have-value.asp.

-

AuthorDina El MahdyArticle title:The Economic Effect of Bitcoin Halving Events on the U.S. Capital MarketURL: https://www.intechopen.com/online-first/the-economic-effect-of-bitcoin-halving-events-on-the-u-s-capital-market.

-

Article title:How Cryptocurrencies Can Help Global Economy and Build a Better Future. Website title:Finextra https://www.finextra.com/blogposting/18159/how-cryptocurrencies-can-help-global-economy-and-build-a-better-future