INTRODUCTION TO GST

The Goods and Services Tax is an indirect tax that has replaced many indirect taxes in India, such as the excise duty, VAT, service tax, etc. It is levied on the supply of goods and services and is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST has replaced multiple indirect taxes with a single, unified tax structure, achieving the goal of ‘One Nation, One Tax’. It has ensured uniform tax rates across states, simplifying administration and improving compliance through systems like e-way bills and e-invoicing. It has eliminated the cascading effect of taxes by allowing tax to be levied only on the value added at each stage, enabling seamless input tax credit. To curb tax evasion, GST has introduced stricter provisions like input credit eligibility only on verified invoices and mandatory e-invoicing, which has reduced fraudulent claims. The tax has widened the taxpayer base by bringing more businesses, including those in unorganised sectors, under the tax net due to unified registration thresholds and better enforcement. GST has also enhanced the ease of doing business by digitising key processes like registration, return filing, and refunds. Logistics has improved supply chain efficiency and reduced costs by removing interstate checkpoints and standardising documentation. Finally, GST has promoted competitive pricing by eliminating cascading taxes, which has helped increase consumption and boost indirect tax revenue for the government.

There are 4 components of GST : CGST, SGST, IGST, and UTGST. So, the kind of tax to be paid under GST depends on whether the nature of supply is inter-state and intra-state. When the supply of goods or services happens within a state or intra-state transactions, both the CGST and SGST will be claimed. In case of supply between states or inter-state transactions, only IGST will be collected, and when it happens within union territories, UTGST will be levied.

- CGST: The Central Goods and Services Tax is an indirect tax under the GST regime that is applicable to intrastate transactions. Based on Section 15 of the CGST Act, this tax is levied on the transaction value of the goods or services supplied which is the price actually paid or payable for the said supply of goods or services. For instance, if a supplier from Mumbai has sold goods worth Rs. 10,000 to a customer in Mumbai and the GST applicable is 18%, then CGST and SGST will be divided equally. Hence, out of the total revenue earned, Rs. 900 will go to the Central Government towards CGST.

- SGST: State Goods and Service Tax is an indirect tax levied on the intrastate supply of goods and services and is collected by the State Government of the respective state under the State Goods and Services Act, 2017. SGST is levied on the transaction value of the goods or services supplied which is the price actually paid for the supply of goods or services. Additionally, as per sections 12 and 13 of the SGST Act, the obligation to pay SGST is at the time of supply of goods or services and the CGST portion will also be levied accordingly.

- UTGST: Union Territory Goods and Service Tax is another indirect tax imposed and collected by the respective Union Territory under the Union Territory Goods and Services Act (UTGST), 2017, on the intra-state supply of goods or services. UTGST is applicable to the supplies of goods and services that take place in the Union Territories of Andaman and Nicobar Islands, Chandigarh, Dadra and Nagar Haveli, Daman and Diu, and Lakshadweep. However, it is to be noted here that the SGST law will be applicable to the union territories of Delhi and Puducherry since these territories have their own private legislature and government.

- IGST: Integrated Goods and Service Tax is another component of GST that is applicable to the interstate supply of goods and services as well as to imports and exports between 2 states. The IGST is governed and collected by the Central Government under the IGST Act. The accumulated tax is then divided between the respective states by the Central Government.

WHY DO WE NEED GST 2.0 MODEL

The initial implementation of GST in India, while a monumental step toward tax unification, quickly exposed several systemic and operational vulnerabilities that necessitated a substantial recalibration, referred to broadly as GST 2.0. This imperative for change arose because the foundational GST framework, despite achieving the ‘one nation, one tax’ ideal, became hindered by practical difficulties that severely impacted ease of doing business, revenue collection, and compliance for various stakeholders. Therefore, GST 2.0 was deemed essential to address and overcome these critical shortcomings, transforming the tax regime from a complex mechanism into a truly simplified, robust, and technologically resilient structure.

The key challenges that necessitated the shift to GST 2.0 included:

- The presence of multiple GST slabs created significant classification challenges, as businesses often struggled to determine the correct tax rate for specific goods and services, leading to frequent disputes and litigation. This complexity particularly burdened small and medium enterprises, which faced heightened compliance costs and administrative difficulties in ensuring accurate GST application.

- The complex GST structure with frequent rate changes, multiple return formats, and intricate procedures created substantial compliance and monitoring challenges for both taxpayers and authorities.

- Several essential goods and services were taxed at higher or mid-level slabs, increasing the tax burden on everyday consumers. Additionally, the presence of cesses and very high rates on luxury goods created structural distortions within the system. Moreover, even critical services like health insurance attracted GST, which was counterproductive in a country like India where healthcare demand is already high, making affordability a pressing concern.

