Banking consolidations, or mergers and acquisitions, are a common occurrence in the financial industry. These consolidations can benefit banks, consumers, and the overall economy.

Benefits of Banking Consolidations

Economies of scale: Larger banks can often operate more efficiently, reducing costs in technology, compliance, and administration. This can lead to lower fees for consumers.

Expanded market presence: Merging with or acquiring other banks can help institutions expand their geographic reach or enter new markets. This can give consumers more choices and make it easier for businesses to access banking services.

Diversification: Combining banks can lead to a more diverse portfolio of products and services. This can benefit consumers by giving them access to a broader range of financial products and services.

Increased competitive advantage: Larger banks may have a competitive edge regarding resources, technology, and expertise. This can lead to lower prices and better products and services for consumers.

Challenges and Concerns

Integration risk: Merging or acquiring banks must successfully integrate their operations, which can be complex and risky. This can lead to disruptions for customers and employees.

Regulatory compliance: Consolidations often face regulatory scrutiny to ensure they do not result in monopolistic or anti-competitive behaviour. This can slow down the process and make it more expensive.

Cultural and workforce challenges: Combining different corporate cultures and crews can be difficult and may lead to employee and customer dissatisfaction.

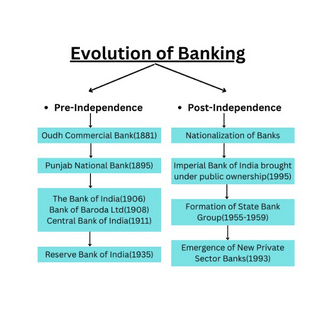

Major Consolidations in India Post-Independence

-

- Punjab National Bank (PNB), Oriental Bank of Commerce, and United Bank of India: These three banks merged to become the nation’s second-largest lender, effective April 1, 2020.

- Canara Bank and Syndicate Bank: The merger formed the fourth-largest public sector bank with a substantial business presence.

- Union Bank of India, Andhra Bank, and Corporation Bank: The amalgamation of these three banks strengthened the Indian banking landscape.

- Indian Bank and Allahabad Bank: This merger created a larger banking entity with a vast network and substantial customer base.

There are several potential benefits to these banking consolidations in India. These include:

Improved financial stability: Larger and more diversified banks may be better able to withstand economic shocks and financial crises.

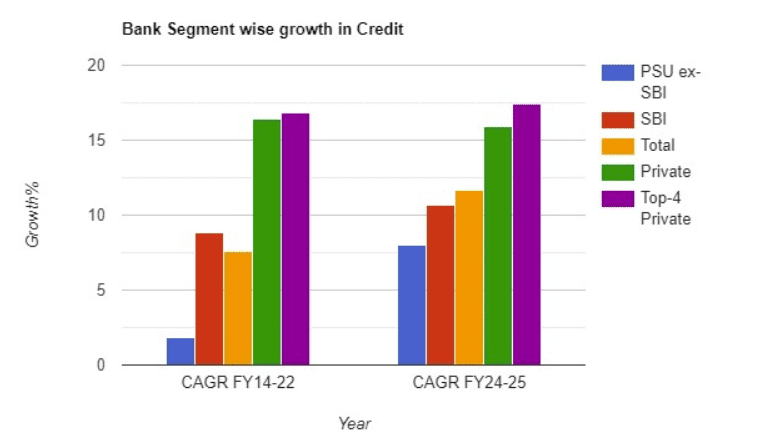

Increased access to credit: Larger banks may lend more money to businesses and consumers, boosting economic growth.

Lower costs for consumers: Consolidation could lead to lower fees and more competitive pricing for banking products and services.

However, there are also some potential challenges to these banking consolidations in India. These include:

Reduced competition: If too many banks consolidate, it could reduce competition in the banking sector. This could lead to higher fees and less innovation.

Job losses: Consolidation could lead to job losses in the banking sector. This could hurt the economy.

Loss of local expertise: If too many regional banks consolidate, it could lead to losing local expertise and knowledge. This could make it more difficult for businesses and consumers to access banking services in rural areas.

Overall, the future outlook for banking consolidation in India is mixed. There are both potential benefits and challenges to consider. It is essential to carefully weigh these factors before deciding about further consolidation.

