A credit card is not just any simple-looking plastic card; it is a unit that had the power to revolutionise the entire economy and introduced concepts like a cashless economy no paper economy. A 3 by 2-inch card can withhold all the money you need.

Credit cards work on a simple principle: they enable people to make transactions by allowing them to borrow funds interest-free for some time. These borrowers pay back these funds within a stipulated time or pay interest on the period these funds were due for, post the specified date.

How this differs from loans is the sheer simplicity of this whole lending process; once verified after checking a person’s credit score, the Banks, NBFCs or other such institutions allow people to borrow funds up to a specific limit based on their historical financial activity. This process makes the borrowing process instantaneous for the borrower whenever he uses the credit card and allows him to enjoy interest-free borrows for a stipulated time.

To understand how credit cards penetrated and acquired the Indian Market, let’s study the historical overview and its current adoption.

Credit cards revolutionized the Indian economy, with Kali Mody introducing the Diners Club in 1961. The Central Bank of India issued the first bank credit card in 1980. Andhra Bank’s Visa cards sparked interest, while Vijaya Bank introduced Mastercard.

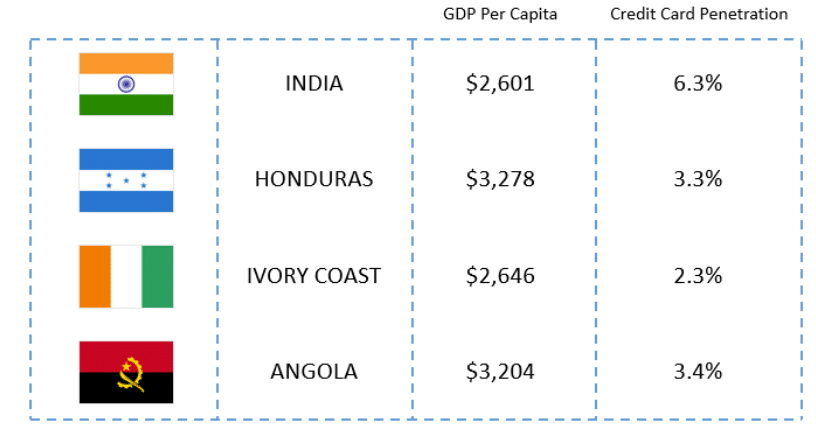

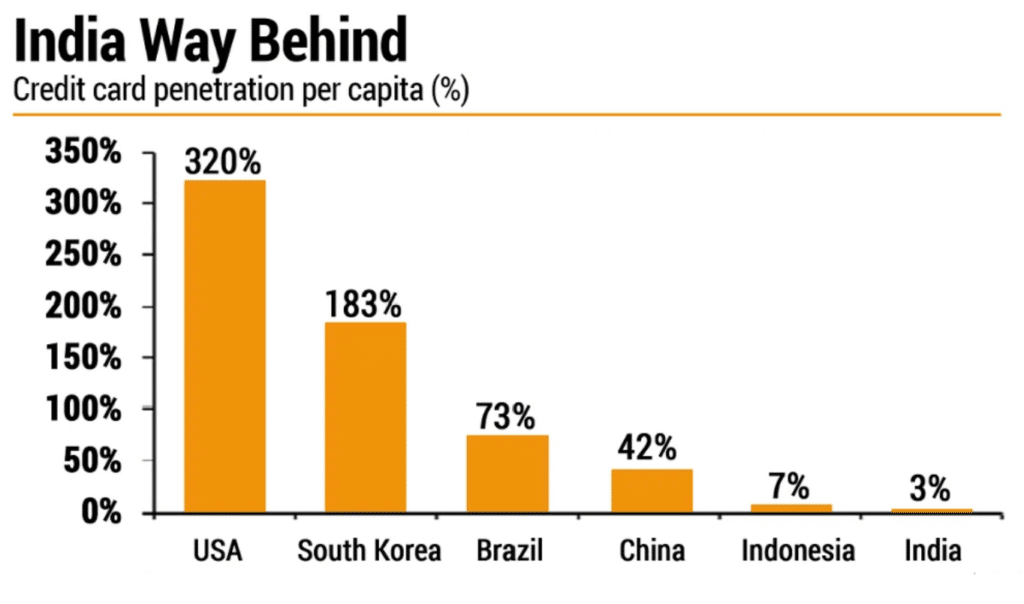

Credit card eligibility in India was challenging until 1988, when PSU banks provided credit cards to select clients. India’s credit card penetration is estimated at 5.5% of the population, which includes 77 million people. This market is more significant than Malaysia or Thailand, and as India’s wealth increases, the number of potential card users will increase.