- Private consumption was lagging due to factors like inflation and income constraints, leading to subdued demand in the economy. Reducing tax rates on high-consumption goods was seen as an effective way to stimulate demand and provide a fiscal boost through increased consumer spending.

- GST 1.0 was ill-suited for new sectors, digital businesses, and evolving consumption patterns. Rationalizing rates, simplifying processes, and modernizing the framework were necessary to make GST more transparent, inclusive, and growth-oriented. The 2025 GST reforms aimed to reshape India’s taxation system to better align with the aspirations of the youth, while reducing costs in critical sectors such as education, technology, and healthcare to enhance overall competitiveness. They also sought to provide relief to smaller enterprises, cottage industries, and MSMEs.

- Ambiguities in the taxation of certain intermediaries, services, and supply chains often resulted in disputes and litigation, as businesses struggled to interpret the existing GST rules. In particular, provisions related to export status, eligibility for input tax credits, and zero-rating were unclear, creating confusion for companies operating across states or internationally. These issues highlighted the need for clarification and reform to ensure consistent application of GST, reduce legal disputes, and improve ease of doing business.

SECTOR – SPECIFIC OUTCOMES

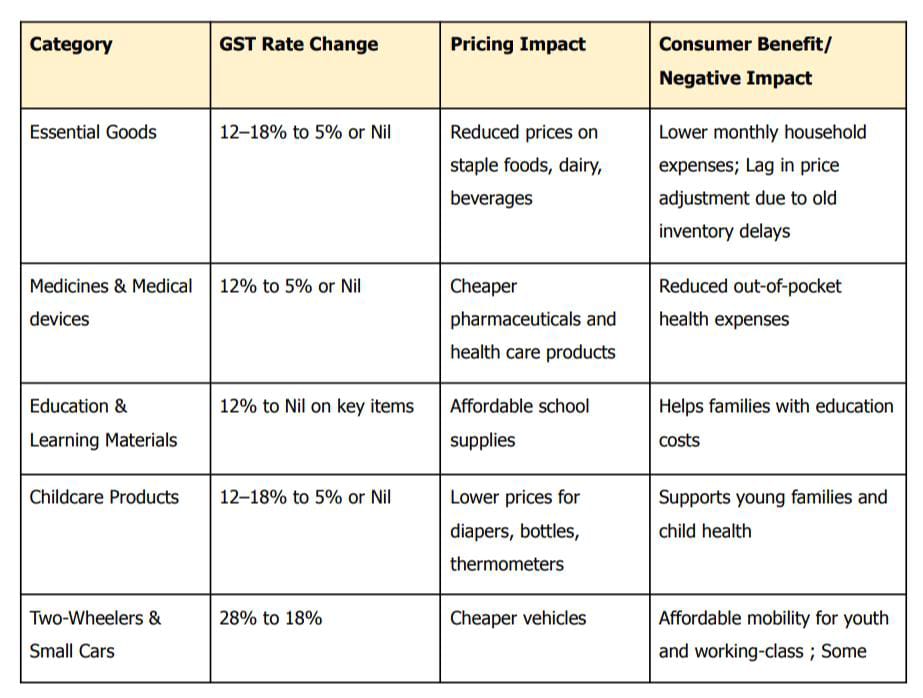

While GST 2.0 represents a major policy shift towards simplification and efficiency from the earlier, 5-12-18-28 model to the new 5-18-40, its real success lies in how it impacts individual sectors of the economy. Each industry, from manufacturing to digital commerce, has experienced distinct transformations in cost structures, compliance, and competitiveness and has different impacts due to the implementation of GST 2.0. While some industries tend to benefit directly by more fluid demand, strengthen cash flows, and increase profitability, other industries seem to be under pressure due to higher taxes, demand compression, and valuation headwinds.

Sectors Benefiting from GST 2.0

- Automobile Industry : Cars and two-wheelers that previously attracted 28% GST now fall under the 18% standard slab. This 10% reduction can cut consumer prices by almost a lakh rupees on mid-segment vehicles.

- Pharma and Healthcare : Medicines and life-saving drugs now fall under the 5% slab, making them more affordable for consumers. This is expected to increase demand, especially in semi-urban and rural markets.

- Retail and Consumer Goods : Higher revenues, better inventory turnover, and improved working capital cycles will positively impact business valuations in this sector. Investors are likely to re-rate retail companies upward as a result.

Sectors Under Pressure

- Luxury Goods: High-end cars and bikes, Premium electronics and luxury accessories now fall under the 40% GST bracket. This steep hike makes such products less affordable, leading to weaker sales volumes.