It is also important to note that the government is taking steps to mitigate the potential challenges of banking consolidation. For example, the government has said it will only allow banks to become small and dominant. The government is also working to ensure that smaller banks remain viable and competitive.

Major Banking Reforms in India Post 1991

Narasimham Committee Reforms: A Turning Point for the Indian Banking Sector

The Narasimham Committee reforms were a series of financial sector reforms introduced in India in the early 1990s. The reforms were aimed at improving the efficiency and competitiveness of the banking sector and reducing its dependence on government intervention.

The Narasimham Committee 1, which was appointed in 1991, made several key recommendations, including:

-

- Reduction in the Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR)

- Reorganisation of the banking sector through mergers and acquisitions

- Establishment of the Asset Reconstruction Fund (ARF) Tribunal to deal with bad debts

- Removal of dual control over the banking sector

- Elimination of government interest rate controls

- Greater autonomy for banks in their operations

The Narasimham Committee reforms had a significant impact on the Indian banking sector. They led to increased competition, innovation, and efficiency in the industry. The reforms also helped to reduce government intervention in the banking sector and to make it more responsive to the needs of the market.

The Narasimham Committee reforms are widely credited with playing a vital role in transforming the Indian banking sector into a more modern and efficient system. The reforms helped to lay the foundation for the solid economic growth that India has experienced in recent decades. The recommendations of the Narasimham Committee 1 reshaped India’s banking sector, making it more competitive and responsive to market forces.

Navigating the Path to a Stronger Banking System: The Narasimham Committee II

The Narasimham Committee II, established in 1998, delved into the intricacies of banking sector reforms, aiming to bolster the Indian financial landscape. The committee’s recommendations addressed prevalent issues such as high Non-Performing Assets (NPAs) and the need for technological advancements.

Key Recommendations:

-

- Robust Banking System: Merging central public sector banks to enhance trade and stability.

- NPAs and Narrow Banking: Introducing the concept of Narrow Banking, enabling banks to invest in low-risk assets to mitigate NPAs.

- Role of RBI: RBI is a regulator, but not an owner, of banks, ensuring impartial oversight.

- Capital Adequacy Ratio: Increasing Capital Adequacy Ratio norms to safeguard banks against financial shocks.

- Foreign Exchange: Enhancing risk management by assigning 100% risk weight to foreign exchange open position limits.

Positive Impacts:

-

- Strengthened Banking System: A more resilient and competitive banking system, fostering overall financial stability.

- Promoted Competition: Encouraged the entry of private and foreign banks, stimulating innovation and customer-centric services.

- Reduced Government Interference: Promoted bank autonomy, enabling more efficient decision-making.

- Technological Upgradation: Modernized banking operations, paving the way for Internet and mobile banking.

- Global Integration: Harmonized Indian banking practices with international standards, facilitating global operations.

Potential Concerns:

-

- Job Security: Increased competition could raise concerns about job security, particularly in public sector banks.

- Financial Inclusion: Emphasis on profitability might overshadow financial inclusion initiatives, affecting marginalised communities.

- Risk and Volatility: Reduced statutory ratios and greater market exposure could heighten vulnerability to economic fluctuations.

- NPA Management: The focus on asset quality might necessitate stringent measures to address NPAs effectively.

- Customer Service: Rapid expansion of private and foreign banks could challenge maintaining consistent customer service standards.

- Market Forces Reliance: Over-reliance on market forces might prioritise short-term gains over long-term stability.

The Narasimham Committee II’s recommendations marked a significant step towards a more robust and globally integrated Indian banking system. While addressing potential concerns, the reforms paved the way for a dynamic and competitive financial sector poised for future growth and resilience.

Indradhanush Framework Reforms: A Critical Analysis

The Indradhanush Framework, introduced in 2015, was a comprehensive reform package aimed at revitalising and reforming public sector banks (PSBs) in India. The framework comprised seven key components: appointments, bank boards bureau, capitalisation, de-stressing, empowerment, framework of accountability, and governance reforms.