- Credit card transactions in India have overtaken debit card transactions in volume and value.

- In April 2023, there were 25 crore credit card merchant transactions compared to 22 crore debit card transactions.

- The total value of credit card transactions was ₹1.33 lakh crore, while the full value of debit card transactions was ₹53,000 crore.

A study by OneScore, an AI-based credit score-checking app, found that Indians’ average credit score in 2021-22 was 715, with 56.8% regularly monitoring their scores. 63% of respondents had a score between 300 and 747, a trend that has not changed since FY21. Late payments dropped by 26%, and 83% of credit card users paid bills on time. Kerala had the highest average credit score at 726, followed by Gujarat, Chandigarh, and Delhi at 720. This suggests an increased awareness among the current generation to pay loans and dues on time.

Despite such success, some psychological barriers exist to credit card usage.

Fear of Debt

Cultural Stigma: Indians have always considered money matters and personal finance taboos to discuss amongst people. Debt has been an even more significant interdiction; even the faintest idea of taking on debt has been shunned. Credit cards were, hence, always seen as institutional weapons of desolation. This may stem from what we read in primary schooling about how a large section of society faced debt traps in colonial history or maybe just the conservative mindset imbibed in the country.

Preference for cash: Indians prefer cash over credit cards for convenience, security, and control, while some worry about data breaches and feel credit cards provide less financial power.

Lack of awareness: Indians’ lack of understanding about the benefits and responsible use of credit cards can hinder financial growth due to their reluctance to apply.

To further strengthen our study, let’s compare the benefits of credit cards in India and some of the world’s developed countries.

India:

- Reward Points and Cash Back: Many Indian credit cards offer reward points or cashback on specific spending categories like dining, fuel, travel, etc., which is generally typical for every country.

- Fuel Surcharge Waiver: Some Indian credit cards provide a waiver on fuel surcharges at petrol stations.

- Airport Lounge Access: Premium credit cards in India often offer complimentary access to airport lounges.

- Discounts and Offers: Credit cards in India may provide discounts and special offers on dining, shopping, entertainment, and travel.

- EMI Conversion: Cardholders can convert high-value purchases into monthly instalments with lower interest rates.

- Insurance Coverage: Some credit cards in India offer benefits like travel insurance, medical insurance, or rental car insurance.

- Annual Fee Waiver: Some credit card issuers may waive the annual fee if a certain spending threshold is met.

United States:

- Introductory 0% APR: Many U.S. credit cards offer a 0% introductory APR on purchases and balance transfers for a specific period.

- Sign-Up Bonuses: Credit card companies in the U.S. often provide sign-up bonuses to attract new customers.

- Travel Benefits: Premium U.S. cards frequently offer travel-related perks like airline credits, airport lounge access, and travel insurance.

- Specialised Cards: There are various specialised cards in the U.S., such as travel cards, cashback cards, and co-branded cards with airlines or retailers.

United Kingdom:

- Balance Transfer Offers: Similar to the U.S., UK cards may offer introductory 0% APR on balance transfers.

- Contactless Payments: Contactless payment technology is widely adopted in the UK, allowing quick and easy transactions.

- Travel Benefits: Premium UK cards may offer travel insurance, lounge access, and other travel-related perks.

- Purchase Protection: Some UK cards offer purchase protection, covering items against loss, theft, or damage.

Canada:

- Travel Benefits: Premium Canadian cards often provide travel insurance, airport lounge access, and other travel-related perks.

- Low APR Cards: Some Canadian cards may offer lower ongoing APR rates than other countries.

- Balance Transfer Offers: Similar to the U.S. and UK, Canadian cards may offer introductory 0% APR on balance transfers.

India’s credit card benefits are generally less generous than those in other developed countries, with higher APR rates, more common annual fees, and less great rewards programs, despite higher yearly costs in other countries.