- Tobacco/Sin Products: Tobacco, cigarettes, and aerated drinks have been hit with the highest tax slab. Beyond reducing consumption, these products already face regulatory pressures. The combined effect is a negative outlook on cash flows and long-term valuations.

- Imported Brands: Imported liquor, premium cosmetics, and other global lifestyle products face significant price hikes under GST 2.0. Hospitality businesses dependent on premium F&B sales may also experience reduced margins. For investors, this raises questions about the sustainability of growth in these segments.

EFFECT ON MSMEs & STARTUP ENVIRONMENT

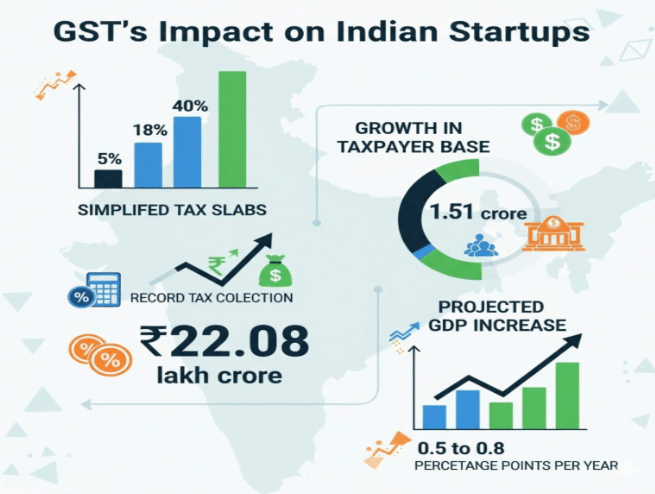

The GST impact on Indian startups is expected to be a game-changer as India stands on the cusp of a transformational economic revolution. They signal a new era of entrepreneurship, industrial development, and inclusive growth. With simplified GST slabs of 5%, 18%, and 40%, and a record ₹22.08 lakh crore collected in 2024–25 (a 9.4% year-on-year increase), India is primed for unprecedented business expansion. These reforms have a significant impact on entrepreneurs and startups as they reduce compliance costs, eliminate bottlenecks, and create a more stable business environment. The GST taxpayer base has grown from 66.5 lakh entities in 2017 to 1.51 crore by 2025. This reflects the formalization of India’s economy and creates a fertile environment for new ventures. With reduced taxes and simplified compliance procedures, these reforms are expected to boost GDP by 0.5 to 0.8 percentage points per year, while creating growth opportunities across all sectors.

On the one hand, harmonisation of rates within categories ensures that businesses can comply with the intent of GST policy with ease while enhancing breadth of product and service offerings. Furthermore, uniform pricing of wider spectrums of SKUs and smoother logistics flows across states will expand a startup’s addressable market, facilitating sectors like quick commerce, logistics, D2C brands and healthcare with consistency to build for scale. On the other hand, under the GST regime, regular taxpayers need to file at least 2 monthly and 1 annual returns, totalling 25 returns in a year. This has increased the compliance burden for MSME businesses with over Rs.5 crore annual turnover. In addition, the delays in ITC refunds may cause significant challenges to managing cash flow for smaller companies with limited access to working capital. Finally, a completely online taxation system can create challenges for businesses operating in remote areas with limited access to hardware, software, and reliable connectivity.

To summarize, in the long term, GST 2.0 is likely to formalize and de-risk MSMEs and startups by simplifying rates, cutting compliance costs, accelerating refunds, and improving credit visibility, which should raise productivity, expand market access, and support steadier growth across the ecosystem. A measured caveat is that some sectors may face adjustment frictions or input-credit bottlenecks during transition, making execution quality and sustained tech-enabled administration decisive for realising the full gains over time.

FISCAL IMPACTS AND GOVERNMENT REVENUE

GST 2.0 focuses on maintaining fiscal discipline by expanding the tax base and ensuring better compliance through data-backed monitoring and digital tracking systems. The reform introduces AI-enabled invoice matching and real-time analytics to reduce tax evasion, enhancing transparency and efficiency in tax administration. This will help states reduce their dependence on central compensation and improve fiscal discipline. Although there might be short-term administrative costs and compliance burdens for small enterprises, the long-term gain lies in stabilizing government finances and minimizing revenue leakages.