While the Indradhanush Framework has made some progress in improving the financial health and operational efficiency of PSBs, it has also faced challenges in implementation. Some of the key pros and cons of the framework include:

Pros:

-

- Enhanced transparency and accountability

- Capital infusion

- Empowerment through autonomy

- Professionalisation of boards

- Asset quality improvement

- Technology adoption and digital banking

Cons:

-

- Implementation challenges

- Slow progress in NPA resolution

- Governance issues persisted

- Market perception and investor confidence

- Impact on employee morale

- Dependence on the government for capital

- Sustainability and long-term viability

Overall, the Indradhanush Framework has been a positive step towards reforming PSBs in India. However, more must be done to address the challenges faced in implementation and sustain the reforms in the long term.

Raghuram Rajan Committee Reforms: A Critical Analysis

The Raghuram Rajan Committee on Financial Sector Reforms was constituted in 2008 to propose comprehensive reforms for the Indian financial system. The committee submitted its report in 2013 with far-reaching recommendations for strengthening financial stability, enhancing market discipline, and promoting financial inclusion.

Key Recommendations

-

- Creation of a unified financial sector regulator

- Strengthened macro-prudential regulation

- Framework for resolution of financial firms

- Market-oriented approach to financial regulation

- Measures to enhance consumer protection and investor rights

- Simplified regulatory processes

Impact

The Rajan Committee reforms have had a significant impact on the Indian financial sector. Some of the critical effects include:

-

- Improved financial stability: The reforms have helped to strengthen the resilience of the banking sector and reduce systemic risks.

- Enhanced market discipline and transparency: The reforms have led to more excellent disclosure norms and improved corporate governance practices in the financial sector.

- Increased financial inclusion: The reforms have helped to expand access to financial services for underserved segments of the population.

Challenges

Despite the positive impact, the implementation of the Rajan Committee reforms has faced some challenges, such as:

-

- Resistance from certain stakeholders

- Difficulties faced by smaller and regional banks in meeting the stringent capital adequacy and risk management standards

- Short-term disruptions caused by the implementation of some reforms

- Concerns about over-regulation

Overall Assessment

The Raghuram Rajan Committee reforms have been a landmark initiative in developing the Indian financial sector. The reforms have helped to make the banking system more resilient, improve market discipline, and promote financial inclusion. However, some challenges remain in the implementation of the reforms. It is essential to monitor and adapt the reforms to ensure they stay effective despite evolving economic and financial conditions.

Nachiket Mor Committee Reforms: A Critical Analysis

The Nachiket Mor Committee was established in 2013 to recommend measures for achieving financial inclusion and increased access to financial services. The committee’s recommendations have had a significant impact on the Indian financial sector, leading to the establishment of Payment Banks and Small Finance Banks and the expansion of digital financial services.

Key Recommendations

-

- Universal Electronic Bank Account (UEBA)

- Ubiquitous access to payment services and deposit products

- Sufficient access to affordable formal credit

- Universal access to a range of insurance and risk management products

- Right to Suitability

Effects

-

- Enhanced financial inclusion

- Broadened scope of banking services

- Technology adoption

- Innovative products and services

- Risk mitigation and diversification

Challenges

-

- Implementation challenges

- Regulatory oversight

- Potential for over-extension

- Cybersecurity concerns

- Market disruption

- Impact on traditional banking models

Overall Assessment

The Nachiket Mor Committee reforms have played a pivotal role in advancing financial inclusion in India. The reforms have expanded the reach of formal banking services, empowered individuals and businesses, and ushered in a digital revolution in financial transactions. However, some challenges remain in implementation and regulation. It is essential to continue monitoring and adapting the reforms to ensure they remain effective in the long term.

The banking landscape in India has witnessed a dynamic evolution through a series of mergers and acquisitions guided by pivotal reforms over the years. These transformations have ushered in a new era of efficiency, competitiveness, and financial inclusion. The amalgamation of banks has harnessed economies of scale, expanded market reach, and bolstered the country’s financial stability. Simultaneously, landmark reforms like those recommended by the Narasimham, Raghuram Rajan, and Nachiket Mor Committees have fortified the sector, boosting transparency and resilience while extending the reach of formal banking services to underserved populations. However, challenges persist, particularly in the implementation and regulation of these reforms. As India’s banking sector evolves, a delicate balance between innovation and stability remains crucial. Vigilance, adaptability, and continued efforts are paramount to ensure these reforms yield lasting benefits for the nation’s economy and people.