Keeping the customer in mind, let us explore how a merchant feels about the system of credit cards.

Merchants’ aversion to credit cards

Merchant Fees: Merchants face significant challenges due to the fees associated with accepting credit card payments, including interchange and processing fees, which can significantly impact their profit margins as charged by credit card companies.

Chargebacks: Merchants face chargebacks when customers dispute transactions, withdrawing funds from their accounts. This can be time-consuming and frustrating, especially if merchants believe the chargeback is unjustified.

Delay in Payment: Merchants often wait several days for funds from credit card transactions, which can be a concern for small businesses or those with tight cash flow.

Risk of Fraud: Merchants must implement security measures to verify cardholder identities and protect against fraudulent transactions to mitigate the risk of credit card fraud.

Reduced customer loyalty: Merchants fear that accepting credit cards may decrease customer loyalty, as customers may switch to competitors with better rewards programs.

Accessibility and Inclusivity Concerns: Smaller businesses, especially in rural or cash-based economies, may face challenges accepting credit cards due to insufficient infrastructure or resources.

- Financial Inclusion Initiatives:

India’s government policies, such as Pradhan Mantri Jan Dhan Yojana (PMJDY), have significantly contributed to financial inclusion by introducing unbanked populations to the formal financial system, thereby increasing access to banking services and credit card usage.

- Regulatory Changes and Interest Rates:

The Reserve Bank of India regulates credit card interest rates and fees, directly impacting consumer behaviour. Lower rates encourage card usage, while higher rates may make individuals cautious, affecting spending patterns.

- Digital India Initiatives:

The Digital India campaign by the government has significantly impacted financial transactions, particularly credit card payments, leading to a surge in usage, particularly in online transactions and e-commerce purchases, thanks to government-backed platforms like UPI.

- Credit Access and Subsidies:

Government subsidies and credit facilities in specific sectors, such as agriculture and small business, can boost individuals’ spending capacity, encouraging them to use credit cards for daily expenses.

- Introduction of Rupay Cards:

The National Payments Corporation of India (NPCI) has introduced Rupay cards, an indigenous payment system with government support, offering a domestic alternative to international card schemes with lower processing fees.

- Promoting Contactless Payments:

The government is promoting contactless payments, including credit cards, to ensure safe and convenient transactions during the COVID-19 pandemic, reducing physical contact.

- Financial Literacy Programs:

The government and financial institutions are implementing financial literacy programs to educate consumers about the benefits and responsible use of credit cards, thereby preventing debt traps.

Hence, India’s government policies significantly impact credit card usage, influencing financial inclusion, digital payment drives, and taxation policies. As these evolve, the landscape will reflect the dynamic interplay between regulations, economic factors, and consumer behaviour. The government promotes a business-friendly environment, encourages innovation in the banking sector, and stimulates economic growth through digital transactions.

Conclusion

Credit card usage in India proliferates, but it still lags behind developed countries. This is due to several factors, including a need for more financial literacy, a preference for cash, and high merchant fees. However, the Indian government is taking steps to promote credit card usage through financial inclusion initiatives, regulatory changes, and digital India initiatives. As these initiatives take effect, credit card usage in India is expected to grow.

In the future, we expect to see new technologies such as UPI and BNPL services play an increasingly important role in the credit card market. These technologies are making it easier and more convenient for people to use credit and helping reduce the fees charged by merchants. Credit cards will likely become more prevalent in India in the coming years.

In addition to the factors mentioned above, the following factors could also impact credit card usage in India in the future:

The rise of e-commerce: E-commerce drives demand for credit cards, as consumers increasingly prefer to pay for online purchases.

The increasing popularity of contactless payments: Contactless payments are becoming increasingly popular in India, as they are convenient and safe. This will likely boost credit card usage, as many offer contactless payment capabilities.

The emergence of new credit card products and services: Financial institutions are constantly developing new credit card products and services to cater to the needs of different consumers. This will likely make credit cards more attractive to consumers and increase usage.

Overall, the future of credit card usage in India looks bright. The government’s initiatives, the rise of new technologies, and the changing consumer landscape are all likely to contribute to the growth of the credit card market in India in the coming years.