The GST collections have shown steady year-on-year growth, crossing ₹1.7 lakh crore in several months of FY 2024–25, highlighting the fiscal potential of the reform. GST 2.0 proposes rationalizing tax slabs and expanding the digital compliance ecosystem, measures expected to simplify tax filing and reduce litigation. These steps will streamline revenue flows, making tax collection more predictable and boosting the government’s ability to plan expenditure effectively. Increased automation and data integration between GSTN and income tax databases will further reduce fraud, widening the fiscal capacity of the state.

In the long term, GST 2.0 aims to strengthen cooperative federalism by ensuring states’ fiscal autonomy while maintaining overall fiscal discipline. The move towards a unified national market will expand tax coverage, promote exports, and stimulate formalization of the economy, thereby increasing direct and indirect revenues. By making compliance smoother and refund mechanisms faster, GST 2.0 can lead to greater investor confidence and more stable fiscal inflows. Over time, these reforms can reduce fiscal deficits, encourage private investment, and create a more balanced center-state revenue-sharing framework. Furthermore, it will lead to more formalization and faster business operations, which will raise consumer confidence and increase demand over time. As compliance becomes easier and refunds faster, businesses will have more liquidity, allowing them to invest and create jobs. This rise in income and employment will push demand upward, giving the economy a steady growth boost. Overall, GST 2.0 aims to build a cycle where higher compliance supports revenue, and higher revenue supports growth and demand.

CHALLENGES THE GOVERNMENT MIGHT FACE DURING IMPLEMENTATION

Firstly, the transition to a two-slab GST system requires significant updates to the Goods and Services Tax Network (GSTN). Ensuring that the digital infrastructure can handle the increased volume of transactions and provide real-time updates is crucial. Any technical glitches could disrupt compliance and refund processes, affecting businesses and consumers alike. Secondly, businesses, especially small and medium enterprises (SMEs), need to be educated about the new tax structure and compliance requirements. The government must invest in training programs and awareness campaigns to ensure smooth adoption of GST 2.0. Thirdly, with the introduction of new tax rates and exemptions, there is a risk of misuse or evasion, and hence the government must strengthen monitoring mechanisms and enforcement to prevent fraudulent activities and ensure compliance. Finally, the long-term effects of GST 2.0 on various sectors need continuous evaluation. The government should establish frameworks to assess the impact on revenue generation, sectoral growth, and employment to make timely adjustments if necessary.

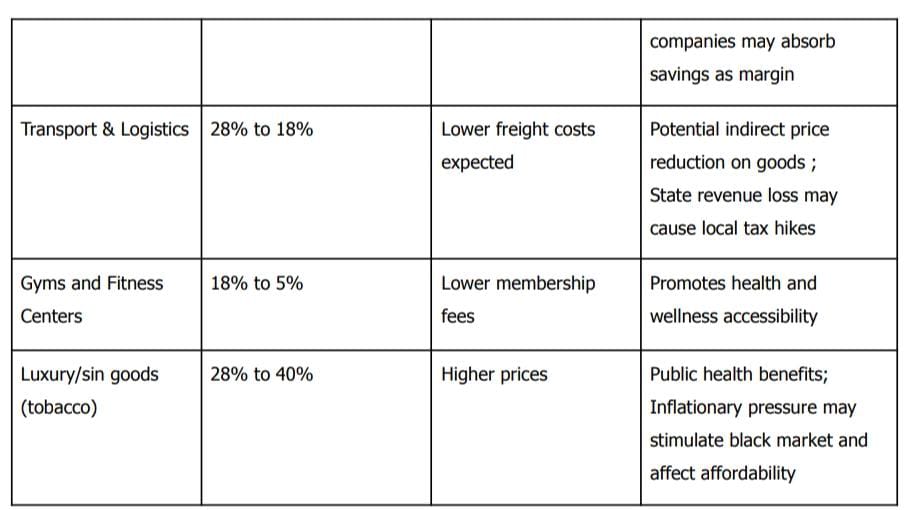

INTER-STATE TRADE and E-WAY BILL REVOLUTION

Inter-state trade, also known as Inland Trade in India, is commerce between two or more states or territories within a country, involving goods and services moving across state boundaries. Under the GST regime, inter-state supply of goods and services is subject to Integrated Goods and Services Tax (IGST), which is levied by the Central Government and then shared with the destination state. This is in contrast to intra-state trade, which is confined within a single state and attracts both Central GST (CGST) and State GST (SGST).

The E-Way Bill is a mandatory electronic document under the GST regime that is required for the movement of goods. It is a compliance mechanism that requires the person causing the movement of goods to upload the relevant information and generate the e-way bill on the common GST portal before the movement of goods commences. The E-Way Bill data is now synchronised instantly with the overall GST Network, enabling tighter scrutiny and cross-verification with other documents like e-invoices. Furthermore, the system is now designed to automatically trigger penalty notices for non-compliance, such as a delay in updating vehicle details or a failure to generate the EWB on time, significantly increasing the cost of non-compliance. The push towards GPS-based toll systems signals a future where vehicle movements are tracked in real-time and linked to the E-Way Bill. This moves beyond traditional physical checks to a continuous, digital, and verifiable compliance mechanism on national highways.

IMPACT ON INTERNATIONAL TRADE

GST 2.0 streamlines India’s indirect tax regime, reducing classification disputes and simplifying compliance for international trade. The exporters benefit from quicker, easier input-tax-credit refunds that improve cash flow and competitiveness, lower rates on manufacturing inputs and essential materials cut production costs, making exports more competitive. Rationalised rates and the elimination of inverted duties make imports more efficient and less costly, strengthening global supply-chain integration. Digital compliance with real-time invoice matching and automated refunds enhances transparency, reduces disputes, and speeds up transactions. Furthermore, aligned with India’s Free Trade Agreements, including market access in the EU and beyond, GST 2.0 ultimately lowers costs, improves supply-chain efficiency, and promotes the ease of doing business internationally.

CONCLUSION

To summarise, GST 2.0 stands as a strategic, citizen-centric evolution of India’s tax framework, aimed at streamlining the system and enhancing the quality of life for all stakeholders. This next-generation reform promises fairer taxation and easier compliance. Consumers are poised to benefit from lower taxes on essential goods, which boosts their purchasing power and makes everyday items more affordable. Businesses from large enterprises to small and medium firms anticipate reduced compliance costs and greater predictability, as GST 2.0 brings smoother registration processes and more stable tax policies. For the government, the reformed regime is expected to broaden the tax base and strengthen revenues while fostering a more unified national market, reflecting a commitment to transparency and ease of doing business.

Looking ahead, GST 2.0 lays a strong foundation for a more predictable and growth-oriented indirect tax regime. The government envisions a system that continues to become simpler, more technology-driven, and highly compliant, in line with the public’s and industry’s expectations for an efficient, transparent, and growth-focused tax framework. However, realising the full benefits of GST 2.0 will require navigating certain challenges. Authorities must ensure that the intended advantages reach end consumers, for instance, by monitoring that businesses pass on tax rate reductions in the form of lower prices, since experience with tax cuts has shown mixed results in price pass-through. Likewise, some industries may need careful attention to avoid any unintended consequences of the new rates (such as sectors deemed “luxury” now facing higher taxes). Continuous refinement of the GST system, including addressing such anomalies and expanding digital compliance tools, will be crucial in the coming years. Potential future reforms might involve further leveraging technology (like advanced e-invoicing and data analytics) to improve compliance and considering the inclusion of currently exempt items into the GST ambit, thereby reinforcing the “one nation, one tax” principle.

SOURCES

- Bajaj Finserv. (2025, September 8). GST reforms 2.0 (2025): Relief for the common man and simpler taxes. https://www.bajajfinserv.in/

gst-reforms-2-0 - CFO India. (2025). GST 2.0: Key challenges Indian businesses must navigate. https://www.cfo-india.in/gst-

2-0-key-challenges-india - ClearTax. (2025, September 18). GST reforms in India: New rates, slabs, and key changes in 2025. https://cleartax.in/s/next-

generation-gst-reforms - Entrepreneur Team. (n.d.). GST impact on Indian startups: 6 game-changing policies. Entrepreneur India. Retrieved October 6, 2025, from https://www.entrepreneurindia.

co/blogs/gst-impact-on-indian- startups/ - KPMG. (2025, September 10). Reforms, relief, and resolutions: Key takeaways from the 56th GST Council meeting. https://kpmg.com/in/en/blogs/

2025/09/reforms-relief-and- resolutions-key-takeaway-from- the-56th-gst-council.html - Press Information Bureau. (2025, September 3). Recommendations of the 56th meeting of the GST Council. https://www.pib.gov.in/

PressReleasePage.aspx?PRID= 2163555 - Press Information Bureau. (2025, September 20). GST reforms for a new generation (Factsheet). Government of India. https://www.pib.gov.in/

FactsheetDetails.aspx?Id= 150302 - TaxPowerGST. (n.d.). E-way Bill 2.0 portal launch – E-way Bill 2.0. Retrieved October 8, 2025, from https://taxpowergst.com/e-way-

bill-2-0-portal-launch-e-way- bill-2-0/ - ThinkSurvey. (2025, September 22). GST 2.0 in India: What it means for startups and SMEs this festive season. https://thinksurvey.co/blog/

business-research/gst-2-0- india-startups-smes-market- research/